Enlarge image

Illinois Department of Revenue

2023 Subgroup Schedule Instructions (UB)

General Information

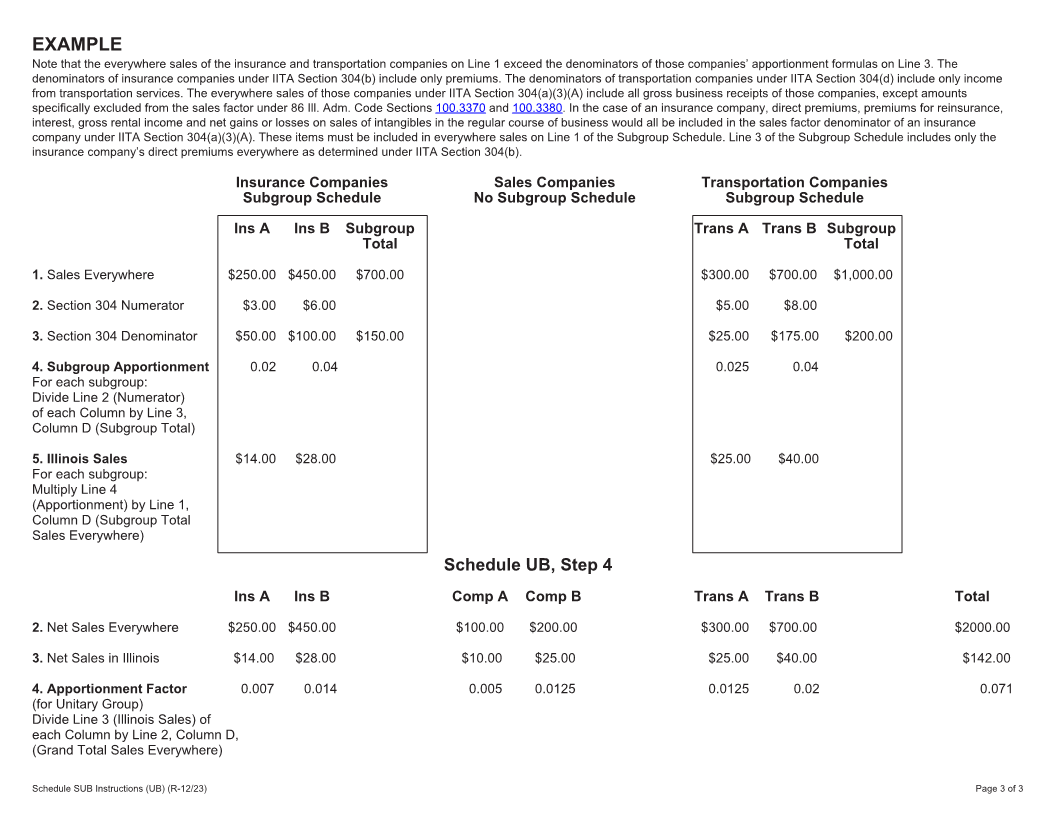

Complete a separate Subgroup Schedule for each Insurance Company Subgroup, Financial Organization Subgroup, Regulated

Exchange Subgroup, and Transportation Company Subgroup. Use the Subgroup Schedule to determine the amounts to

enter on Schedule UB, Combined Apportionment for Unitary Business Group, Step 4, Lines 2 and 3 for each member of that

subgroup. Attach all Subgroup Schedules to the Schedule UB.

Do not complete a separate Subgroup Schedule for Sales Subgroups. Also, do not complete a separate Form IL-1120,

Corporation Income and Replacement Tax Return, for each subgroup when applying the subgroup method. List all members

from each subgroup on Schedule UB, Steps 1, 2, 3 and 4. Failure to follow these instructions may cause processing delays or

result in additional correspondence from the department.

Only groups that include members who use different apportionment formulas are required to apply the subgroup method.

Note: Entities subject to Illinois Income Tax Act (IITA) Section 304(a) calculate total everywhere sales and total Illinois sales as

if the subgroup method does not apply. See Schedule UB instructions, Step 4, Lines 2 and 3 for additional information.

When is a unitary partnership included on a Subgroup Schedule?

If the unitary partnership is

• a financial organization (IITA Section 304(c)),

• a federally regulated exchange (IITA Section 304(c-1)), or

• a transportation company (IITA Section 304(d),

and does not use the single sales formula to apportion its business income per IITA Section 304(a), you must ask:

“Is the unitary partnership required to be included on Schedule UB because the members of the unitary group own or control

more than 90 percent of all the interest in the partnership?”

• YES - Then the unitary partnership must be included on the Subgroup Schedule as its own member along with the

other members of the subgroup.

• NO - Then the distributive shares from the unitary partnership must be incorporated on the Subgroup Schedule as

follows:

• If the unitary partnership and the owning partner use the SAME apportionment formula, the partner must then

add the distributive share of the partnership’s sales everywhere and Illinois sales to its own sales on the Subgroup

Schedule.

• If the unitary partnership and the owning partner use a DIFFERENT apportionment formula, the partnership must

then calculate its sales everywhere and Illinois sales on the applicable subgroup schedule using only the owning

partner’s distributive shares. Then the partner will add the partnership’s calculated figures to its own sales when

entering them on the Schedule UB.

When is a unitary partnership not included on a Subgroup Schedule?

If a unitary partnership apportions its business income using the single sales formula under IITA Section 304(a), do not include

the owning partner’s distributive share of the partnership’s apportionment factors on the subgroup schedule as no calculation is

needed for single sales entities. The partner will add the partnership’s sales everywhere and Illinois sales to its own sales when

entering them on the Schedule UB. See “Partnership requirements” and Step 4, Lines 2 and 3, of the Schedule UB Instructions

for information on how to report an IITA Section 304(a) partnership on Schedule UB.

For more information about unitary partnerships, see 86 Ill. Adm. Code Section 100.3380.

Should I round?

You must round the dollar amounts on the Subgroup Schedule to whole-dollar amounts. To do this, you should drop any

amount less than 50 cents and increase any amount of 50 cents or more to the next higher dollar.

What if I need additional assistance or forms?

• For assistance, forms, or schedules, visit our website at tax.illinois.gov or scan the QR code

provided.

• Write us at:

ILLINOIS DEPARTMENT OF REVENUE

PO BOX 19001

SPRINGFIELD IL 62794-9001

• Call 1 800 732-8866 or217 782-3336 (TTY at1 800 544-5304).

• Visit a taxpayer assistance office - 8:00 a.m. to 5:00 p.m. (Springfield) and 8:30 a.m. to 5:00 p.m.

(all other offices), Monday - Friday.

Schedule SUB Instructions (UB) (R-12/23) Printed by the authority of the state of Illinois - electronic only - one copy. Page 1 of 3