Enlarge image

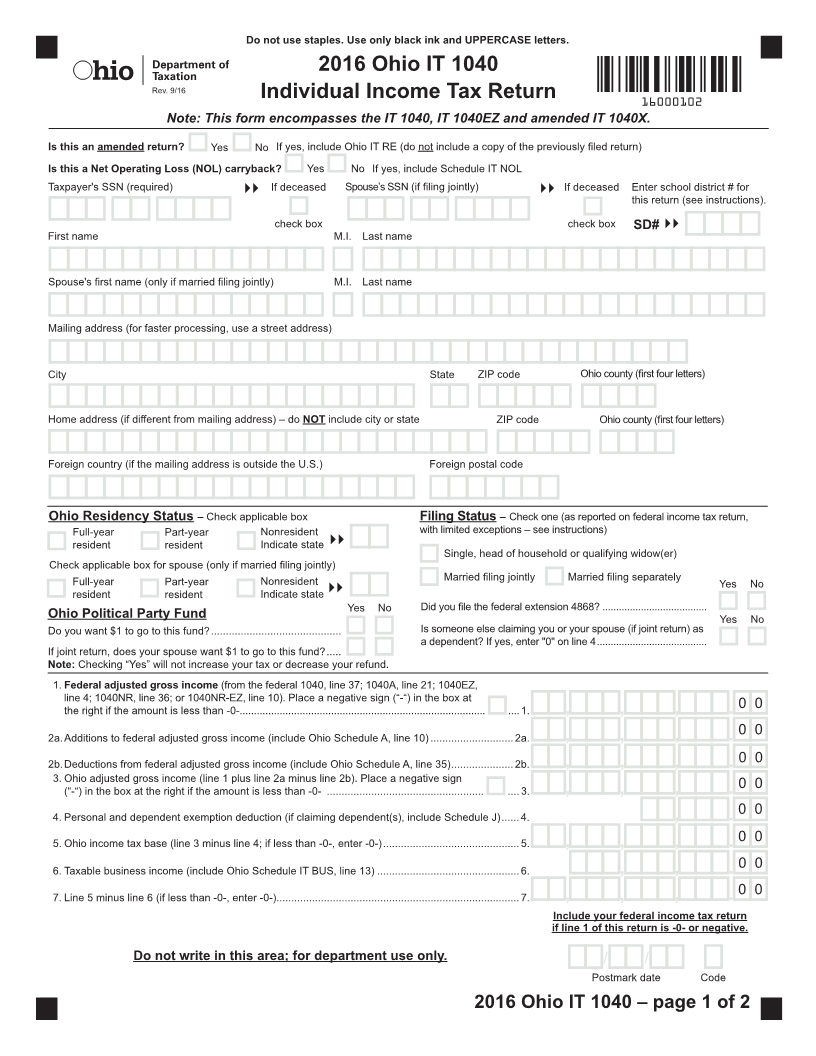

Do not use staples. Use only black ink and UPPERCASE letters.

2016 Ohio IT 1040

Rev. 9/16

Individual Income Tax Return 16000102

Note: This form encompasses the IT 1040, IT 1040EZ and amended IT 1040X.

Is this an amended return? Yes No If yes, include Ohio IT RE (do not include a copy of the previously fi led return)

Is this a Net Operating Loss (NOL) carryback? Yes No If yes, include Schedule IT NOL

Taxpayer's SSN (required) If deceased Spouse’s SSN (if fi ling jointly) If deceased Enter school district # for

this return (see instructions).

check box check box SD#

First name M.I. Last name

Spouse's fi rst name (only if married fi ling jointly) M.I. Last name

Mailing address (for faster processing, use a street address)

City State ZIP code Ohio county (fi rst four letters)

Home address (if different from mailing address) – do NOT include city or state ZIP code Ohio county (fi rst four letters)

Foreign country (if the mailing address is outside the U.S.) Foreign postal code

Ohio Residency Status – Check applicable box Filing Status – Check one (as reported on federal income tax return,

Full-year Part-year Nonresident with limited exceptions – see instructions)

resident resident Indicate state

Single, head of household or qualifying widow(er)

Check applicable box for spouse (only if married fi ling jointly)

Full-year Part-year Nonresident Married fi ling jointly Married fi ling separately

Yes No

resident resident Indicate state

Yes No Did you fi le the federal extension 4868? ......................................

