Enlarge image

Illinois Department of Revenue Use for tax year ending on or

after December 31, 2022, and

IL-1120 Instructions before December 31, 2023. 2022

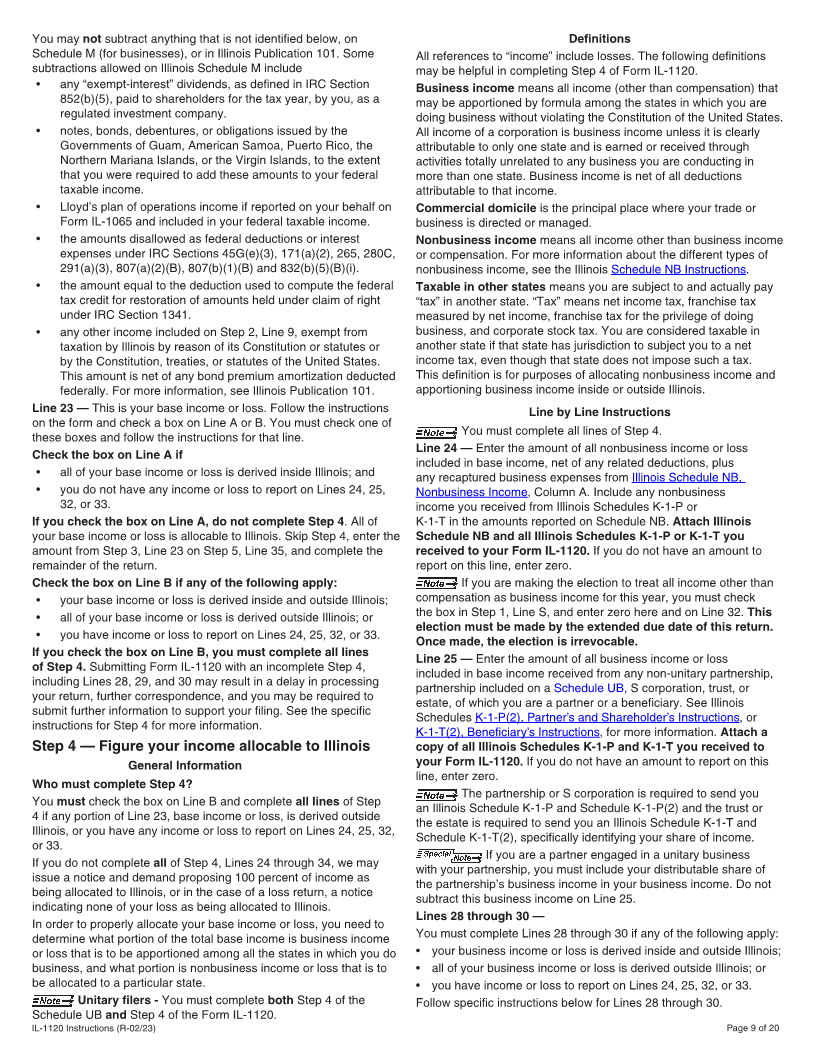

What’s New? Table of Contents

• Illinois Net Loss deductions are to be reported on Schedule NLD, What’s New? ........................................................ 1

Illinois Net Loss Deduction, or Schedule UB/NLD, Unitary Illinois

Net Loss Deduction. Attach Schedule NLD or UB/NLD to your

Form IL-1120. General Information ............................................ 1

• The extension to file Form IL-1120 has been changed. The

Specific Instructions ........................................... 6

extension to file is now seven months (eight months for June filers)

from the original due date.

Apportionment Formulas .................................. 15

• IL-4562 has been updated to include 80 percent bonus

depreciation.

Appendix A - Extension Tax Payment

• Schedule 4255 has new recapture of credit lines. Worksheet .......................................................... 18

• Income Tax Credits -- Information about all the credits can be

found in Schedule 1299-I.

