Enlarge image

202 2 Idaho Income Tax

Substitute Form Specifications

September 2022

tax.idaho.gov

Enlarge image |

202 2 Idaho Income Tax

Substitute Form Specifications

September 2022

tax.idaho.gov

|

Enlarge image |

Contents

Introduction ............................................................................................................................................................................. 2

Approval Process for Substitute Income Tax Forms ................................................................................................................ 2

Helpful Hints ........................................................................................................................................................................ 3

Income Tax Forms ................................................................................................................................................................... 3

Substitute Form Standards ...................................................................................................................................................... 4

Specific Guidelines ................................................................................................................................................................... 4

Shading ................................................................................................................................................................................ 4

Form Fonts ........................................................................................................................................................................... 4

Keying Symbols and Line Numbers ...................................................................................................................................... 4

Scannable Forms .................................................................................................................................................................. 4

State Use Only Boxes ........................................................................................................................................................... 5

Intelligent Character Recognition (ICR) Readable Boxes ..................................................................................................... 5

Intelligent Character Recognition (ICR) Guidelines ................................................................................................................... 5

1-D Barcode .............................................................................................................................................................................. 7

1

|

Enlarge image |

Introduction

The Idaho State Tax Commission (ISTC) accepts substitute or reproduced tax forms. These forms must meet the

requirements of ISTC’s original forms. ISTC has established these guidelines and standards for software developers,

computer tax processors, business forms companies, and any other individual or business that plans to market,

distribute, or file substitute or reproduced tax forms.

Approval Process for Substitute Income Tax Forms

A company that develops any substitute form must receive approval from ISTC before releasing or distributing

the substitute form to its customers or clients. Any changes to the form by the developer after the original approval

must be resubmitted for additional approval.

The approval process begins with a visual verification of all scan lines, data fields, and barcode validation, to quickly

identify layout errors. The approval process is completed through our imaging equipment for intelligent character

recognition and system validation.

Developers will receive notification of their forms results within 10 business days. All reviewed returns will be emailed

with a statement indicating approval or notice of required changes.

All Income Tax Forms must be submitted by December 16, 2022 and authorized by January 31, 2023.

Please adhere to the NACTP standards (http://www.nactp.org/).

Initial and all subsequent Substitute Document test submissions must include the complete set of submissions that

have not yet been authorized. Partial submission sets will not be accepted. When emailing multiple forms for approval,

please separate the submissions between Individual Income Tax Forms and Business Income Tax Forms. In addition,

please indicate in the subject line of the email if the attached forms are an initial submission or a resubmission.

Submit one sample copy of each form for approval; this sample copy must contain variable data in all possible locations

and positions on each form. Variable data must be sample data rather than actual taxpayer data and must

be calculated correctly for each line.

A Note for Substitute Document developers who work in tandem with MeF development teams:

If your substitute document program corresponds with an MeF program, there will be a final test once the MeF

calculation engine has been authorized. You will be asked to fulfill a substitute document that contains calculated fields.

The expectation is these calculated fields will mirror those found in the approved MeF calculation engine.

2

|

Enlarge image |

Submission of Two Data-Filled Voucher Scenarios Per Form Type:

When you create your voucher substitute documents for submission, use the data in the test pack to populate the data

on the form and to create the corresponding scan line for each form. Test packets are located on the State Exchange

System (SES) in tax year 202 . 2

Authorization of your substitute document will be contingent on:

• Correct scan lines and

• Forms that meet the specifications listed in this document.

Substitute forms will not be accepted by fax. Submit all substitute income tax forms by PDF format to:

substituteforms@tax.idaho.gov

Helpful Hints

• Substitute forms must contain all annual changes prior to submission to the state.

• Do not print EINs, SS#s, or copyright information on the top or bottom of the first or second page of the forms.

• For Forms 40, 43, 41, 41S, 65, and 66, ISTC requires a single data-filled form for testing. Substitute forms must be

proofread prior to submission to the state.

• Substitute forms must include your NACTP vendor ID number and the form version date. Place the NACTP

vendor ID above the year of the tax form. You may reproduce any Idaho scannable income tax form listed. The

reproductions must be identical to the official Tax Commission forms.

• The Tax Commission will verify accuracy of line references, data dots, lines, indicator boxes, and any

reference to percentages. The Tax Commission will check the revision dates, header of the returns, form name,

year, response boxes, and barcodes for accuracy. The Tax Commission will also check the calculation values for

each line provided on the form. The Tax Commission will not verify verbiage or spelling.

