Enlarge image

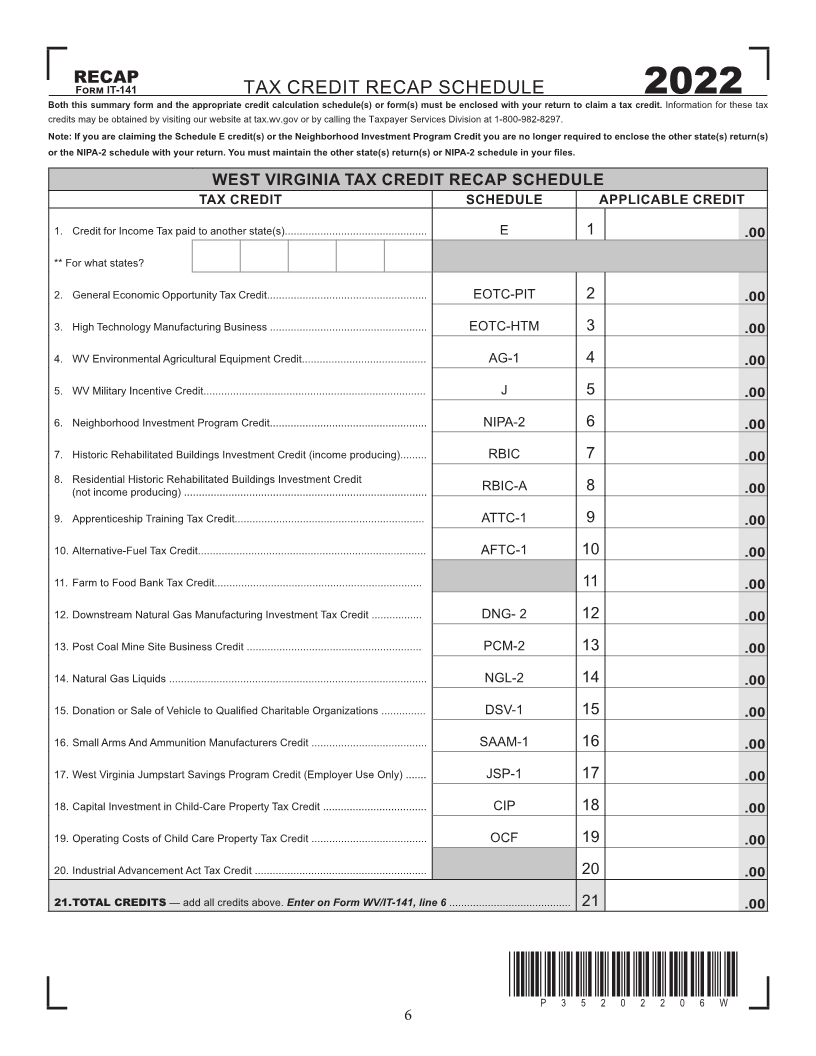

RECAP

F IT-141 TAX CREDIT RECAP SCHEDULE

Both this summary form and the appropriate credit calculation schedule(s) or form(s) must be enclosed with your return to claim a tax2022credit. Information for these tax

credits may be obtained by visiting our website at tax.wv.gov or by calling the Taxpayer Services Division at 1-800-982-8297.

Note: If you are claiming the Schedule E credit(s) or the Neighborhood Investment Program Credit you are no longer required to enclose the other state(s) return(s)

or the NIPA-2 schedule with your return. You must maintain the other state(s) return(s) or NIPA-2 schedule in your fi les.

WEST VIRGINIA TAX CREDIT RECAP SCHEDULE

TAX CREDIT SCHEDULE APPLICABLE CREDIT

1. Credit for Income Tax paid to another state(s)................................................ E 1 .00

** For what states?

2. General Economic Opportunity Tax Credit...................................................... EOTC-PIT 2 .00

3. High Technology Manufacturing Business ..................................................... EOTC-HTM 3 .00

4. WV Environmental Agricultural Equipment Credit.......................................... AG-1 4 .00

5. WV Military Incentive Credit........................................................................... J 5 .00

6. Neighborhood Investment Program Credit..................................................... NIPA-2 6 .00

7. Historic Rehabilitated Buildings Investment Credit (income producing)......... RBIC 7 .00

8. Residential Historic Rehabilitated Buildings Investment Credit

(not income producing) .................................................................................. RBIC-A 8 .00

9. Apprenticeship Training Tax Credit................................................................ ATTC-1 9 .00

10. Alternative-Fuel Tax Credit............................................................................. AFTC-1 10 .00

11. Farm to Food Bank Tax Credit...................................................................... 11 .00

12. Downstream Natural Gas Manufacturing Investment Tax Credit ................. DNG- 2 12 .00

13. Post Coal Mine Site Business Credit ........................................................... PCM-2 13 .00

14. Natural Gas Liquids ....................................................................................... NGL-2 14 .00

15. Donation or Sale of Vehicle to Quali fied Charitable Organizations ............... DSV-1 15 .00

16. Small Arms And Ammunition Manufacturers Credit ....................................... SAAM-1 16 .00

17. West Virginia Jumpstart Savings Program Credit (Employer Use Only) ....... JSP-1 17 .00

18. Capital Investment in Child-Care Property Tax Credit ................................... CIP 18 .00

19. Operating Costs of Child Care Property Tax Credit ....................................... OCF 19 .00

20. Industrial Advancement Act Tax Credit .......................................................... 20 .00

21. TOTAL CREDITS — add all credits above. Enter on Form WV/IT-141, line 6 ......................................... 21 .00

*P35202206W*

P35202206W

6