Enlarge image

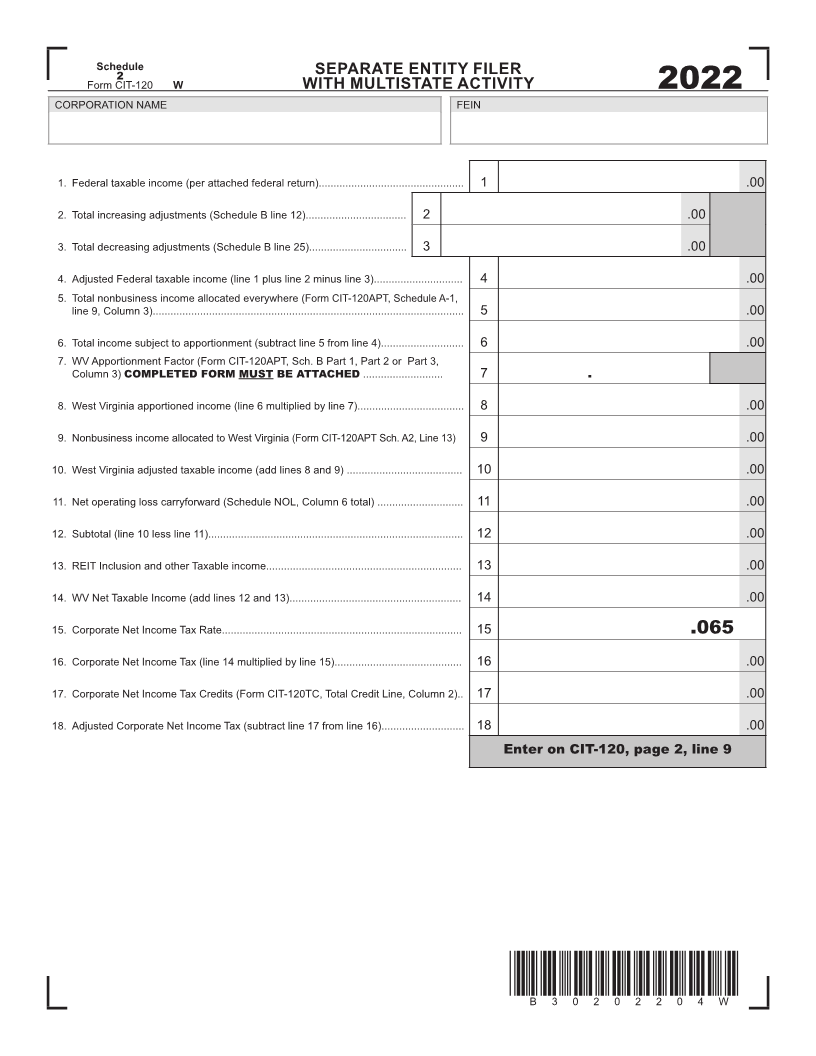

Schedule SEPARATE ENTITY FILER

2

Form CIT-120 W WITH MULTISTATE ACTIVITY 2022

CORPORATION NAME FEIN

1. Federal taxable income (per attached federal return)................................................. 1 .00

2. Total increasing adjustments (Schedule B line 12).................................. 2 .00

3. Total decreasing adjustments (Schedule B line 25)................................. 3 .00

4. Adjusted Federal taxable income (line 1 plus line 2 minus line 3).............................. 4 .00

5. Total nonbusiness income allocated everywhere (Form CIT-120APT, Schedule A-1,

line 9, Column 3)......................................................................................................... 5 .00

6. Total income subject to apportionment (subtract line 5 from line 4)............................ 6 .00

7. WV Apportionment Factor (Form CIT-120APT, Sch. B Part 1, Part 2 or Part 3,

Column 3) COMPLETED FORM MUST BE ATTACHED ........................... 7 .

8. West Virginia apportioned income (line 6 multiplied by line 7).................................... 8 .00

9. Nonbusiness income allocated to West Virginia (Form CIT-120APT Sch. A2, Line 13) 9 .00

10. West Virginia adjusted taxable income (add lines 8 and 9) ....................................... 10 .00

11. Net operating loss carryforward (Schedule NOL, Column 6 total) ............................. 11 .00

12. Subtotal (line 10 less line 11)...................................................................................... 12 .00

13. REIT Inclusion and other Taxable income.................................................................. 13 .00

14. WV Net Taxable Income (add lines 12 and 13).......................................................... 14 .00

15. Corporate Net Income Tax Rate................................................................................. 15 .065

16. Corporate Net Income Tax (line 14 multiplied by line 15)........................................... 16 .00

17. Corporate Net Income Tax Credits (Form CIT-120TC, Total Credit Line, Column 2).. 17 .00

18. Adjusted Corporate Net Income Tax (subtract line 17 from line 16)............................ 18 .00

Enter on CIT-120, page 2, line 9

*B30202204W*

B30202204W