Enlarge image

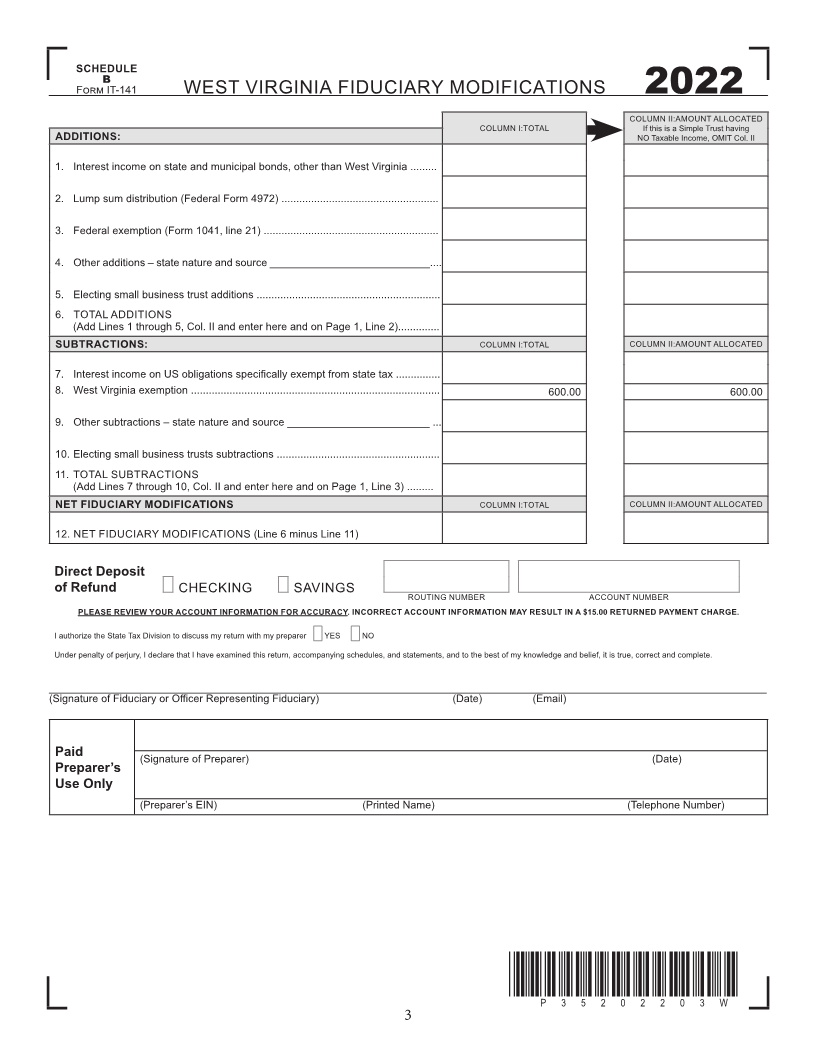

SCHEDULE

B

F IT-141 WEST VIRGINIA FIDUCIARY MODIFICATIONS

2022

COLUMN II:AMOUNT ALLOCATED

COLUMN I:TOTAL If this is a Simple Trust having

ADDITIONS: NO Taxable Income, OMIT Col. II

1. Interest income on state and municipal bonds, other than West Virginia .........

2. Lump sum distribution (Federal Form 4972) .....................................................

3. Federal exemption (Form 1041, line 21) ...........................................................

4. Other additions – state nature and source ___________________________....

5. Electing small business trust additions ..............................................................

6. TOTAL ADDITIONS

(Add Lines 1 through 5, Col. II and enter here and on Page 1, Line 2)..............

SUBTRACTIONS: COLUMN I:TOTAL COLUMN II:AMOUNT ALLOCATED

7. Interest income on US obligations speci fically exempt from state tax ...............

8. West Virginia exemption .................................................................................... 600.00 600.00

9. Other subtractions – state nature and source ________________________ ...

10. Electing small business trusts subtractions .......................................................

11. TOTAL SUBTRACTIONS

(Add Lines 7 through 10, Col. II and enter here and on Page 1, Line 3) .........

NET FIDUCIARY MODIFICATIONS COLUMN I:TOTAL COLUMN II:AMOUNT ALLOCATED

12. NET FIDUCIARY MODIFICATIONS (Line 6 minus Line 11)

Direct Deposit

of Refund CHECKING SAVINGS ROUTING NUMBER ACCOUNT NUMBER

PLEASE REVIEW YOUR ACCOUNT INFORMATION FOR ACCURACY. INCORRECT ACCOUNT INFORMATION MAY RESULT IN A $15.00 RETURNED PAYMENT CHARGE.

I authorize the State Tax Division to discuss my return with my preparer YES NO

Under penalty of perjury, I declare that I have examined this return, accompanying schedules, and statements, and to the best of my knowledge and belief, it is true, correct and complete.

_________________________________________________________________________________________________________________________

(Signature of Fiduciary or O fficer Representing Fiduciary) (Date) (Email)

Paid (Signature of Preparer) (Date)

Preparer’s

Use Only

(Preparer’s EIN) (Printed Name) (Telephone Number)

*P35202203W*

P35202203W

3