Enlarge image

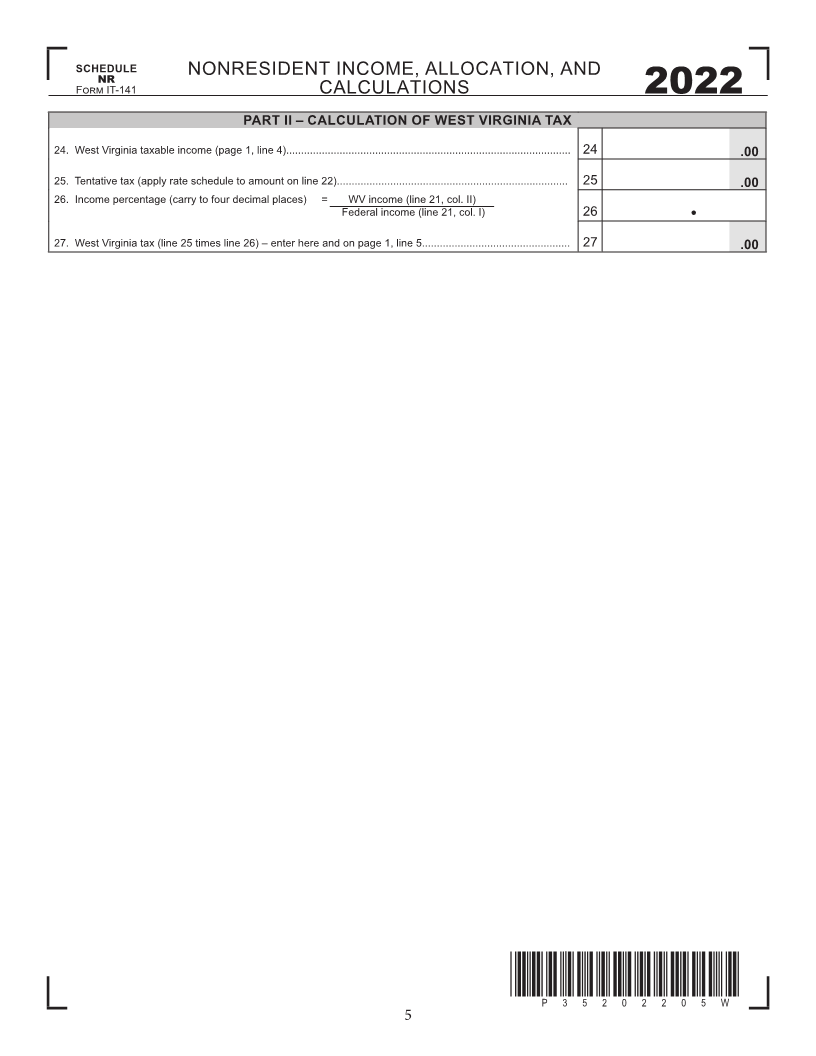

SCHEDULE NONRESIDENT

NR

F IT-141 INCOME, ALLOCATION, AND CALCULATIONS

(To be completed by nonresident estates and trusts only)2022

PART I – NONRESIDENT INCOME AND ALLOCATION

INCOME COLUMN I COLUMN II

REPORTED ON FEDERAL RETURN ALLOCATED TO WEST VIRGINIA

1. Interest income (includes QFT).................................................... 1 .00 1 .00

2. Dividends (includes QFT)............................................................. 2 .00 2 .00

3. Business income or loss ............................................................. 3 .00 3 .00

4. Capital gain or loss (includes QFT).............................................. 4 .00 4 .00

5. Rents, royalties, partnerships, other estates and trusts, etc. ...... 5 .00 5 .00

6. Farm income or loss..................................................................... 6 .00 6 .00

7. Ordinary gain or loss.................................................................... 7 .00 7 .00

8. Other income (state nature of income) ___________________ . 8 .00 8 .00

9. Total income (add lines 1 through 8) ........................................... 9 .00 9 .00

COLUMN I COLUMN II

DEDUCTIONS REPORTED ON FEDERAL RETURN ALLOCATED TO WEST VIRGINIA

10. Interest........................................................................................... 10 .00 10 .00

11. Taxes (includes QFT) ................................................................... 11 .00 11 .00

12. Fiduciary fees (includes QFT)....................................................... 12 .00 12 .00

13. Charitable deduction...................................................................... 13 .00 13 .00

14. Attorney, accountant, and return preparer fees (includes QFT) ... 14 .00 14 .00

15. A. Other deductions (see instructions for QFT)............................ 15A .00 15A .00

B. Net operating loss deduction ................................................... 15B .00 15B .00

16. Total (sum of lines 10 through 15)................................................. 16 .00 16 .00

17. Adjusted total income or loss (line 9 minus line 16) ..................... 17 .00 17 .00

18. Income distribution deduction........................................................ 18 .00 18 .00

19. Estate tax deduction including certain generation-skipping taxes 19 .00 19 .00

20. Quali fied business income deduction.

Attach copy of IRS Form 8995 or 8995-A ..................................... 20 .00 20 .00

21. Federal exemption......................................................................... 21 .00 21 .00

22. Total deductions (sum of lines 18 through 21).............................. 22 .00 22 .00

23. Taxable income of fiduciary (line 17 minus line 22)....................... 23 .00 23 .00

SCHEDULE NR NONRESIDENT INCOME, ALLOCATION, AND CALCULATIONS

Continues on next page

*P35202204W*

P35202204W

4