Income Tax Forms

Primary return forms include the following:

• Form 40 - Individual Income Tax Return & Associated Schedules

• Form 43 - Part-Year Resident & Nonresident Income Tax Return & Associated Schedules

• Form 41 - Corporation Income Tax Return & Associated Schedules

• Form 41S - S Corporation Income Tax Return & Associated Schedules

• Form 65 - Partnership Return of Income & Associated Schedules

• Form 66 - Fiduciary Income Tax Return & Associated Schedules

Income Tax Payment Vouchers

Income tax payment vouchers will include the following:

• ID-VP –Income Tax Voucher Payment (Tran Code 95)

• Form 41ES – Estimated Tax Payment/Extension of Time Payment for Business Income Tax (Tran Code 10)

• Form 51 – Estimated Payment of Idaho Individual Income Tax (Tran Code 10)

• Form PTE-01- Income Tax Withheld for a Nonresident Individual Owner of a Pass-through Entity (Tran

Code 12)

All payment vouchers that are client copy shall have a watermark stating, “CLIENT COPY ONLY”. Refer to

Idaho Publication – Other Substitute Return Specifications for scan line specifications.

3

|

Enlarge image |

Substitute Form Standards

A substitute form is one designed for use in place of an original Tax Commission issued form. Forms must be developed

as close to the Idaho forms as possible. A substitute form must duplicate the appearance and layout of the Tax

Commission form to include:

• Layout size, font size, style, and margins.

• Special keying symbols, line numbers, and code numbers.

• Paper weight, ink color, and density.

• Official forms less than standard 8 ½” x 11” must either be printed separately or printed on the bottom portion

of a form, with a size of 8 ½” wide and 3 ²/ɜ” high.

There must be a ½” margin on all sides of the page.

When a two-sided form contains only instructional information on the backside, the instructional side does not need to

be submitted for approval.

Each side of a two-sided form that requires the entry of data is treated as a separate single-sided form. Submit all pages

for approval at the same time.

Specific Guidelines

Shading

Several official ISTC forms contain shading. Please include shading where shown on the official form.

Form Fonts

Arial is used throughout the set of Tax Year 2022 forms. Make sure the font size matches the Idaho specific form as

font sizes vary.

Keying Symbols and Line Numbers

Keying symbols such as data dots and line numbers are essential to the Tax Commission’s forms processing system. All

substitute income tax forms must include these symbols and line numbers.

Scannable Forms

Tax Commission income tax forms are optically read on high-speed scanners. All optically scanned forms have boxes for

Social Security numbers and tax due or refund fields.

4

|

Enlarge image |

State Use Only Boxes

NOTE: Developers must fill these in with the appropriate data on a completed return.

• Individual: Name control (box above the last name) - The name control will be the first four letters of the last

name and must be all caps. For example, “Testing” would be TEST. If the last name is less than four letters, use

all letters; “Cat” would be CAT.

• Business: Name control (box in the Business name line) - The name control will be the first four letters of the

business name. If the business name is “Sooner Grocery,” the name control would be SOON. If the name starts

with “The”, do not use “The” and begin the four-character name control with the first letter after “The”. For

example, if the company name is “The Cliff”, the name control would be CLIF. Ampersands and dashes are

allowable in the name control. The “Run & Shop Corporation” would have the name control of RUN&.

• Tax Period (box at the end of the tax period ending date) - Enter the tax period ending date in the MMYY

format. For example, “06/30/22” would be 0622.

Intelligent Character Recognition (ICR) Readable Boxes

• Social Security number/Employer Identification Number

• Name Control

• Tax Period (Business Income Tax Forms)