Ohio Political Party Fund Yes No

Do you want $1 to go to this fund? ............................................ Is someone else claiming you or your spouse (if joint return) as

a dependent? If yes, enter "0" on line 4 ........................................

If joint return, does your spouse want $1 to go to this fund? .....

Note: Checking “Yes” will not increase your tax or decrease your refund.

1. Federal adjusted gross income (from the federal 1040, line 37; 1040A, line 21; 1040EZ,

line 4; 1040NR, line 36; or 1040NR-EZ, line 10). Place a negative sign (“-“) in the box at

the right if the amount is less than -0-...................................................................................... ....1. , , , . 00

00

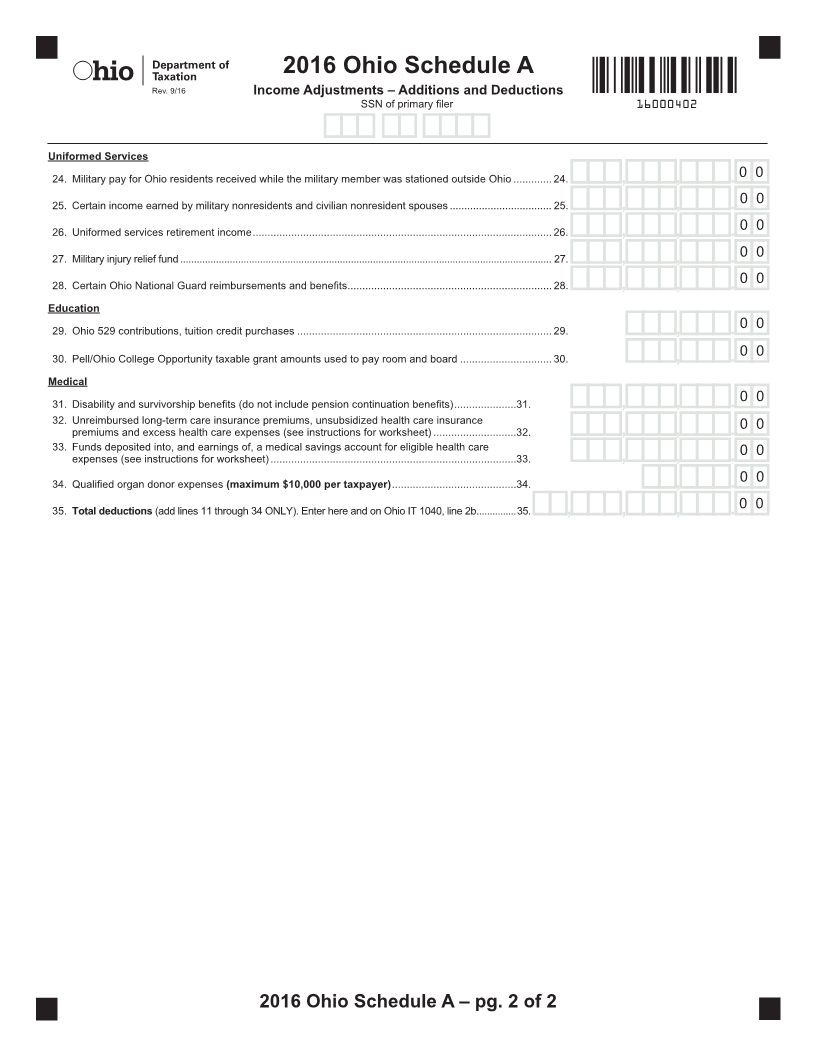

2a. Additions to federal adjusted gross income (include Ohio Schedule A, line 10) ............................2a. , , , .

