Enlarge image

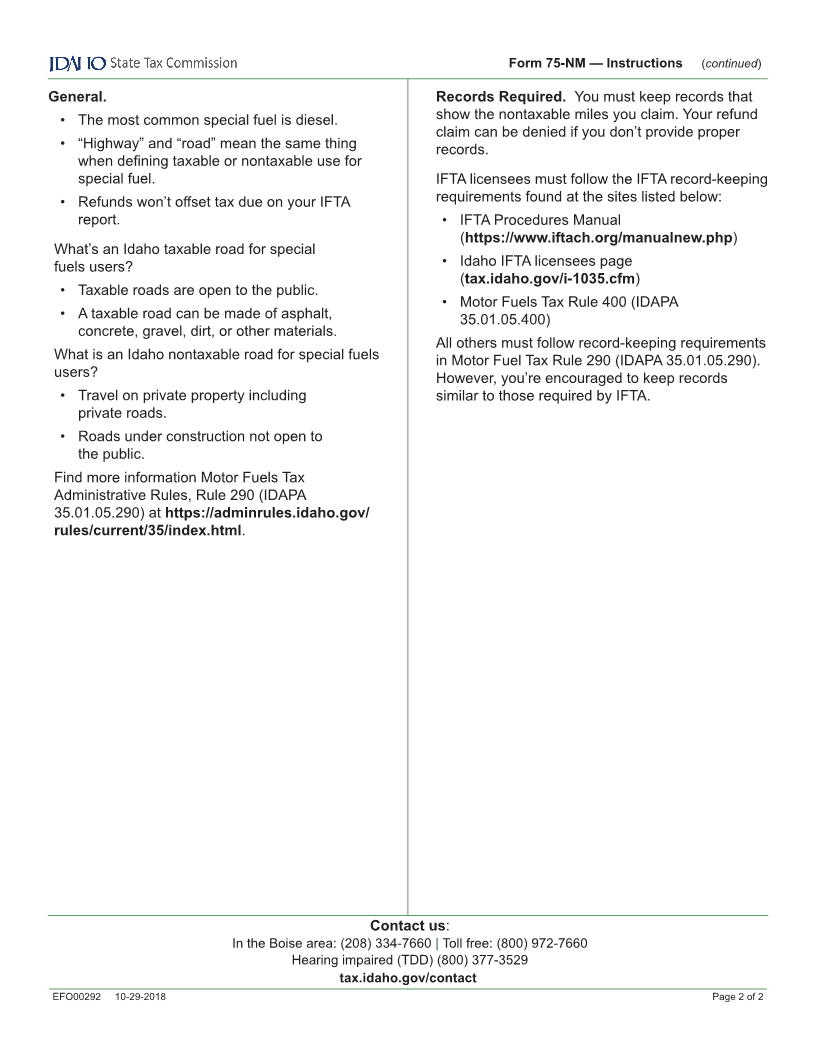

Form 75-NM

Fuels Tax Refund Worksheet

Nontaxable Miles (Special Fuels Only)

Name/DBA Social Security number or EIN

Filing Period: Beginning , and ending , IFTA licensees only, calendar quarter

M M Y Y M M Y Y

Purpose. Use this worksheet to calculate the nontaxable gallons of special fuels, like diesel, for travel on

nontaxable roads. Idaho only allows special fuels-powered vehicles to claim a refund when using tax-paid

special fuels on nontaxable roads.

Who Can Use This Worksheet:

• International Fuel Tax Agreement (IFTA) licensees with qualified vehicles, or

• Any taxpayers with vehicles not included in an IFTA fleet.

Instructions. (for more information, see next page)

Filing Period (Form 75, Section I):

• For an IFTA licensee, the filing period must match the filing period on the IFTA return.

• You can include up to four calendar quarter worksheets with one Form 75 when filing your income tax

return. Include copies of all applicable IFTA returns.

○ For example, if the IFTA return is for the second quarter of 2018, the Form 75 filing period is from

4/1/2018 to 6/30/2018.

• All other fuel consumers seeking refunds can file for periods that are at least one month and not more

than one year.

Nontaxable Use (Form 75, Section III). All users should check box 4, Intrastate motor vehicles

off-highway miles.

Calculate nontaxable gallons:

1. Enter total Idaho miles traveled for all vehicles....................................................

2. Enter Idaho taxable miles for all vehicles.............................................................

3. Calculate your nontaxable miles. Subtract line 2 from line 1...............................

4. Enter the miles per gallon (MPG) for all vehicles.................................................

5. Calculate your nontaxable gallons. Divide line 3 by line 4

(round to whole gallons).......................................................................................

Transfer the nontaxable gallons from line 5, (above) to the Form 75 Section V, line 2 and Section VII,

line 1 for the appropriate fuel type.

Include the following with your Form 75:

• A copy of this worksheet.

• IFTA licensees must include a copy of their IFTA return and write “COPY” at the top.

Not including the items listed above may delay your refund.

Complete a separate worksheet if you’re an IFTA licensee claiming nontaxable gallons from sources other

than nontaxable roads for qualified IFTA vehicles (e.g., a power take-off).

EFO00292 10-29-2018 Page 1 of 2