- 5 -

Enlarge image

|

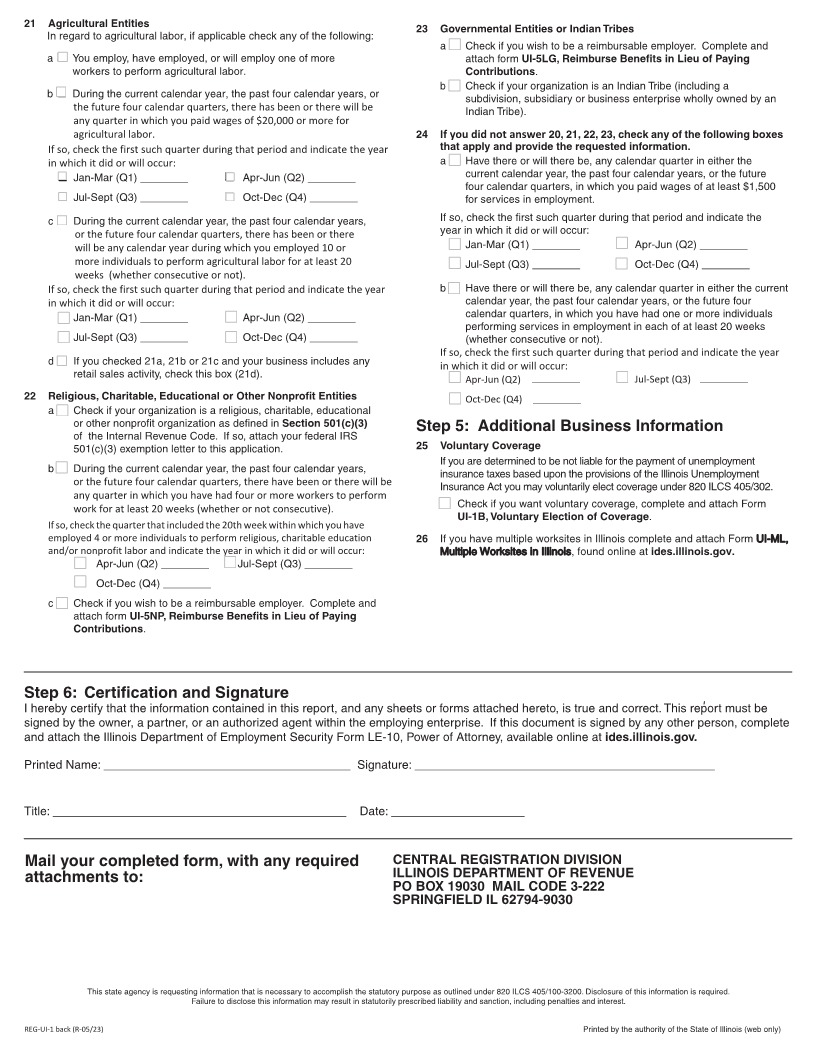

governesses, maids, valets, babysitters, janitors, launderers, furnace men, caretakers, handymen, gardeners, footmen, grooms and chauffeurs of

automobiles for family use. Service not of a household nature, such as by a private secretary, nurse, tutor or librarian, is not considered "domestic"

service.

A "private home" is the fixed place of abode of the individual or family for whom the worker is performing services. A separate and distinct dwelling unit

maintained by an individual as a residence, such as a hotel room, boat or trailer, can be a "private home." A room or suite in a nursing home can be a

"private home," provided that the facts and circumstances of the particular case indicate that such room or suite is, in fact, the place where the

individual retains his residence. A home utilized primarily for the purpose of supplying board or lodging to the public as a business enterprise is not a

"private home."

A "local college club" or "local chapter of a college fraternity or sorority" does not include an alumni club or chapter.

