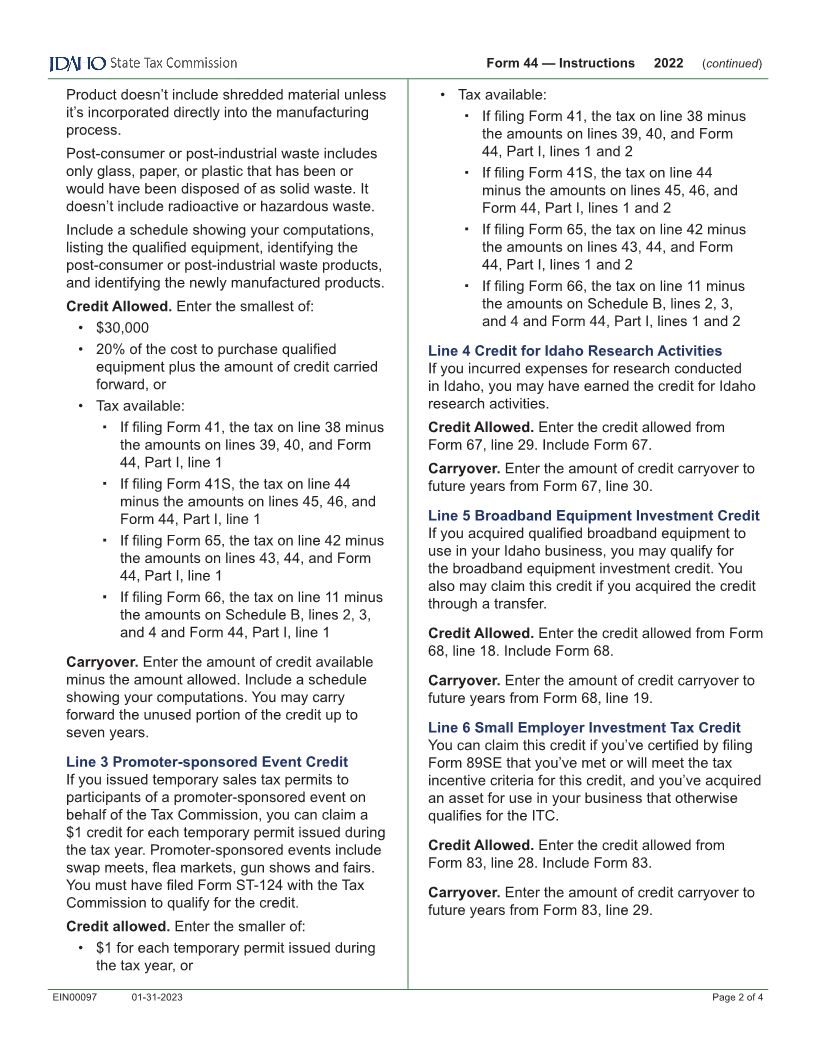

Enlarge image

Form 44 2022

Business Income Tax Credits, Credit Recapture,

and Nonrefundable Credit From a Prior Year Return

Names as shown on return Social Security number or EIN

Part I — Business Income Tax Credits

Credit Allowed Carryover

1. Investment tax credit. Include Form 49 ........................................... ▪ 1 ▪

2. Credit for production equipment using post-consumer waste ......... ▪ 2 ▪

3. Promoter-sponsored event credit .................................................... ▪ 3

4. Credit for Idaho research activities. Include Form 67 ...................... ▪ 4 ▪

5. Broadband equipment investment credit. Include Form 68 ............. ▪ 5 ▪

6. Small employer investment tax credit. Include Form 83 .................. ▪ 6 ▪

7. Small employer real property improvement tax credit.

Include Form 84 ............................................................................... ▪ 7 ▪

8. Small employer new jobs tax credit. Include Form 85 ..................... ▪ 8 ▪

9. Credit for employer contributions to employee’s Idaho college

savings account. Include Form ID-529 ............................................ ▪ 9 ▪

10. Total business income tax credits allowed. Add lines 1 through 9 ... ▪ 10

Part II — Tax from Recapture of Business Income Tax Credits

Tax from recapture of:

1. Investment tax credit. Include Form 49R ......................................................................... ▪ 1

2. Broadband equipment investment credit. Include Form 68R ........................................... ▪ 2

3. Small employer investment tax credit. Include Form 83R ................................................ ▪ 3

4. Small employer real property improvement tax credit. Include Form 84R ....................... ▪ 4

5. Small employer new jobs tax credit. Include Form 85R ................................................... ▪ 5

6. Total tax from recapture of business income tax credits. Add lines 1 through 5 .............. ▪ 6

Part III — Nonrefundable Credit From a Prior Year Return

By completing this section, I am filing my claim for credit.

A B C D E F G

Year ▪

Nonrefundable

Credit ▪

1. Total nonrefundable credit. Add columns A through G ..................................................... ▪ 1

2. Reserved for tax year 2023 .............................................................................................. ▪ 2

3. Add lines 1 and 2. This is your total credit ....................................................................... ▪ 3

4. Enter tax due, plus penalty and interest from applicable form ......................................... ▪ 4

5. Credit allowed. If line 4 is less than line 3, this is your allowed credit.

If line 4 is more than line 3, enter the amount from line 3 ................................................ ▪ 5

6. Credit remaining for future years. Subtract line 5 from line 3.

If the result is less than zero, enter zero........................................................................... ▪ 6

EFO00006 01-31-2023