Enlarge image

Schedule NONRESIDENTS/PART-YEAR RESIDENTS

A

Form IT-140 B SCHEDULE OF INCOME

2022

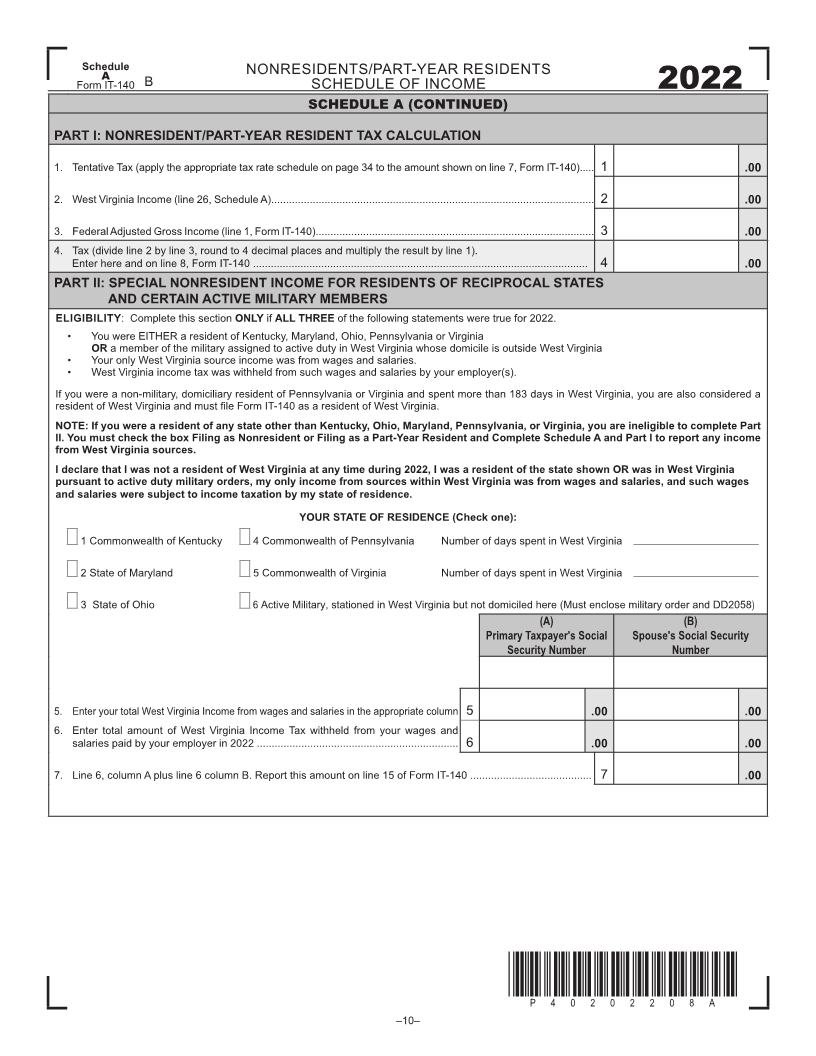

PART-YEAR RESIDENTS: FROM: TO:

Enter period of West Virginia residency MM/DD/YYYY MM/DD/YYYY

(To Be Completed By Nonresidents and Part-Year Residents Only) COLUMN A: COLUMN B: COLUMN C:

INCOME AMOUNT FROM FEDERAL RETURN ALL INCOME DURING PERIOD WV SOURCE INCOME DURING

OF WV RESIDENCY NONRESIDENT PERIOD

1. Wages, salaries, tips (withholding documents) .......... 1 .00 .00 .00

2. Interest ....................................................................... 2 .00 .00 .00

3. Dividends ................................................................... 3 .00 .00 .00

4. IRAs, pensions and annuities ..................................... 4 .00 .00 .00

5. Total taxable Social Security and Railroad Retirement

bene fits (see line 32 and 38 of Schedule M) ................ 5 .00 .00

6. Refunds of state and local income tax

(see line 36 of Schedule M) ........................................ 6 .00 .00

7. Alimony received ....................................................... 7 .00 .00

8. Business pro tfi(or loss) .............................................. 8 .00 .00 .00

9. Capital gains (or losses) ............................................ 9 .00 .00 .00

10. Supplemental gains (or losses) .................................. 10 .00 .00 .00

11. Farm income (or loss) ................................................ 11 .00 .00 .00

12. Unemployment compensation insurance .................. 12 .00 .00 .00

13. Other income from federal return (identify source)

13 .00 .00 .00

14. Total income (add lines 1 through 13) ........................ 14 .00 .00 .00

ADJUSTMENTS

15. Educator expenses ................................................... 15 .00 .00 .00

16. IRA deduction ............................................................ 16 .00 .00 .00

17. Self-employment tax deduction ................................. 17 .00 .00 .00

18. Self Employed SEP, SIMPLE and quali fied plans ...... 18 .00 .00 .00

19. Self-employment health insurance deduction ............ 19 .00 .00 .00

20. Penalty for early withdrawal of savings ...................... 20 .00 .00 .00

21. Other adjustments (See instructions page 28) ........... 21 .00 .00 .00

22. Total adjustments (add lines 15 through 21) .............. 22 .00 .00 .00

23. Adjusted gross income

(subtract line 22 from line 14 in each column) ............ 23 .00 .00 .00

24. West Virginia income

(line 23, Column B plus column C) 24 .00

25. Income subject to West Virginia Tax but exempt

from federal tax.................................... 25 .00

*P40202207A* 26. Total West Virginia income (line 24 plus line 25).

P40202207A Enter here and on line 2 on the next page 26 .00

–9–