Enlarge image

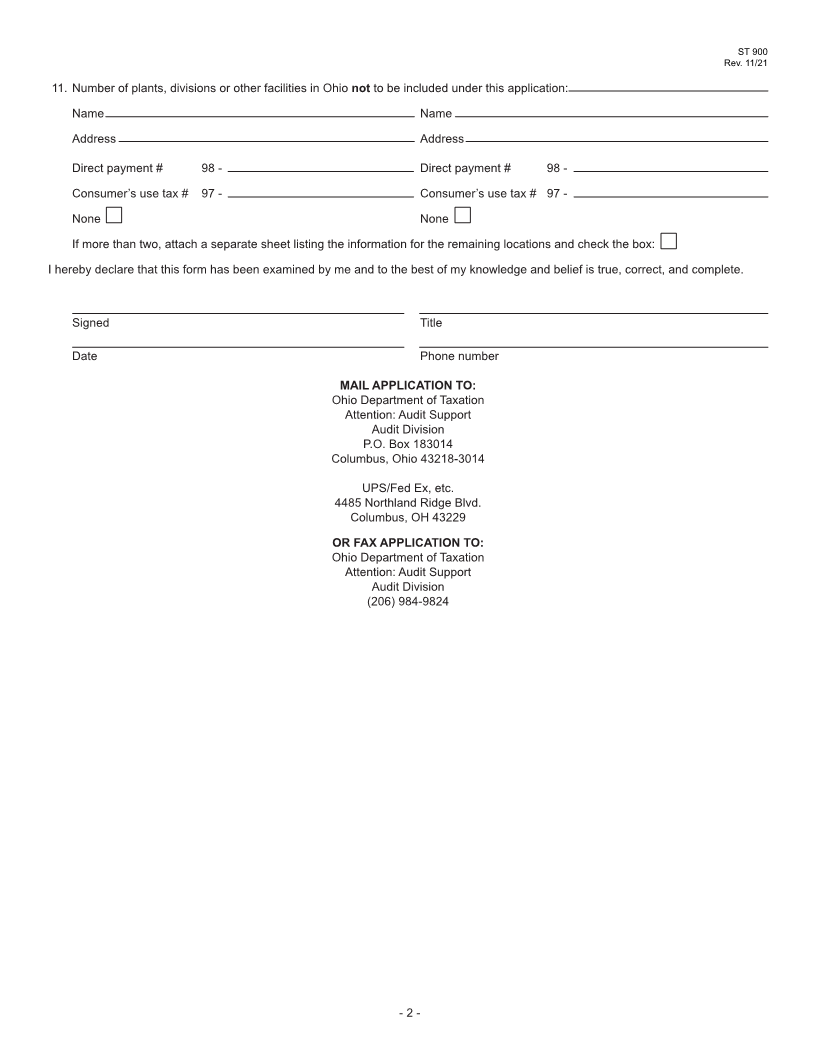

ST 900

Rev. 11/21

Audit Division

P.O. Box 183014

Columbus, OH 43218-3014

Application for an Ohio Direct Payment Permit

The undersigned consumer hereby makes application pursuant to Ohio Revised Code (R.C.) section 5739.031 for authority to pay the

sales tax levied by R.C. sections 5739.02, 5739.021, 5739.023 and 5739.026, and the use tax levied under R.C. sections 5741.02,

5741.021, 5741.022 and 5741.023.

Please type or print clearly. Please complete all sections or the application may be denied.

1. Legal entity name Trade name

2. Tax return mailing address

3. Person to contact regarding application (include telephone no. and e-mail address)

4. Federal employer identification number, or if none assigned for reporting federal taxes, please enter your Social Security number.

FEIN Social Security number

5. Check whether business operates as: Sole proprietor Partnership/LLP C corporation Fiduciary

Limited liability company S corporation

6. If it is a partnership/LLP or limited liability company, provide the names and addresses of the partners or members:

Name Street address City State ZIP code

Name Street address City State ZIP code

Name Street address City State ZIP code

If more than three, attach a separate sheet listing the remaining partners/members’ information and check the box:

7. If it is a C corporation or an S corporation, provide the names and addresses of the officers:

Name/title Street address City State ZIP code

Name/title Street address City State ZIP code

Name/title Street address City State ZIP code

If more than three, attach a separate sheet listing the remaining officers’ information and check the box:

8. Business description:

9. NAICS code Estimated annual amount and number of taxable purchases:

$ Amount # of transactions

10. Number of plants, divisions or other facilities to be included under this application:

Name Name

Address Address

If more than two, attach a separate sheet listing the information for the remaining locations and check the box:

- 1 -