Enlarge image

Use your 'Mouse' or the 'Tab key' to move through the fields and 'Mouse' or 'Space bar' to enable the checkboxes.

Illinois Department of Revenue

ST-16 Annual Report of Manufacturer’s REV 03 Form 063 Station 267

E S _____/_____/_____

Purchase Credit Earned

NS CA

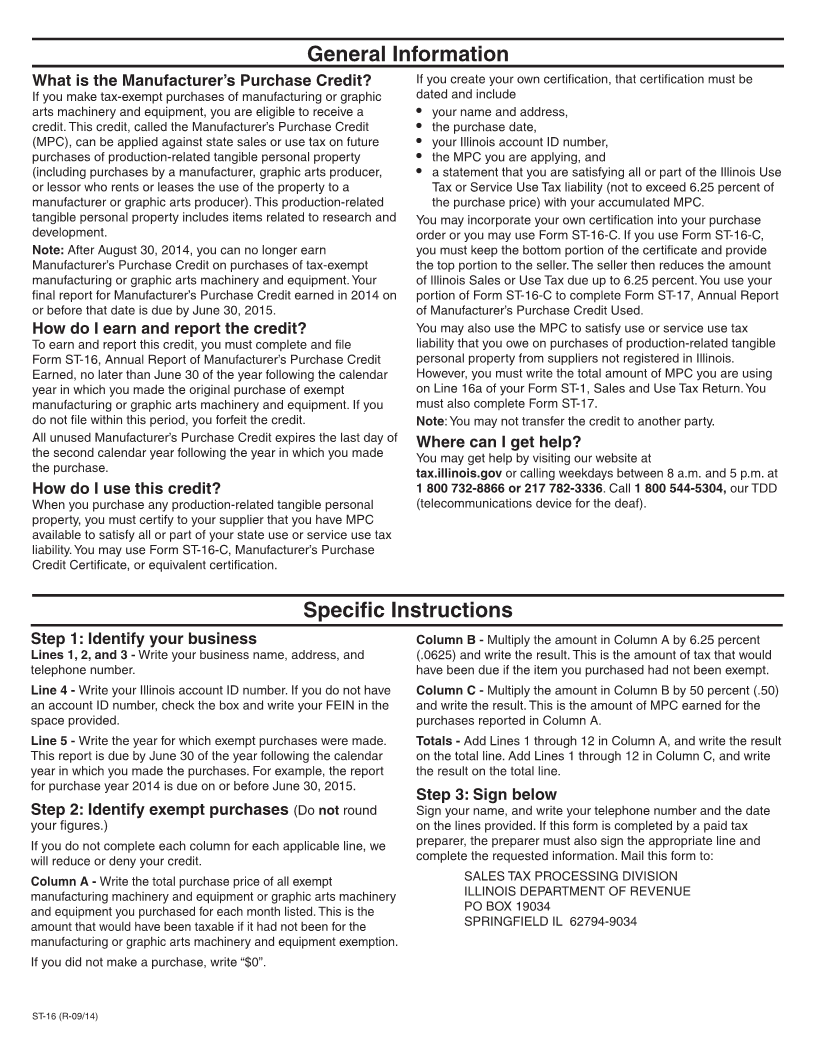

Step 1: Identify your business

1 Business name _____________________________________ 4 Illinois account ID number __ __ __ __ - __ __ __ __

If you do not have an account ID number, check this box and

write your federal employer identification number (FEIN).

2 Business address _____________________________________ __ __ - __ __ __ __ __ __ __

Street address

__________________________________________________ __ 5 Write the purchase year: January through December __ __ __ __

City State ZIP This report is due by June 30 of the following year. Year

3 Business phone number (______)________________________

Step 2: Identify tax-exempt purchases of manufacturing or graphic arts

machinery and equipment (Do not round your figures.)

Note: After August 30, 2014, you can no longer earn Manufacturer’s Purchase Credit on purchases of tax-exempt manufacturing or graphic arts

machinery and equipment. Your final report for Manufacturer’s Purchase Credit earned in 2014 on or before that date is due by June 30, 2015.

A B C

Month of exempt Purchase price Tax that would Amount of

purchase of exempt items State tax rate have been due Percentage credit earned

1 January $ ___________________ X .0625 = $ ___________________ X .50 = $ ___________________

2 February $ ___________________ X .0625 = $ ___________________ X .50 = $ ___________________

3 March $ ___________________ X .0625 = $ ___________________ X .50 = $ ___________________

4 April $ ___________________ X .0625 = $ ___________________ X .50 = $ ___________________

5 May $ ___________________ X .0625 = $ ___________________ X .50 = $ ___________________

6 June $ ___________________ X .0625 = $ ___________________ X .50 = $ ___________________

7 July $ ___________________ X .0625 = $ ___________________ X .50 = $ ___________________

8 August $ ___________________ X .0625 = $ ___________________ X .50 = $ ___________________

9 September $ ___________________ X .0625 = $ ___________________ X .50 = $ ___________________

10 October $ ___________________ X .0625 = $ ___________________ X .50 = $ ___________________

11 November $ ___________________ X .0625 = $ ___________________ X .50 = $ ___________________

12 December $ ___________________ X .0625 = $ ___________________ X .50 = $ ___________________

Total $ ___________________ Total $ ___________________

(Column A) (Column C)

Step 3: Sign below

Under penalties of perjury, I state that I have examined this form and, to the best of my knowledge, it is true, correct, and complete.

______________________________________________________________(____)________________ __ __ /__ __ / __ __ __ __

Taxpayer’s signature Daytime phone number Date

______________________________________________________________(____)________________ __ __ /__ __ / __ __ __ __

Preparer’s signature Preparer’s name (Please print.) Daytime phone number Date

This form is authorized as outlined under the tax or fee Act imposing the tax or fee for which this form is filed. Disclosure of this

ST-16 (R-09/14) information is required. Failure to provide information may result in this form not being processed and may result in a penalty.

Reset Print