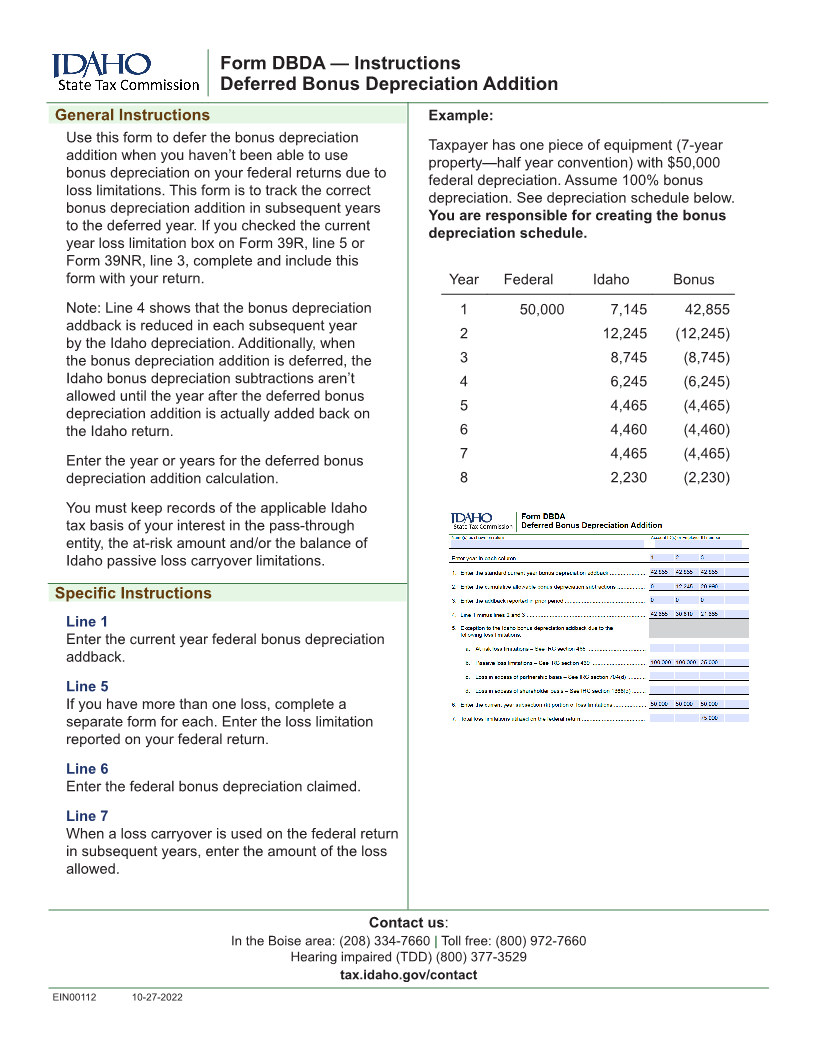

Enlarge image

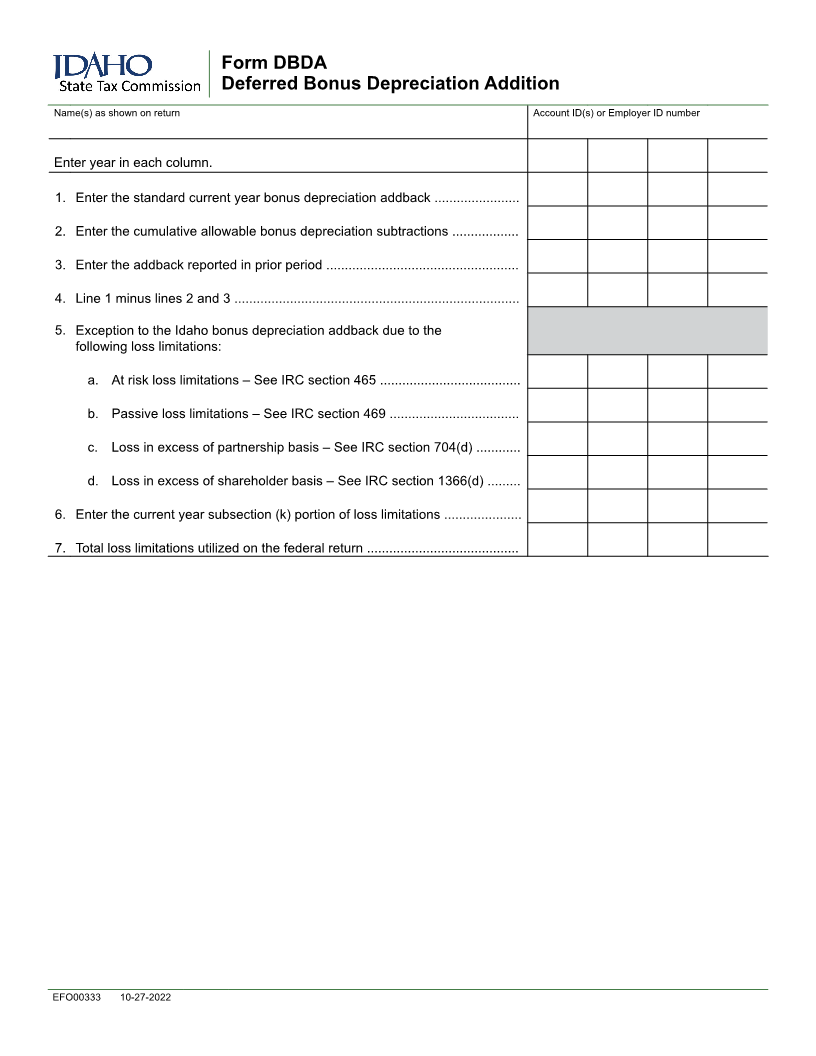

Form DBDA

Deferred Bonus Depreciation Addition

Name(s) as shown on return Account ID(s) or Employer ID number

Enter year in each column.

1. Enter the standard current year bonus depreciation addback .......................

2. Enter the cumulative allowable bonus depreciation subtractions ..................

3. Enter the addback reported in prior period ....................................................

4. Line 1 minus lines 2 and 3 .............................................................................

5. Exception to the Idaho bonus depreciation addback due to the

following loss limitations:

a. At risk loss limitations – See IRC section 465 ......................................

b. Passive loss limitations – See IRC section 469 ...................................

c. Loss in excess of partnership basis – See IRC section 704(d) ............

d. Loss in excess of shareholder basis – See IRC section 1366(d) .........

6. Enter the current year subsection (k) portion of loss limitations .....................

7. Total loss limitations utilized on the federal return .........................................

EFO00333 10-27-2022