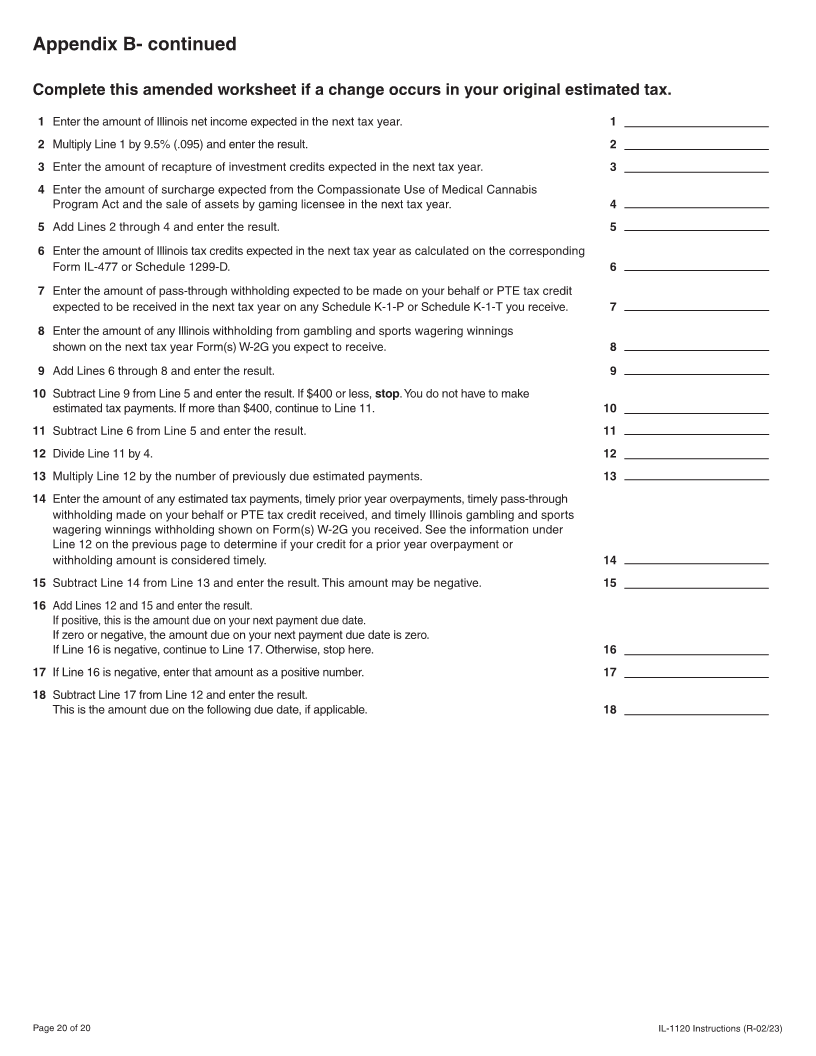

Appendix B - Estimated Payment

• The following credits are new:

Worksheets ........................................................ 19

• Agritourism Liability Insurance (Credit Code 5440)

effective on or after January 1, 2022

• Recovery and Mental Health (Credit Code 0180) effective

on or after January 1, 2023

• The following credits have updated expiration dates:

• Economic Development for a Growing Economy (EDGE)

(Credit Code 5300) - ending on or before June 30, 2027

• Film Production Services (Credit Code 5000)- ending on

or before December 31, 2032

• Hospital (Credit Code 5620) - ending on or before

December 31, 2027

• Invest in Kids (Credit Code 5660) - ending on or before

December 31, 2023

General Information

Who must file Form IL-1120? Limited liability companies — If you are a limited liability company

You must file Form IL-1120 if you are a corporation that and you file as a corporation for federal income tax purposes, you

are treated as a corporation for Illinois purposes.

• has net income or loss as defined under the Illinois Income Tax

Act (IITA); or Foreign corporations — If you are a foreign corporation, you must

observe the same filing requirements as U.S. domestic corporations.

• is qualified to do business in the state of Illinois and is required For Illinois purposes, you should report the taxable income you are

to file a federal income tax return (regardless of net income or reporting for federal purposes under IRC Sections 881 through 885.

loss). You must use only the domestic factor information regarding sales

Unitary filers — If you are a corporation that is a member of information in the “everywhere” denominator when apportioning

a unitary business group, see Illinois Schedule UB, Combined business income to Illinois. If you are a foreign corporation that is a

Apportionment for Unitary Business Group, and its Instructions for member of a unitary business group, see Illinois Schedule UB and

information about filing requirements. Instructions for information about filing requirements.

Political organizations and homeowners’ associations — If you Domestic international sales corporations and foreign sales

are a corporation that falls under the definition in Internal Revenue corporations — If you are a Domestic International Sales

Code (IRC), Sections 527 and 528, and you report your federal Corporation (DISC) under IRC Section 992, you are not subject to

taxable income on U.S. Form 1120-POL or U.S. Form 1120-H, you the taxes imposed by IRC Subtitle A (except for the tax imposed on

are subject to Illinois Income and Replacement Taxes and must file transfers to avoid income tax under IRC Section 1491). Similarly, you

Form IL-1120. are not required to file Form IL-1120.

Cooperatives — If you are a corporation operating on a cooperative For Illinois purposes, distributions from DISCs are treated in

basis under IRC Section 1381, and file U.S. Form 1120-C, you are accordance with the federal rules pertaining to dividends, dividend

subject to Illinois Income and Replacement Taxes and must file exclusions, and dividend-received deductions.

Form IL-1120. If you are a Foreign Sales Corporation (FSC) for federal purposes

Settlement funds — If you are a settlement fund under IRC and have federal taxable income apportionable or allocable to Illinois,

Section 468B and you report your federal taxable income on you are subject to Illinois tax rules applicable to all corporations. You

U.S. Form 1120-SF, you are subject to Illinois Income and are taxed by Illinois to the extent that your nonexempt foreign trade

Replacement Taxes and must file Form IL-1120. income, investment income, and carrying charges (taxable for federal

purposes) are apportionable or allocable to Illinois.

IL-1120 Instructions (R-02/23) Printed by the authority of the State of Illinois - web only - one copy. Page 1 of 20