Enlarge image

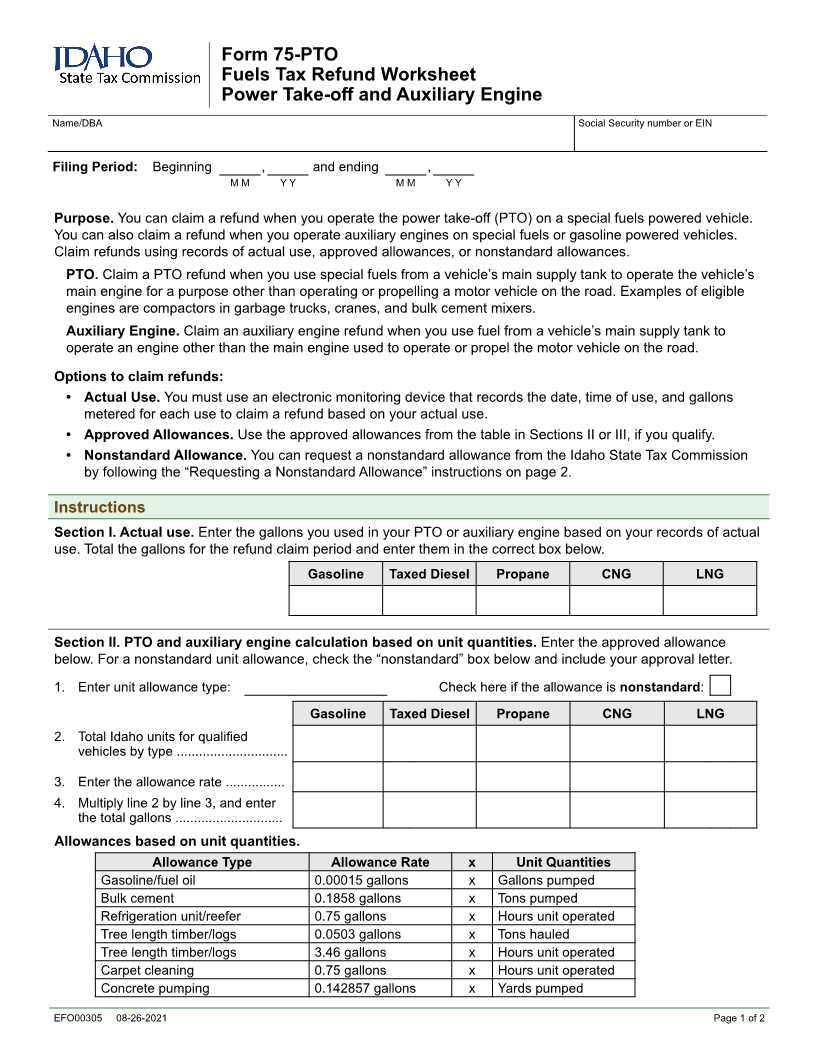

Form 75-PTO

Fuels Tax Refund Worksheet

Power Take-off and Auxiliary Engine

Name/DBA Social Security number or EIN

Filing Period: Beginning , and ending ,

M M Y Y M M Y Y

Purpose. You can claim a refund when you operate the power take-off (PTO) on a special fuels powered vehicle.

You can also claim a refund when you operate auxiliary engines on special fuels or gasoline powered vehicles.

Claim refunds using records of actual use, approved allowances, or nonstandard allowances.

PTO. Claim a PTO refund when you use special fuels from a vehicle’s main supply tank to operate the vehicle’s

main engine for a purpose other than operating or propelling a motor vehicle on the road. Examples of eligible

engines are compactors in garbage trucks, cranes, and bulk cement mixers.

Auxiliary Engine. Claim an auxiliary engine refund when you use fuel from a vehicle’s main supply tank to

operate an engine other than the main engine used to operate or propel the motor vehicle on the road.

Options to claim refunds:

• Actual Use. You must use an electronic monitoring device that records the date, time of use, and gallons

metered for each use to claim a refund based on your actual use.

• Approved Allowances. Use the approved allowances from the table in Sections II or III, if you qualify.

• Nonstandard Allowance. You can request a nonstandard allowance from the Idaho State Tax Commission

by following the “Requesting a Nonstandard Allowance” instructions on page 2.

Instructions

Section I. Actual use. Enter the gallons you used in your PTO or auxiliary engine based on your records of actual

use. Total the gallons for the refund claim period and enter them in the correct box below.

Gasoline Taxed Diesel Propane CNG LNG

Section II. PTO and auxiliary engine calculation based on unit quantities. Enter the approved allowance

below. For a nonstandard unit allowance, check the “nonstandard” box below and include your approval letter.

1. Enter unit allowance type: Check here if the allowance is nonstandard:

Gasoline Taxed Diesel Propane CNG LNG

2. Total Idaho units for qualified

vehicles by type ..............................

3. Enter the allowance rate ................

4. Multiply line 2 by line 3, and enter

the total gallons .............................

Allowances based on unit quantities.

Allowance Type Allowance Rate x Unit Quantities

Gasoline/fuel oil 0.00015 gallons x Gallons pumped

Bulk cement 0.1858 gallons x Tons pumped

Refrigeration unit/reefer 0.75 gallons x Hours unit operated

Tree length timber/logs 0.0503 gallons x Tons hauled

Tree length timber/logs 3.46 gallons x Hours unit operated

Carpet cleaning 0.75 gallons x Hours unit operated

Concrete pumping 0.142857 gallons x Yards pumped

EFO00305 08-26-2021 Page 1 of 2