Enlarge image

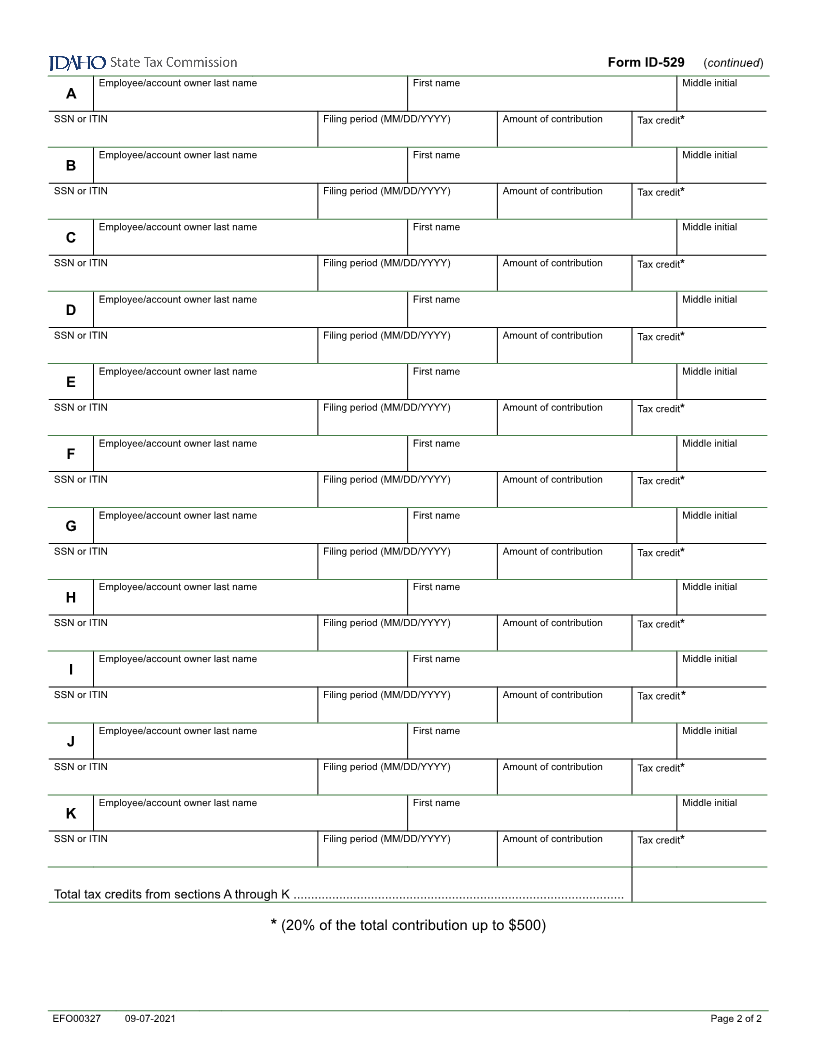

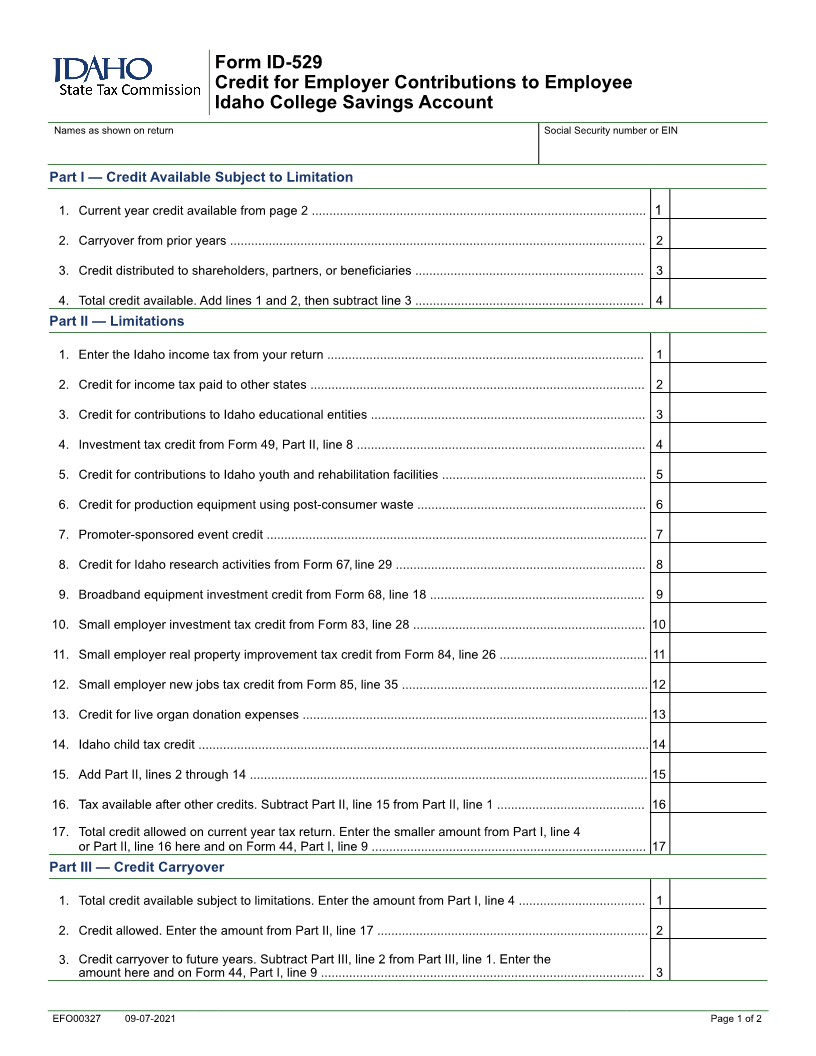

Form ID-529

Credit for Employer Contributions to Employee

Idaho College Savings Account

Names as shown on return Social Security number or EIN

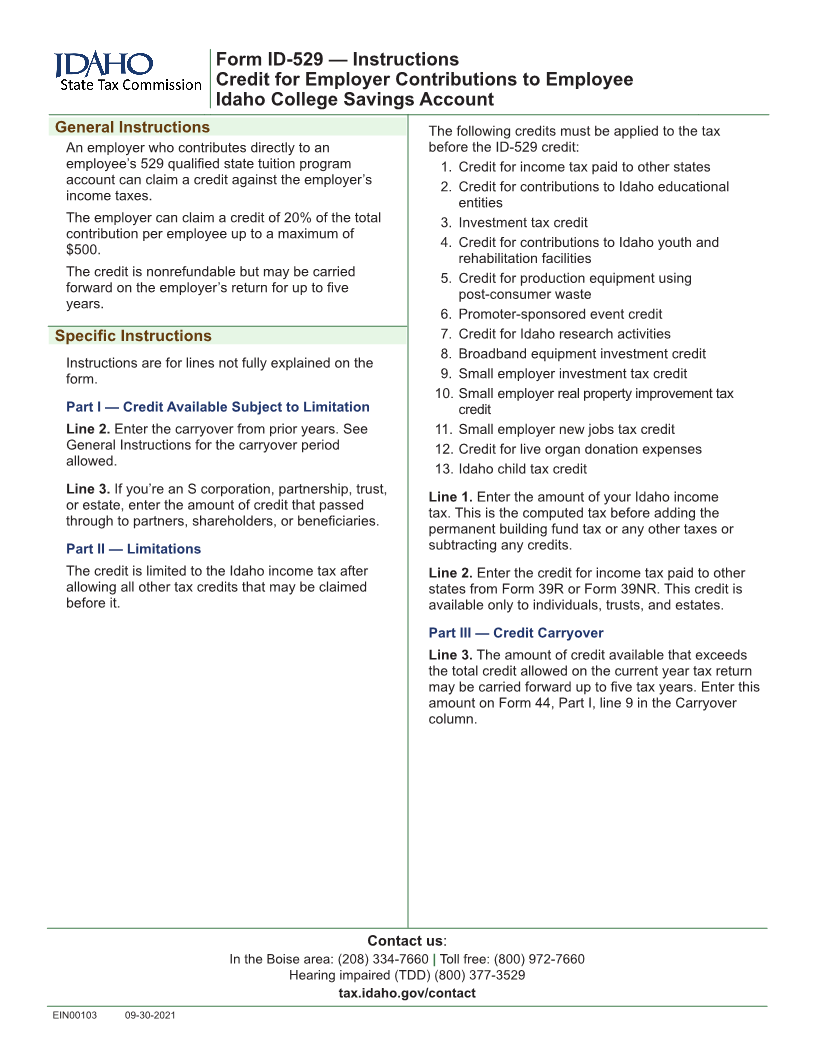

Part I — Credit Available Subject to Limitation

1. Current year credit available from page 2 ............................................................................................... 1

2. Carryover from prior years ...................................................................................................................... 2

3. Credit distributed to shareholders, partners, or beneficiaries ................................................................. 3

4. Total credit available. Add lines 1 and 2, then subtract line 3 ................................................................. 4

Part II — Limitations

1. Enter the Idaho income tax from your return .......................................................................................... 1

2. Credit for income tax paid to other states ............................................................................................... 2

3. Credit for contributions to Idaho educational entities .............................................................................. 3

4. Investment tax credit from Form 49, Part II, line 8 .................................................................................. 4

5. Credit for contributions to Idaho youth and rehabilitation facilities .......................................................... 5

6. Credit for production equipment using post-consumer waste ................................................................. 6

7. Promoter-sponsored event credit ............................................................................................................ 7

8. Credit for Idaho research activities from Form 67, line 29 ....................................................................... 8

9. Broadband equipment investment credit from Form 68, line 18 ............................................................. 9

10. Small employer investment tax credit from Form 83, line 28 .................................................................. 10

11. Small employer real property improvement tax credit from Form 84, line 26 .......................................... 11

12. Small employer new jobs tax credit from Form 85, line 35 ...................................................................... 12

13. Credit for live organ donation expenses .................................................................................................. 13

14. Idaho child tax credit ................................................................................................................................ 14

15. Add Part II, lines 2 through 14 ................................................................................................................. 15

16. Tax available after other credits. Subtract Part II, line 15 from Part II, line 1 .......................................... 16

17. Total credit allowed on current year tax return. Enter the smaller amount from Part I, line 4

or Part II, line 16 here and on Form 44, Part I, line 9 .............................................................................. 17

Part III — Credit Carryover

1. Total credit available subject to limitations. Enter the amount from Part I, line 4 .................................... 1

2. Credit allowed. Enter the amount from Part II, line 17 ............................................................................. 2

3. Credit carryover to future years. Subtract Part III, line 2 from Part III, line 1. Enter the

amount here and on Form 44, Part I, line 9 ............................................................................................ 3

EFO00327 09-07-2021 Page 1 of 2