Enlarge image

Schedule

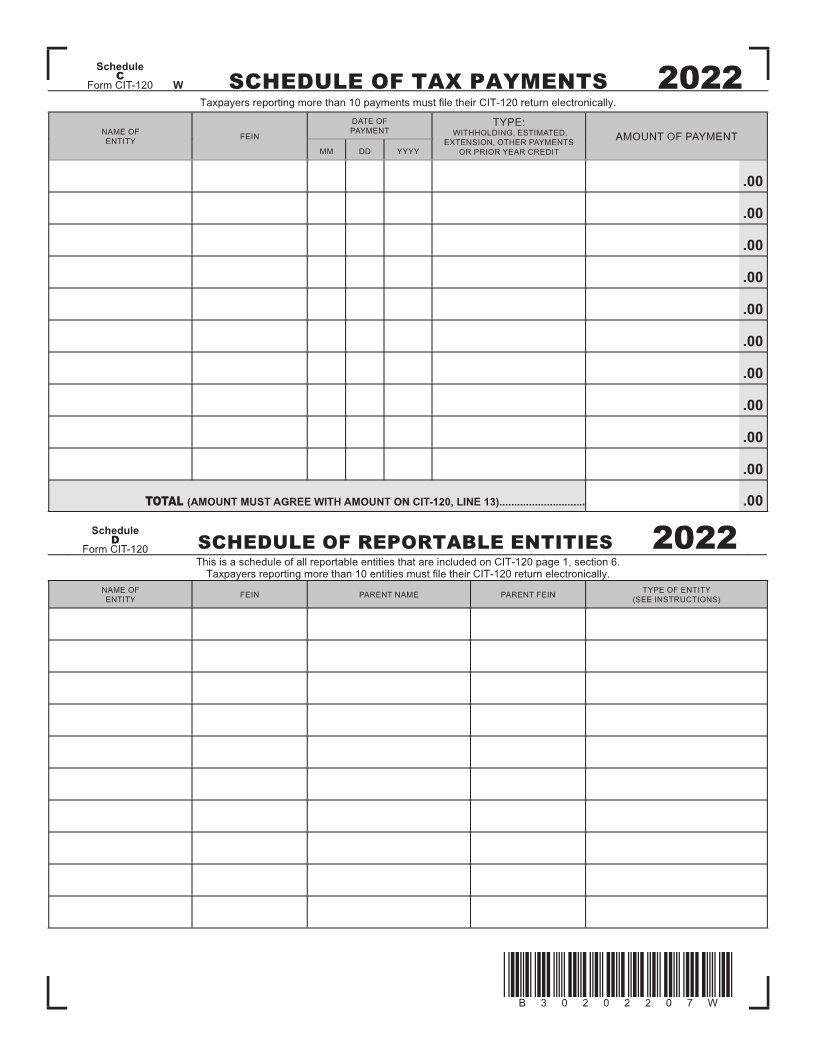

C

Form CIT-120 W SCHEDULE OF TAX PAYMENTS 2022

Taxpayers reporting more than 10 payments must file their CIT-120 return electronically.

DATE OF TYPE:

NAME OF FEIN PAYMENT WITHHOLDING, ESTIMATED, AMOUNT OF PAYMENT

ENTITY EXTENSION, OTHER PAYMENTS

MM DD YYYY OR PRIOR YEAR CREDIT

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

TOTAL (AMOUNT MUST AGREE WITH AMOUNT ON CIT-120, LINE 13)............................. .00

Schedule

D

Form CIT-120 SCHEDULE OF REPORTABLE ENTITIES 2022

This is a schedule of all reportable entities that are included on CIT-120 page 1, section 6.

Taxpayers reporting more than 10 entities must file their CIT-120 return electronically.

NAME OF FEIN PARENT NAME PARENT FEIN TYPE OF ENTITY

ENTITY (SEE INSTRUCTIONS)

*B30202207W*

B30202207W