Enlarge image

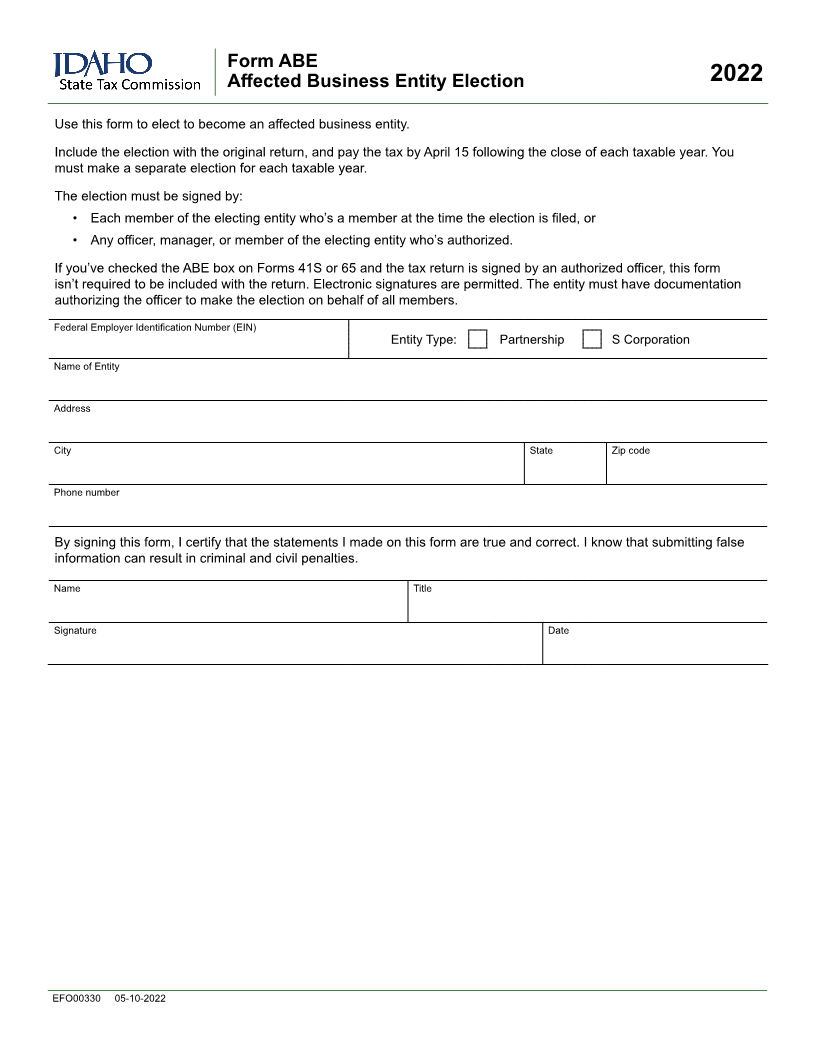

Form ABE

Affected Business Entity Election 2022

Use this form to elect to become an affected business entity.

Include the election with the original return, and pay the tax by April 15 following the close of each taxable year. You

must make a separate election for each taxable year.

The election must be signed by:

• Each member of the electing entity who’s a member at the time the election is filed, or

• Any officer, manager, or member of the electing entity who’s authorized.

If you’ve checked the ABE box on Forms 41S or 65 and the tax return is signed by an authorized officer, this form

isn’t required to be included with the return. Electronic signatures are permitted. The entity must have documentation

authorizing the officer to make the election on behalf of all members.

Federal Employer Identification Number (EIN)

Entity Type: Partnership S Corporation

Name of Entity

Address

City State Zip code

Phone number

By signing this form, I certify that the statements I made on this form are true and correct. I know that submitting false

information can result in criminal and civil penalties.

Name Title

Signature Date

EFO00330 05-10-2022