• Tax Due

• Refund

• Amended box

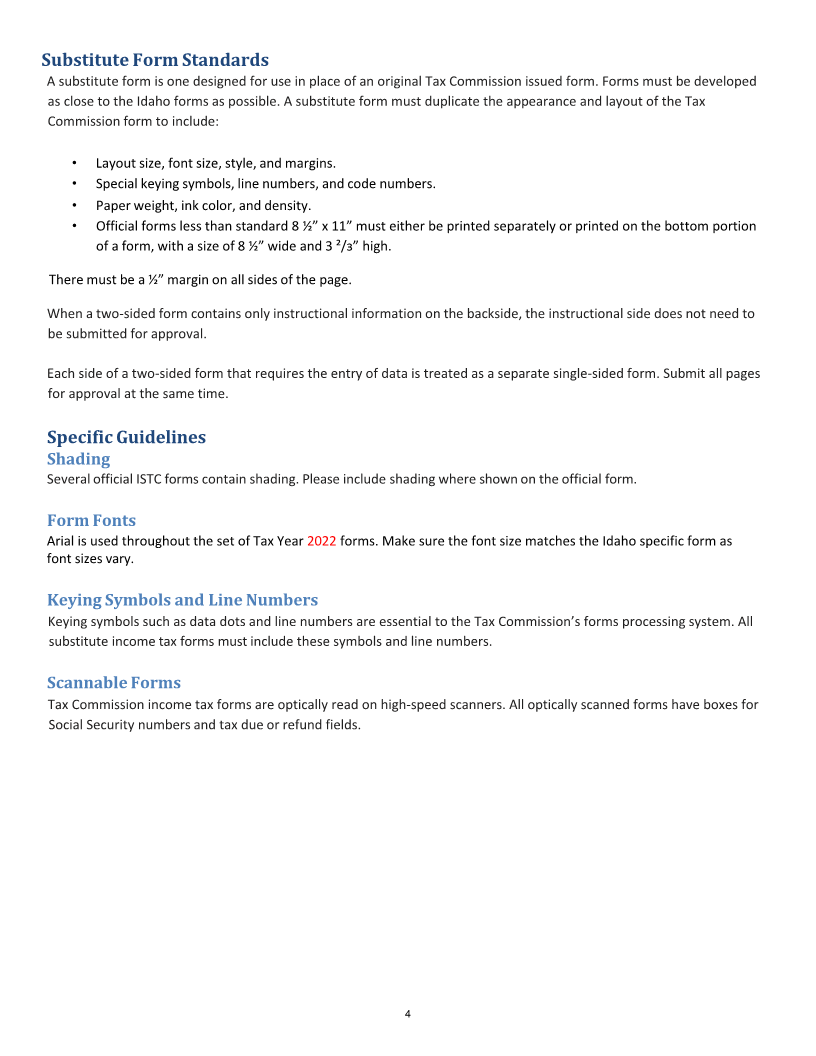

Intelligent Character Recognition (ICR) Guidelines

In order to receive a successful read in these fields, here are some guidelines when creating these boxes:

Numbers in the boxes and the amended indicator must be centered. Do not left or right justify. The fields containing

ICR data should be larger than the other fields. Smaller fields are more difficult to scan and read. For example, the

Amended Return box below is too small to be scanned. In the scenario below, the Amended Return box should be at

least twice the size shown.

As a general rule, the boxes of information containing ICR data should be roughly twice the size of non-ICR fields. For the

boxes that contain numeric or text data, the size of the box should be twice the height of the font used for data entry

into that box of information. Below is an example of a box that’s too small in relation to the font size:

When typing information into ICR fields, avoid inserting data near the borders of the field. The following data is typed

too close to the bottom border:

