Enlarge image

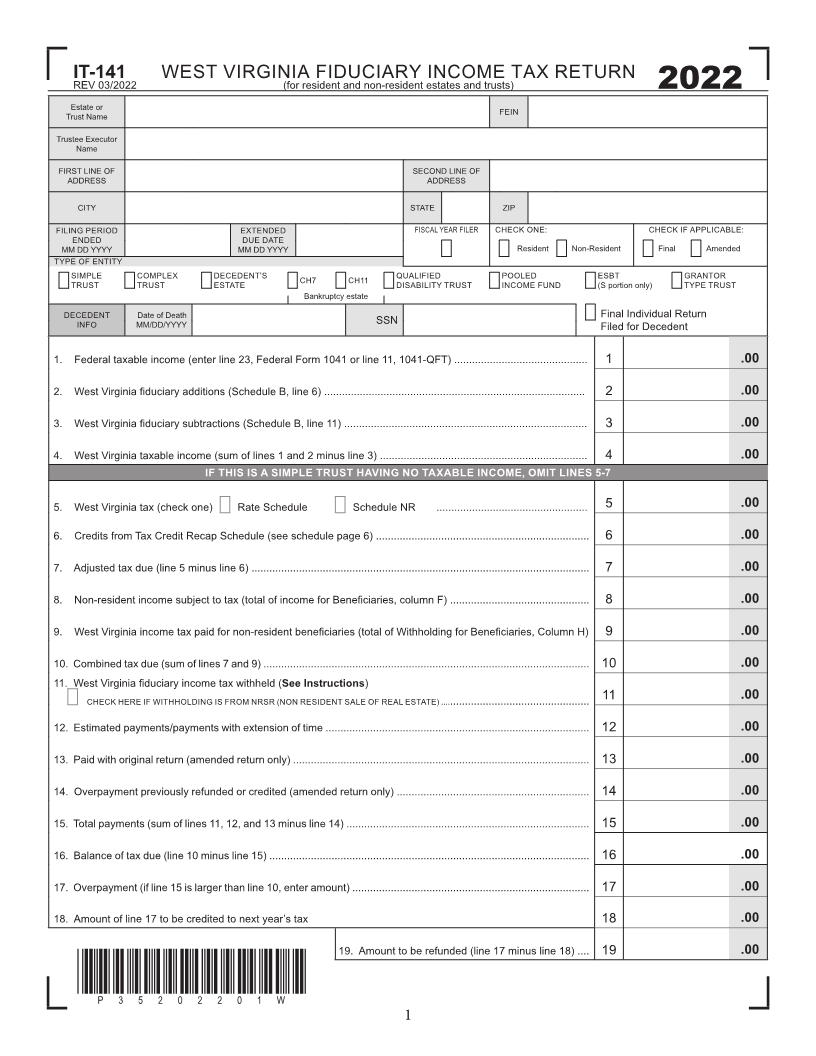

IT-141 WEST VIRGINIA FIDUCIARY INCOME TAX RETURN

REV 03/2022 (for resident and non-resident estates and trusts)

2022

Estate or FEIN

Trust Name

Trustee Executor

Name

FIRST LINE OF SECOND LINE OF

ADDRESS ADDRESS

CITY STATE ZIP

FILING PERIOD EXTENDED FISCAL YEAR FILER CHECK ONE: CHECK IF APPLICABLE:

ENDED DUE DATE

MM DD YYYY MM DD YYYY Resident Non-Resident Final Amended

TYPE OF ENTITY

SIMPLE COMPLEX DECEDENT’S CH7 CH11 QUALIFIED POOLED ESBT GRANTOR

TRUST TRUST ESTATE DISABILITY TRUST INCOME FUND (S portion only) TYPE TRUST

Bankruptcy estate

DECEDENT Date of Death SSN Final Individual Return

INFO MM/DD/YYYY Filed for Decedent

1. Federal taxable income (enter line 23, Federal Form 1041 or line 11, 1041-QFT) ............................................. 1 .00

2. West Virginia fiduciary additions (Schedule B, line 6) ........................................................................................ 2 .00

3. West Virginia fiduciary subtractions (Schedule B, line 11) .................................................................................. 3 .00

4. West Virginia taxable income (sum of lines 1 and 2 minus line 3) ...................................................................... 4 .00

IF THIS IS A SIMPLE TRUST HAVING NO TAXABLE INCOME, OMIT LINES 5-7

5. West Virginia tax (check one) Rate Schedule Schedule NR ................................................... 5 .00

6. Credits from Tax Credit Recap Schedule (see schedule page 6) ........................................................................ 6 .00

7. Adjusted tax due (line 5 minus line 6) .................................................................................................................. 7 .00

8. Non-resident income subject to tax (total of income for Bene ficiaries, column F) ............................................... 8 .00

9. West Virginia income tax paid for non-resident bene ficiaries (total of Withholding for Bene ficiaries, Column H) 9 .00

10. Combined tax due (sum of lines 7 and 9) .............................................................................................................. 10 .00

11. West Virginia fiduciary income tax withheld (See Instructions)

CHECK HERE IF WITHHOLDING IS FROM NRSR (NON RESIDENT SALE OF REAL ESTATE) ................................................... 11 .00

12. Estimated payments/payments with extension of time ......................................................................................... 12 .00

13. Paid with original return (amended return only) .................................................................................................... 13 .00

14. Overpayment previously refunded or credited (amended return only) ................................................................. 14 .00

15. Total payments (sum of lines 11, 12, and 13 minus line 14) .................................................................................. 15 .00

16. Balance of tax due (line 10 minus line 15) ............................................................................................................ 16 .00

17. Overpayment (if line 15 is larger than line 10, enter amount) ................................................................................ 17 .00

18. Amount of line 17 to be credited to next year’s tax 18 .00

19. Amount to be refunded (line 17 minus line 18) .... 19 .00

*P35202201W*

P35202201W

1