Enlarge image

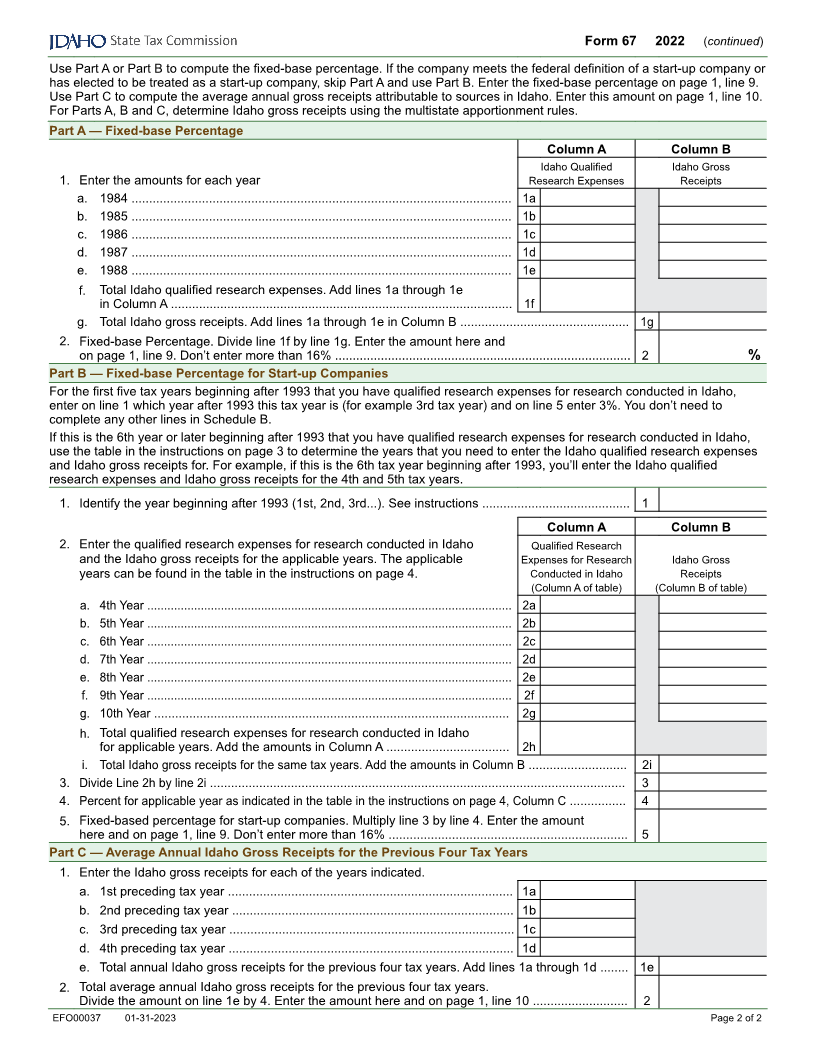

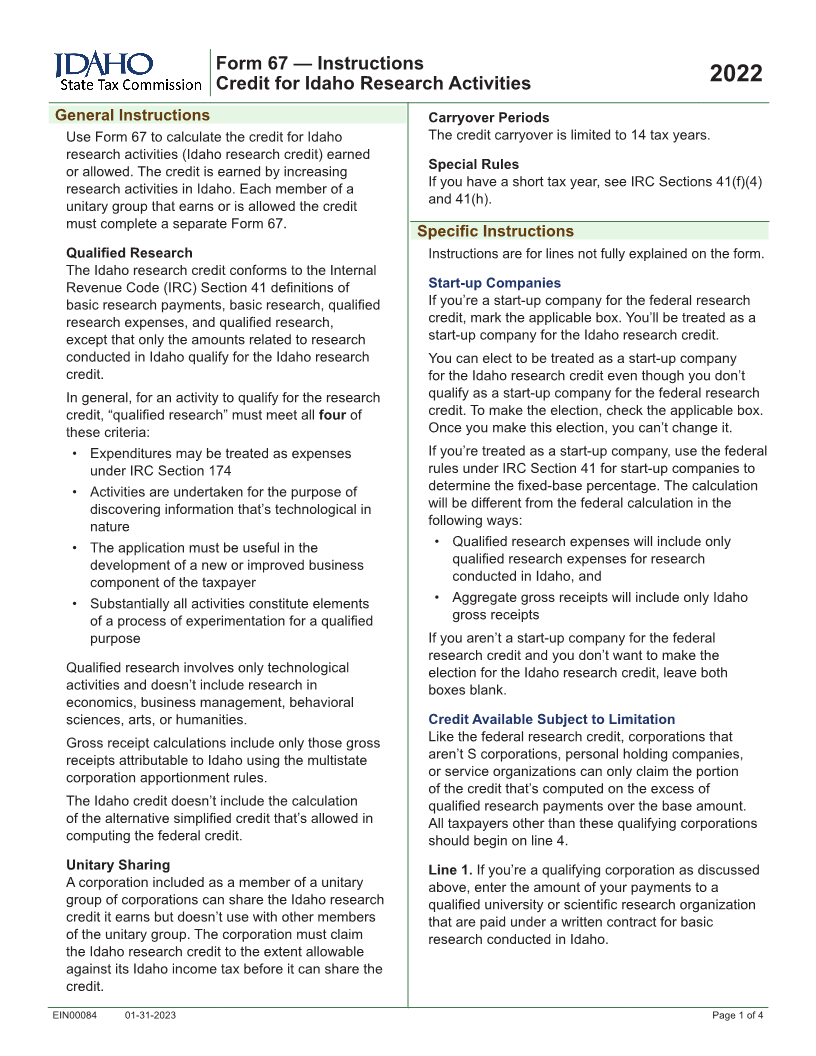

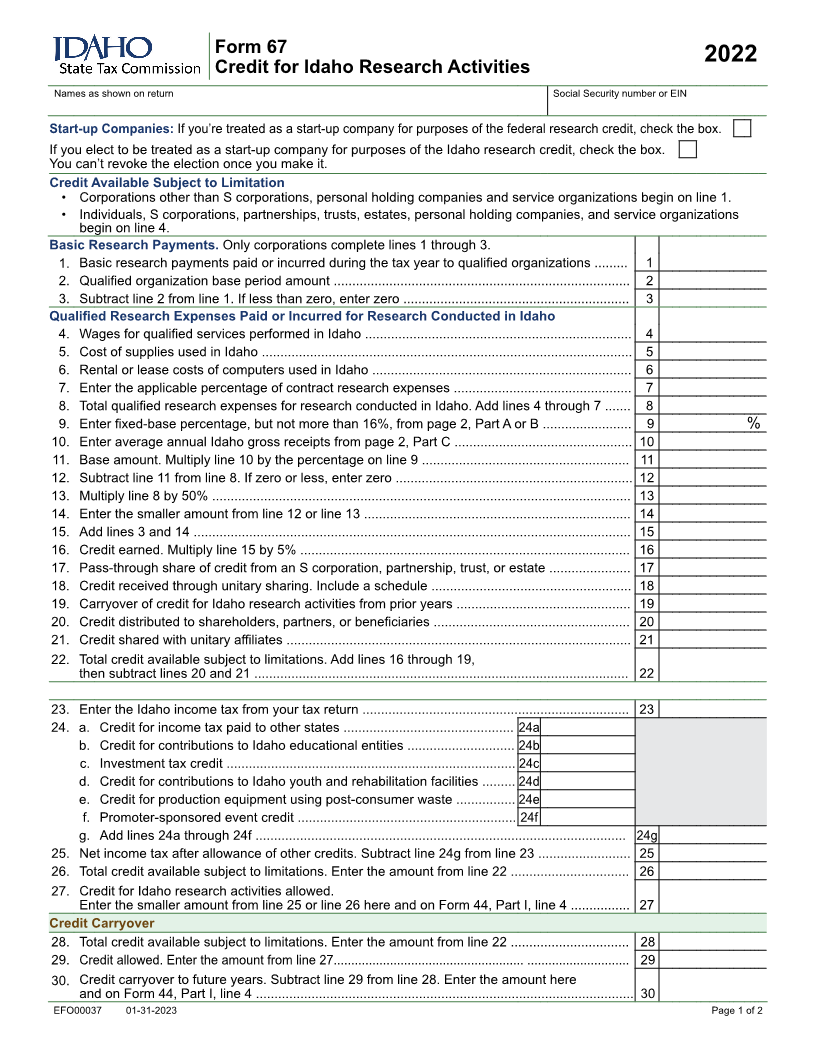

Form 67

2022

Credit for Idaho Research Activities

Names as shown on return Social Security number or EIN

Start-up Companies: If you’re treated as a start-up company for purposes of the federal research credit, check the box.

