Enlarge image

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

*33712221W*

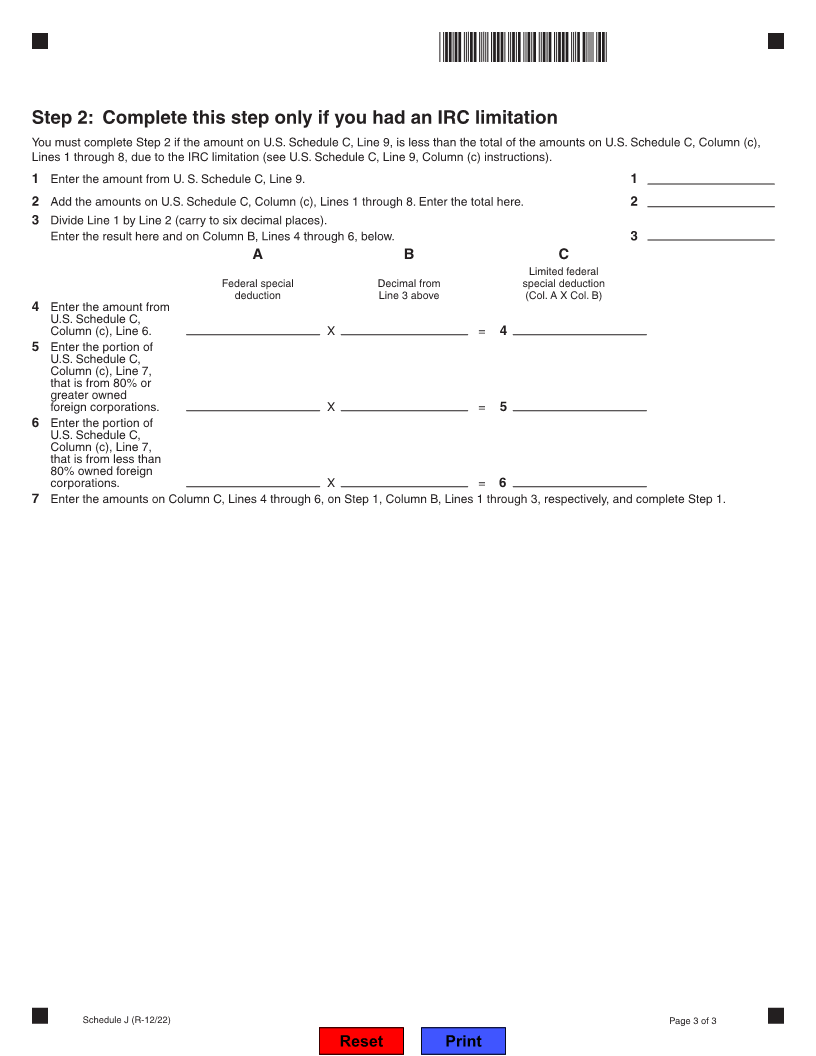

Illinois Department of Revenue Year ending

____ ____

Schedule J Foreign Dividends

Attach to your Form IL-1120 Month Year

IL Attachment No. 10

Enter your name as shown on your Form IL-1120. Enter your federal employer identification number (FEIN).

Step 1: Figure your subtraction

The line references in each item refer to U.S. 1120, Schedule C, and must be used to complete Columns A and B. If you did not file a

U.S. 1120, Schedule C, **use the corresponding lines from the federal schedule you filed (see the list under “What must I attach to Schedule J?”). If

you had an IRC limitation, complete Column A, then refer to Step 2 on Page 3 for the correct amounts to enter in Column B, Lines 1 through 3. Do not

include any dividends received from a domestic corporation.

A B C D E

Enter the following amounts Foreign dividends received Federal special deduction Net amount Illinois Foreign dividend

from **Federal Schedule C: (U.S. Schedule C, Column (a)) (U.S. Schedule C, Column (c)) (Col. A minus Col. B) percentage subtraction

1 Line 6. X 50% (.50) = 1

2 the portion of Line 7

that is from 80% or

greater owned foreign

corporations. X 100% (1.00) = 2

3 the portion of Line 7

that is from less than

80% owned foreign

corporations. X 65% (.65) = 3

4 the portion of Line 13

that is from 80% or

greater owned foreign

corporations. X 100% (1.00) = 4

5 the portion of Line 13

that is from 20% or

more but less than

80% owned foreign

corporations. X 65% (.65) = 5

6 the portion of Line 13

that is from less than

20% owned

foreign corporations. X 50% (.50) = 6

7 the portion of Line 14

that is from 80% or

greater owned foreign

corporations. X 100% (1.00) = 7

8 the portion of Line 14

that is from 20% or

more but less than

80% owned foreign

corporations. X 65% (.65) = 8

9 the portion of Line 14

that is from less than

20% owned

foreign corporations. X 50% (.50) = 9

10 RESERVED X 100% (1.00) = 10

11 RESERVED X 65% (.65) = 11

12 RESERVED X 50% (.50) = 12

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this

information is REQUIRED. Failure to provide information could result in a penalty.

Schedule J (R-12/22) Page 1 of 3