Enlarge image

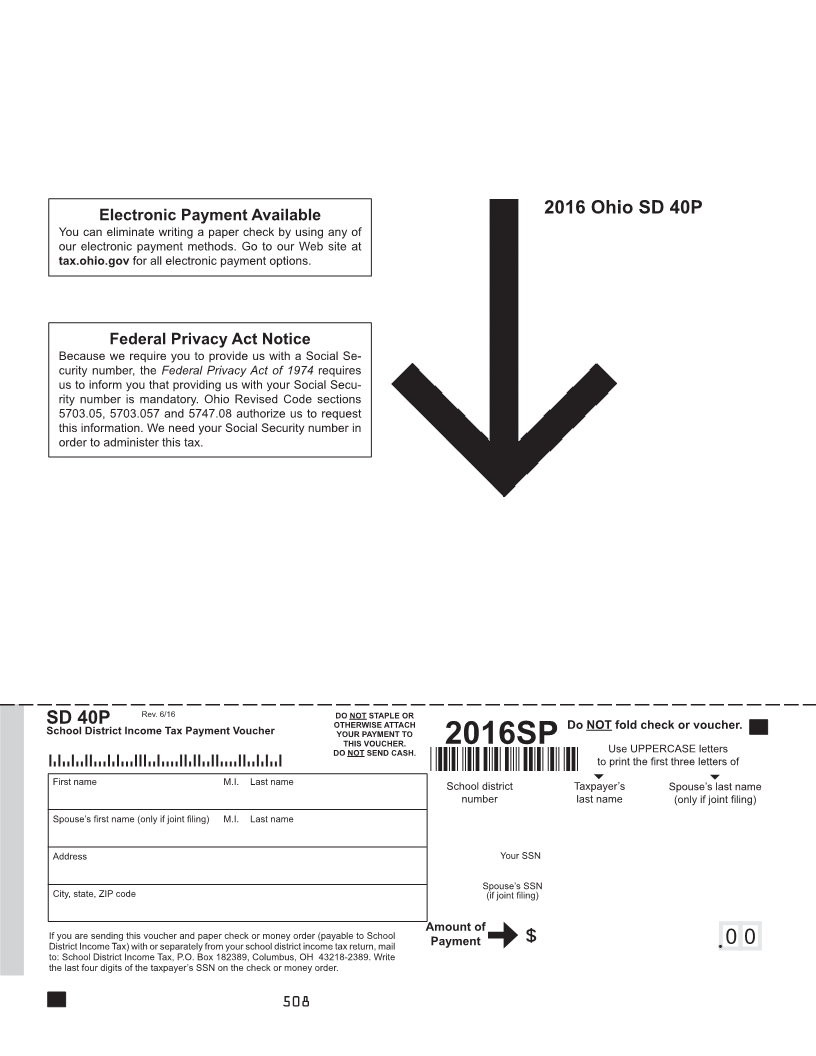

Electronic Payment Available 2016 Ohio SD 40P

You can eliminate writing a paper check by using any of

our electronic payment methods. Go to our Web site at

tax.ohio.gov for all electronic payment options.

Federal Privacy Act Notice

Because we require you to provide us with a Social Se-

curity number, the Federal Privacy Act of 1974 requires

us to inform you that providing us with your Social Secu-

rity number is mandatory. Ohio Revised Code sections

5703.05, 5703.057 and 5747.08 authorize us to request

this information. We need your Social Security number in

order to administer this tax.

Rev. 6/16 DO NOT STAPLE OR

SD 40P OTHERWISE ATTACH Do NOT fold check or voucher.

School District Income Tax Payment Voucher YOUR PAYMENT TO

DOTHISNOTVOUCHER.SEND CASH. 2016SP Use UPPERCASE letters

to print the fi rst three letters of

First name M.I. Last name School district Taxpayer’s Spouse’s last name

number last name (only if joint filing)

Spouse’s fi rst name (only if joint filing) M.I. Last name

Address Your SSN

Spouse’s SSN

City, state, ZIP code (if joint filing)

Amount of

If you are sending this voucher and paper check or money order (payable to School

District Income Tax) with or separately from your school district income tax return, mail Payment $ 0 0

to: School District Income Tax, P.O. Box 182389, Columbus, OH 43218-2389. Write

the last four digits of the taxpayer’s SSN on the check or money order.

508