2b. Deductions from federal adjusted gross income (include Ohio Schedule A, line 35) .....................2b. , , , .00

3. Ohio adjusted gross income (line 1 plus line 2a minus line 2b). Place a negative sign

(“-“) in the box at the right if the amount is less than -0- ..................................................... ....3. , , , . 00

00

4. Personal and dependent exemption deduction (if claiming dependent(s), include Schedule J) ......4. , .

5. Ohio income tax base (line 3 minus line 4; if less than -0-, enter -0-) ..............................................5. , , , . 00

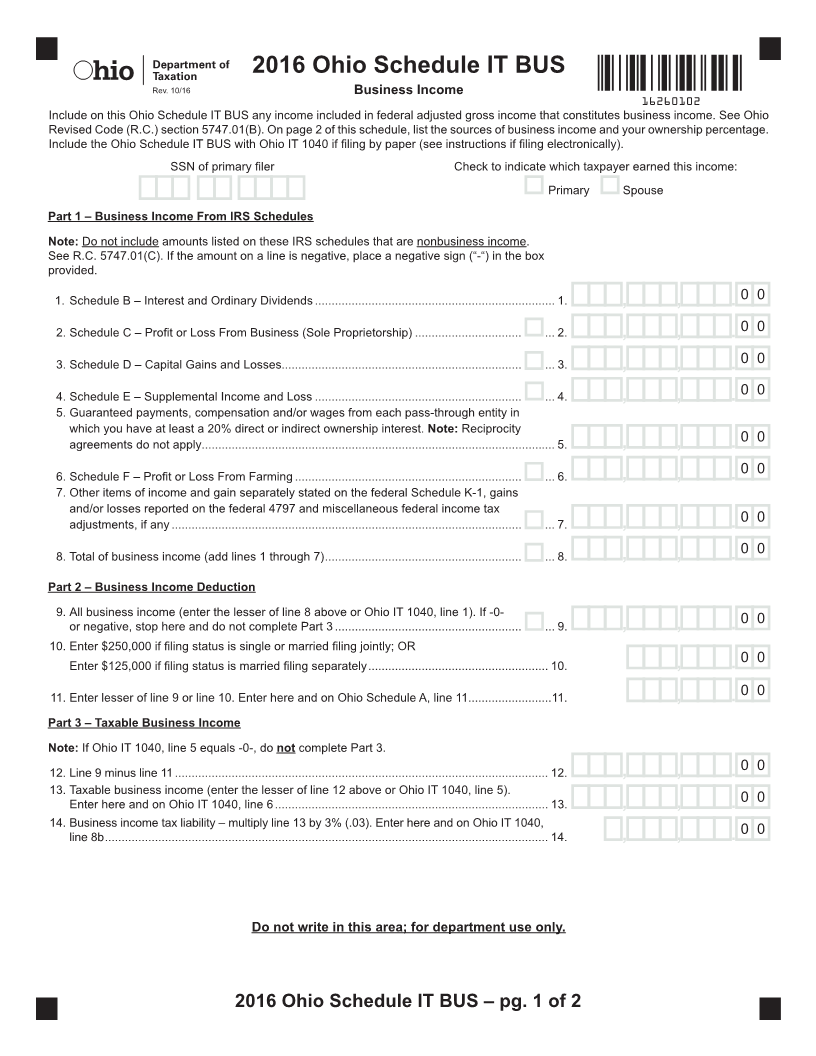

6. Taxable business income (include Ohio Schedule IT BUS, line 13) ................................................6. , , . 00

7. Line 5 minus line 6 (if less than -0-, enter -0-)..................................................................................7. , , , . 00

Include your federal income tax return

if line 1 of this return is -0- or negative.

Do not write in this area; for department use only. / /

Postmark date Code

2016 Ohio IT 1040 – page 1 of 2