Enlarge image

bL375E

Form ID-POA 12-17-2019

Power of Attorney

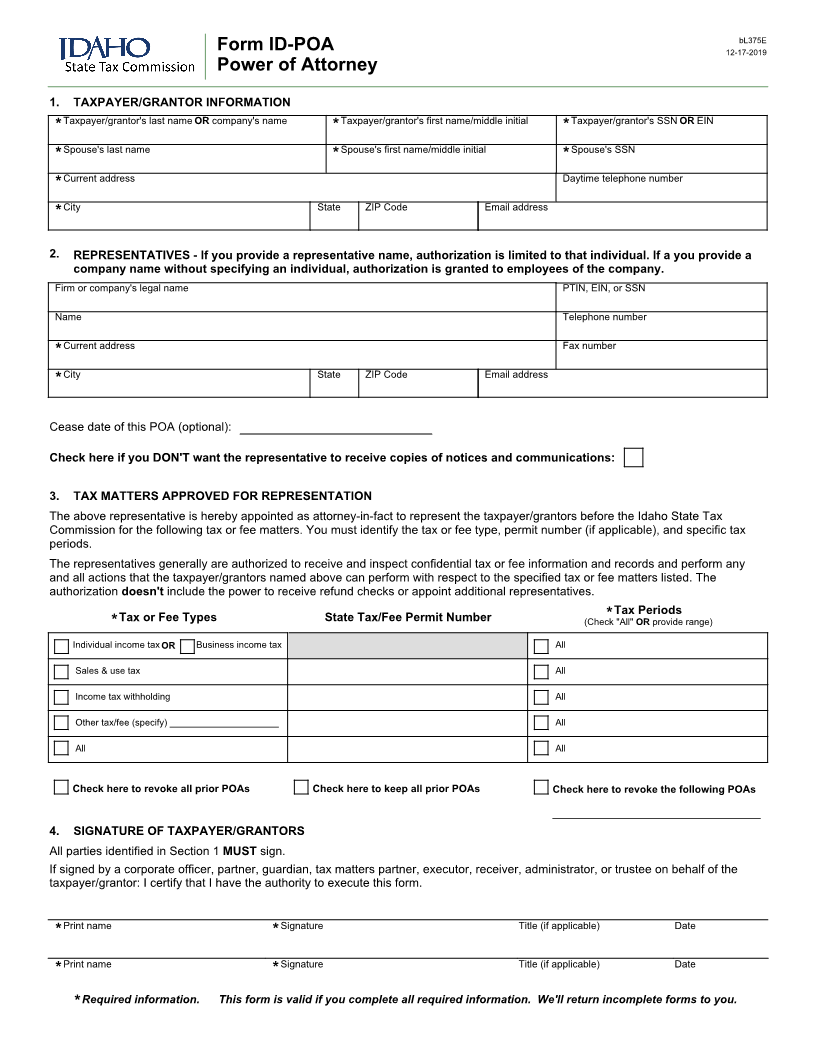

1. TAXPAYER/GRANTOR INFORMATION

*Taxpayer/grantor's last name ORcompany's name *Taxpayer/grantor's first name/middle initial *Taxpayer/grantor's SSN OREIN

*Spouse's last name *Spouse's first name/middle initial * Spouse's SSN

*Current address Daytime telephone number

City* State ZIP Code Email address

2. REPRESENTATIVES - If you provide a representative name, authorization is limited to that individual. If a you provide a

company name without specifying an individual, authorization is granted to employees of the company.

Firm or company's legal name PTIN, EIN, or SSN

Name Telephone number

*Current address Fax number

City* State ZIP Code Email address

Cease date of this POA (optional):

Check here if you DON'T want the representative to receive copies of notices and communications:

3. TAX MATTERS APPROVED FOR REPRESENTATION

The above representative is hereby appointed as attorney-in-fact to represent the taxpayer/grantors before the Idaho State Tax

Commission for the following tax or fee matters. You must identify the tax or fee type, permit number (if applicable), and specific tax

periods.

The representatives generally are authorized to receive and inspect confidential tax or fee information and records and perform any

and all actions that the taxpayer/grantors named above can perform with respect to the specified tax or fee matters listed. The

authorization doesn't include the power to receive refund checks or appoint additional representatives.

* Tax Periods

* Tax or Fee Types State Tax/Fee Permit Number (Check "All" OR provide range)

Individual income tax OR Business income tax All

Sales & use tax All

Income tax withholding All

Other tax/fee (specify) _____________________ All

All All

Check here to revoke all prior POAs Check here to keep all prior POAs Check here to revoke the following POAs

____________________________________

4. SIGNATURE OF TAXPAYER/GRANTORS

All parties identified in Section 1 MUST sign.

If signed by a corporate officer, partner, guardian, tax matters partner, executor, receiver, administrator, or trustee on behalf of the

taxpayer/grantor: I certify that I have the authority to execute this form.

*Print name Signature* Title (if applicable) Date

*Print name Signature* Title (if applicable) Date

* Required information. This form is valid if you complete all required information. We'll return incomplete forms to you.