Enlarge image

.00 .00 .00 .00 .00 .00 .00 .00 .00 .00 .00 .00 .00 .00

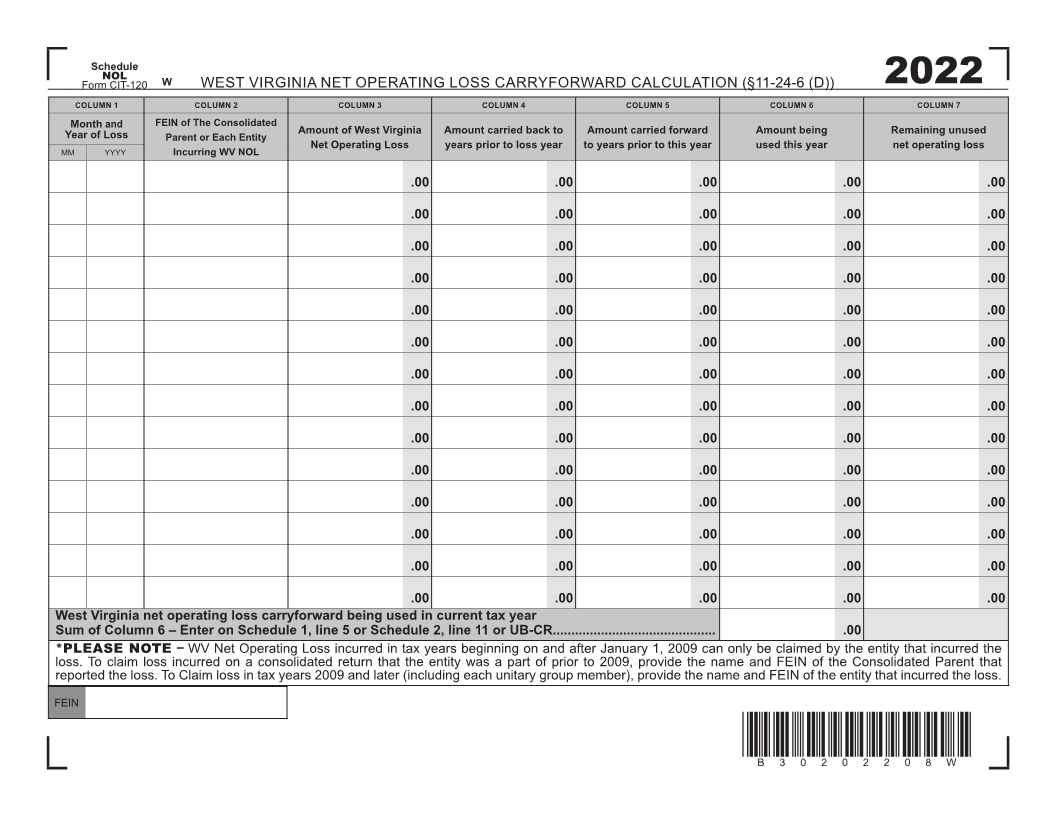

COLUMN 7

Remaining unused net operating loss

2022

.00 .00 .00 .00 .00 .00 .00 .00 .00 .00 .00 .00 .00 .00 .00

COLUMN 6

Amount being used this year B30202208W

*B30202208W*

.00 .00 .00 .00 .00 .00 .00 .00 .00 .00 .00 .00 .00 .00

COLUMN 5

Amount carried forward to years prior to this year

.00 .00 .00 .00 .00 .00 .00 .00 .00 .00 .00 .00 .00 .00

COLUMN 4

Amount carried back to years prior to loss year

.00 .00 .00 .00 .00 .00 .00 .00 .00 .00 .00 .00 .00 .00

COLUMN 3

Net Operating Loss

Amount of West Virginia

WEST VIRGINIA NET OPERATING LOSS CARRYFORWARD CALCULATION (§11-24-6 (D)) COLUMN 2

WV Net Operating Loss incurred in tax years beginning on and after January 1, 2009 can only be claimed by the entity that incurred the

Incurring WV NOL

W Parent or Each Entity

FEIN of The Consolidated

NOL and YYYY

Schedule

Form CIT-120

COLUMN 1 Month Year of Loss MM West Virginia net operating loss carryforward being used in current tax year Sum of Column 6 – Enter on Schedule 1, line 5 or Schedule 2, line 11 or UB-CR............................................ *PLEASE NOTE – loss. To claim loss incurred on a consolidated return that the entity was a part of prior to 2009, provide the name and FEIN of the Consolidated Parent that reported the loss. To Claim loss in tax years 2009 and later (including each unitary group member), provide the name and FEIN of the entity that incurred the loss. FEIN