21."Agricultural labor" means all services performed:

• On a farm, in the employ of any person, in connection with cultivating the soil or in connection with raising or harvesting any agricultural or

horticultural commodity, including the raising, shearing, feeding, caring for, training, and management of livestock, bees, poultry and fur-

bearing animals and wildlife;

• In the employ of the owner or tenant or other operator of a farm, in connection with the operation, management, conservation, improvement

or maintenance of such farm and its tools and equipment;

• In connection with the ginning of cotton, or the operation or maintenance of ditches, canals, reservoirs or waterways not owned or operated

for profit, used exclusively for supplying and storing water for farming purposes;

• In the employ of the operator of a farm, or of a group of operators of farms (or a cooperative organization of which such operators are

members), in handling, planting, drying, packing, packaging, processing, freezing, grading, storing or delivering to storage or to market or to a

carrier for transportation to market, in its unmanufactured state, any agricultural or horticultural commodity; but only if such operator or

operators produced more than one-half of the commodity with respect to which such service is performed. The provisions of this subsection

shall not be deemed to be applicable with respect to service performed in connection with commercial canning or commercial freezing or in

connection with any agricultural or horticultural commodity after its delivery to a terminal market for distribution for consumption.

• For purposes of questions 21b & 21c, count each week in which you had or expect to have 10 or more individuals to perform agricultural labor,

whether or not they all worked or will work at the same time during that week and whether or not you employed or will employ the same

individuals in each week.

"Week" means the seven day period, Sunday through Saturday.

22. For purposes of question 22b, count each week in which you expect to have 10 or more individuals performing services in employment, whether

or not they all worked or will work at the same time during that week and whether or not you employed or will employ the same individuals in each

week.

"Week" means the seven day period, Sunday through Saturday.

"Employment" means any service performed by an individual for an employing unit, unless the Unemployment Insurance Act expressly excludes the

service from the definition of "employment." It includes service in interstate commerce and service on land which is owned, held or possessed by the

United States, and includes all services performed by an officer of a business corporation, without regard to whether such services are executive,

managerial or manual in nature, and without regard to whether such officer is or is not a stockholder or a member of the board of directors of the

corporation.

Benefit Reimbursable Option: Each nonprofit organization subject to the Act may, if certain conditions are met, elect to be a reimbursable employer

by agreeing, in lieu of paying contributions, to reimburse the State for the actual amount of regular benefits and one half the amount of extended

benefits that are charged to it.

23. "Employment" means any service performed by an individual for an employing unit, including a governmental entity or Indian tribe, unless the

Unemployment Insurance Act expressly excludes the service from the definition of "employment."

"Governmental entity" includes the State or any of its instrumentalities, or any political subdivision or municipal corporation thereof or any of their

instrumentalities, or any instrumentality of more than one of the foregoing, or any instrumentality of any of the foregoing and one or more other States

or political subdivisions.

"Indian Tribe" means any Indian tribe, band, nation or other organized group or community, including any Alaskan Native village or regional village or

corporation, which is recognized as eligible for the special programs and services provided by the United States to Indians because of their status as

Indians, and includes any subdivision, subsidiary or business enterprise wholly owned by an Indian tribe.

Benefit Reimbursable Option: Each governmental entity or Indian Tribe subject to the Act may, if certain conditions are met, elect to be a

reimbursable employer by agreeing, in lieu of paying contributions, to reimburse the State for the actual amount of regular benefits and one half the

amount of extended benefits that are charged to it.

24. "Employment" means any service performed by an individual for an employing unit, unless the Unemployment Insurance Act expressly excludes

the service from the definition of "employment." It includes service in interstate commerce and service on land which is owned, held or possessed by

the United States, and includes all services performed by an officer of a business corporation, without regard to whether such services are executive,

managerial or manual in nature, and without regard to whether such officer is or is not a stockholder or a member of the board of directors of the

corporation.

For purposes of question 24b, count each week in which you had or expect to have 1 or more individuals performing services in employment, whether

or not they all worked or will work at the same time during that week and whether or not you employed or will employ the same individuals in each

week.

"Week" means the seven day period, Sunday through Saturday.

25.If an employing unit does not meet the legal definition of an employer for unemployment insurance purposes, the employing unit can elect to be fully

|