Enlarge image

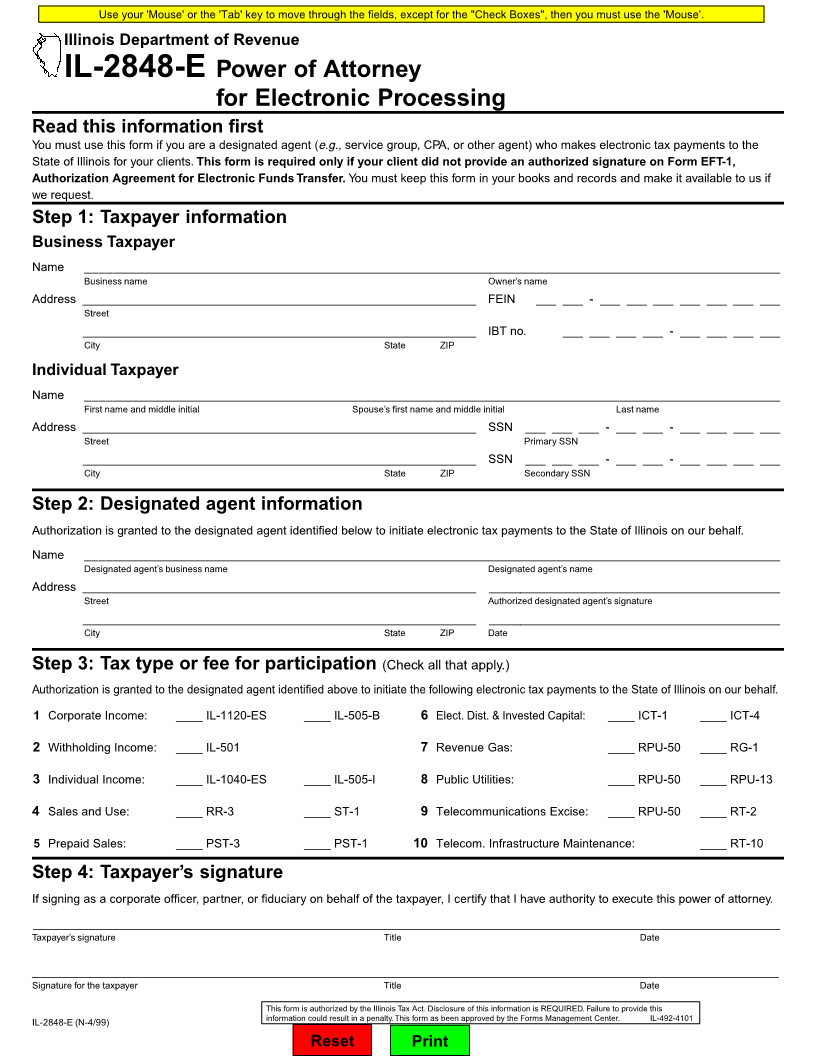

Use your 'Mouse' or the 'Tab' key to move through the fields, except for the "Check Boxes", then you must use the 'Mouse'.

Illinois Department of Revenue

IL-2848-E Power of Attorney

for Electronic Processing

Read this information first

You must use this form if you are a designated agent (e.g., service group, CPA, or other agent) who makes electronic tax payments to the

State of Illinois for your clients. This form is required only if your client did not provide an authorized signature on Form EFT-1,

Authorization Agreement for Electronic Funds Transfer. You must keep this form in your books and records and make it available to us if

we request.

Step 1: Taxpayer information

Business Taxpayer

Name ________________________________________________________________________________________________________

Business name Owner’s name

Address ___________________________________________________________ FEIN ___ ___ - ___ ___ ___ ___ ___ ___ ___

Street

___________________________________________________________ IBT no. ___ ___ ___ ___ - ___ ___ ___ ___

City State ZIP

Individual Taxpayer

Name ________________________________________________________________________________________________________

First name and middle initial Spouse’s first name and middle initial Last name

Address ___________________________________________________________ SSN ___ ___ ___ - ___ ___ - ___ ___ ___ ___

Street Primary SSN

___________________________________________________________ SSN ___ ___ ___ - ___ ___ - ___ ___ ___ ___

City State ZIP Secondary SSN

Step 2: Designated agent information

Authorization is granted to the designated agent identified below to initiate electronic tax payments to the State of Illinois on our behalf.

Name ________________________________________________________________________________________________________

Designated agent’s business name Designated agent’s name

Address ___________________________________________________________ ____________________________________________

Street Authorized designated agent’s signature

___________________________________________________________ ____________________________________________

City State ZIP Date

Step 3: Tax type or fee for participation (Check all that apply.)

Authorization is granted to the designated agent identified above to initiate the following electronic tax payments to the State of Illinois on our behalf.

1 Corporate Income: ____ IL-1120-ES ____ IL-505-B 6 Elect. Dist. & Invested Capital: ____ ICT-1 ____ ICT-4

2 Withholding Income: ____ IL-501 7 Revenue Gas: ____ RPU-50 ____ RG-1

3 Individual Income: ____ IL-1040-ES ____ IL-505-I 8 Public Utilities: ____ RPU-50 ____ RPU-13

4 Sales and Use: ____ RR-3 ____ ST-1 9 Telecommunications Excise: ____ RPU-50 ____ RT-2

5 Prepaid Sales: ____ PST-3 ____ PST-1 10 Telecom. Infrastructure Maintenance: ____ RT-10

Step 4: Taxpayer’s signature

If signing as a corporate officer, partner, or fiduciary on behalf of the taxpayer, I certify that I have authority to execute this power of attorney.

________________________________________________________________________________________________________________

Taxpayer’s signature Title Date

________________________________________________________________________________________________________________

Signature for the taxpayer Title Date

This form is authorized by the Illinois Tax Act. Disclosure of this information is REQUIRED. Failure to provide this

IL-2848-E (N-4/99) information could result in a penalty. This form as been approved by the Forms Management Center. IL-492-4101

Reset Print