5

|

Enlarge image |

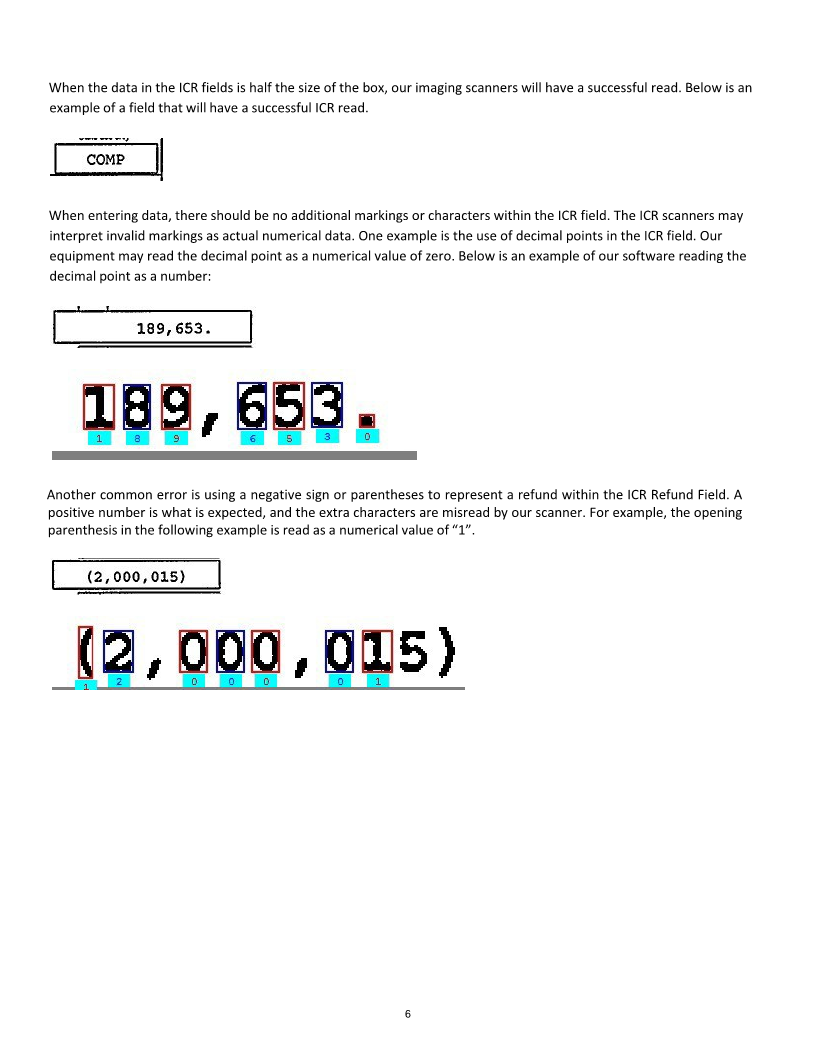

When the data in the ICR fields is half the size of the box, our imaging scanners will have a successful read. Below is an

example of a field that will have a successful ICR read.

When entering data, there should be no additional markings or characters within the ICR field. The ICR scanners may

interpret invalid markings as actual numerical data. One example is the use of decimal points in the ICR field. Our

equipment may read the decimal point as a numerical value of zero. Below is an example of our software reading the

decimal point as a number:

Another common error is using a negative sign or parentheses to represent a refund within the ICR Refund Field. A

positive number is what is expected, and the extra characters are misread by our scanner. For example, the opening

parenthesis in the following example is read as a numerical value of “1”.

