Enlarge image

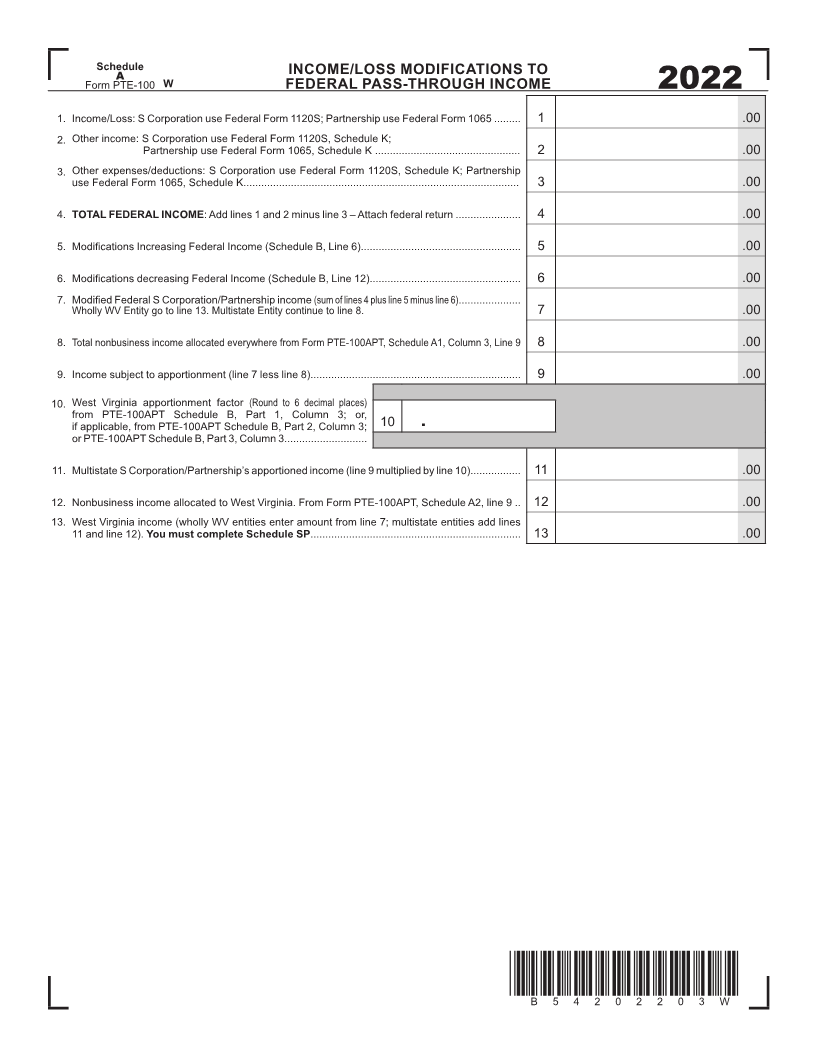

Schedule INCOME/LOSS MODIFICATIONS TO

A

Form PTE-100 W FEDERAL PASS-THROUGH INCOME

2022

1. Income/Loss: S Corporation use Federal Form 1120S; Partnership use Federal Form 1065 ......... 1 .00

2. Other income: S Corporation use Federal Form 1120S, Schedule K;

Partnership use Federal Form 1065, Schedule K ................................................. 2 .00

3. Other expenses/deductions: S Corporation use Federal Form 1120S, Schedule K; Partnership

use Federal Form 1065, Schedule K............................................................................................. 3 .00

4. TOTAL FEDERAL INCOME: Add lines 1 and 2 minus line 3 – Attach federal return ...................... 4 .00

5. Modi fications Increasing Federal Income (Schedule B, Line 6)...................................................... 5 .00

6. Modi fications decreasing Federal Income (Schedule B, Line 12)................................................... 6 .00

7. Modi fied Federal S Corporation/Partnership income(sum of lines 4 plus line 5 minus line 6).....................

Wholly WV Entity go to line 13. Multistate Entity continue to line 8. 7 .00

8. Total nonbusiness income allocated everywhere from Form PTE-100APT, Schedule A1, Column 3, Line 9 8 .00

9. Income subject to apportionment (line 7 less line 8)....................................................................... 9 .00

10. West Virginia apportionment factor (Round to 6 decimal places)

from PTE-100APT Schedule B, Part 1, Column 3; or,

if applicable, from PTE-100APT Schedule B, Part 2, Column 3; 10 .

or PTE-100APT Schedule B, Part 3, Column 3............................

11. Multistate S Corporation/Partnership’s apportioned income (line 9 multiplied by line 10)................. 11 .00

12. Nonbusiness income allocated to West Virginia. From Form PTE-100APT, Schedule A2, line 9 .. 12 .00

13. West Virginia income (wholly WV entities enter amount from line 7; multistate entities add lines

11 and line 12). You must complete Schedule SP....................................................................... 13 .00

*B54202203W*

B54202203W