6

|

Enlarge image |

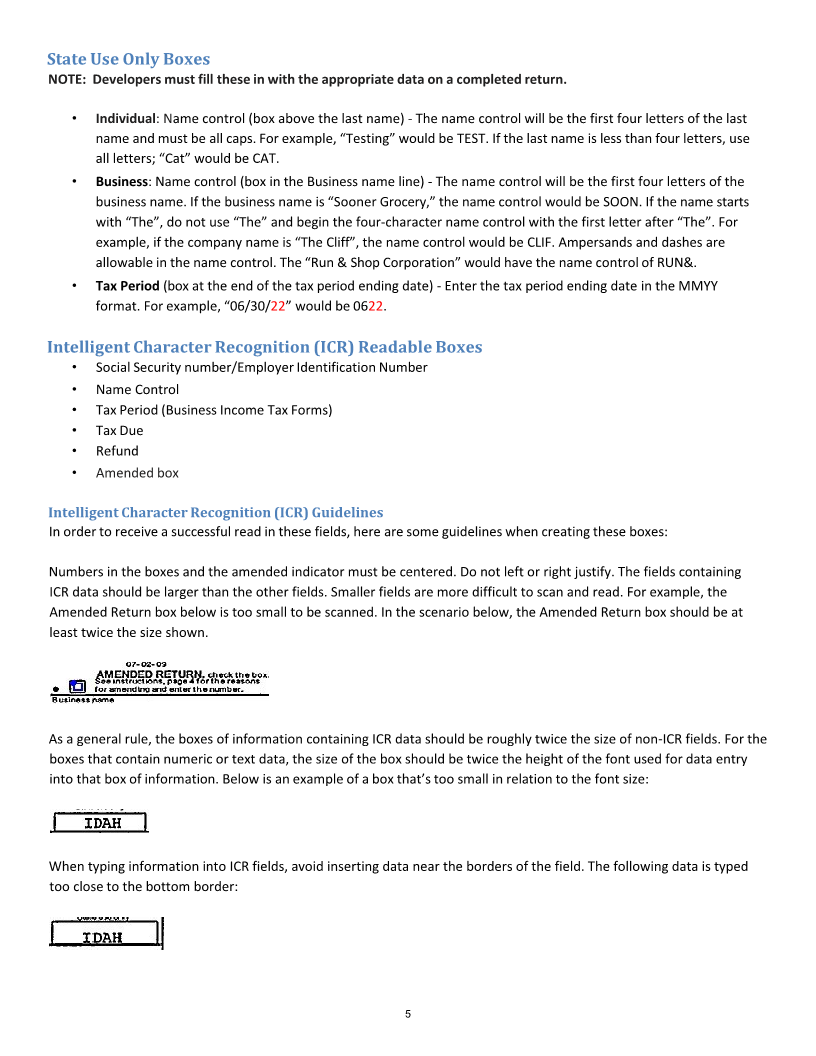

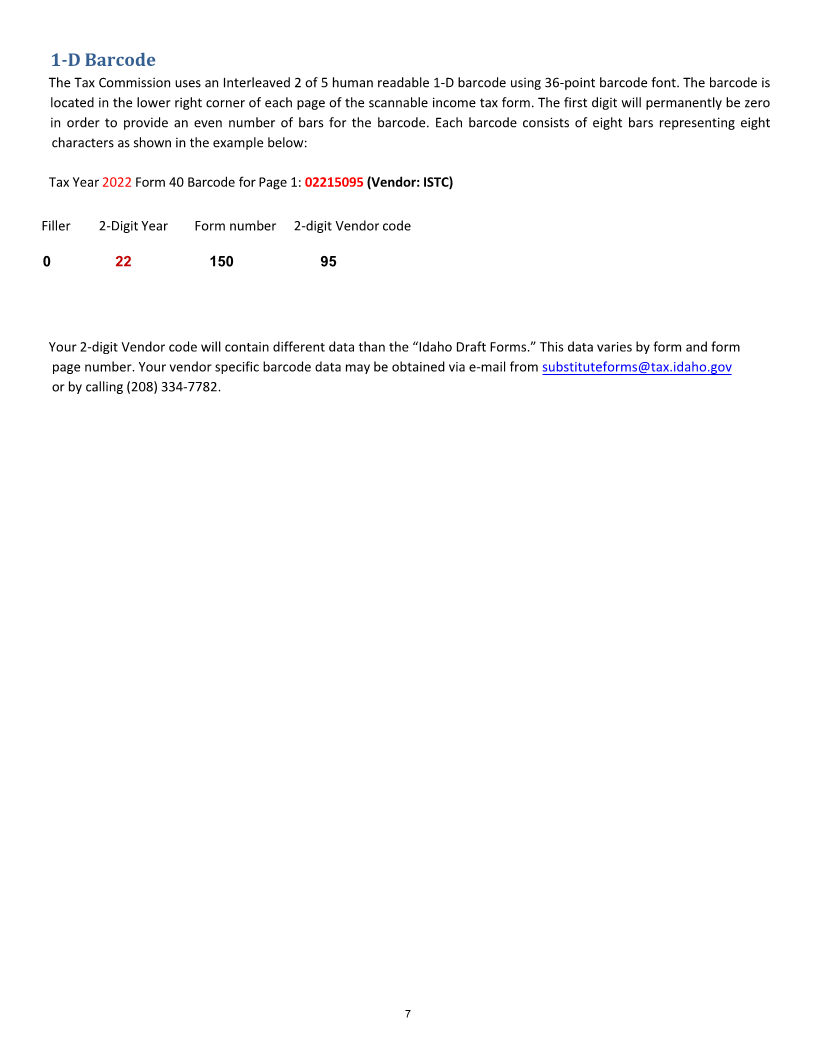

1-D Barcode

The Tax Commission uses an Interleaved 2 of 5 human readable 1-D barcode using 36-point barcode font. The barcode is

located in the lower right corner of each page of the scannable income tax form. The first digit will permanently be zero

in order to provide an even number of bars for the barcode. Each barcode consists of eight bars representing eight

characters as shown in the example below:

Tax Year 2022Form 40 Barcode for Page 1: 022 15095 (Vendor: ISTC)

Filler 2-Digit Year Form number 2-digit Vendor code

0 22 150 95

Your 2-digit Vendor code will contain different data than the “Idaho Draft Forms.” This data varies by form and form

page number. Your vendor specific barcode data may be obtained via e-mail from substituteforms@tax.idaho.gov

or by calling (208) 334-7782.

7

|