If you elect to be treated as a start-up company for purposes of the Idaho research credit, check the box.

You can’t revoke the election once you make it.

Credit Available Subject to Limitation

• Corporations other than S corporations, personal holding companies and service organizations begin on line 1.

• Individuals, S corporations, partnerships, trusts, estates, personal holding companies, and service organizations

begin on line 4.

Basic Research Payments. Only corporations complete lines 1 through 3.

1. Basic research payments paid or incurred during the tax year to qualified organizations ......... 1

2. Qualified organization base period amount ................................................................................ 2

3. Subtract line 2 from line 1. If less than zero, enter zero ............................................................. 3

Qualified Research Expenses Paid or Incurred for Research Conducted in Idaho

4. Wages for qualified services performed in Idaho ........................................................................ 4

5. Cost of supplies used in Idaho .................................................................................................... 5

6. Rental or lease costs of computers used in Idaho ...................................................................... 6

7. Enter the applicable percentage of contract research expenses ................................................ 7

8. Total qualified research expenses for research conducted in Idaho. Add lines 4 through 7 ....... 8

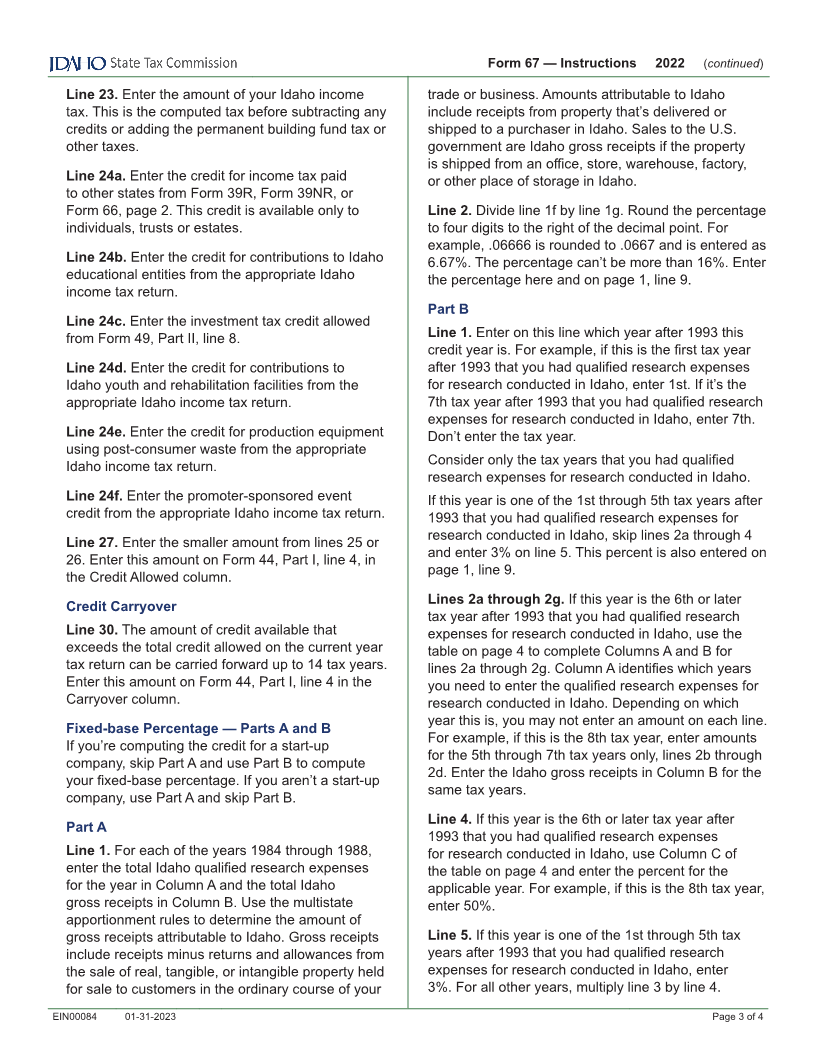

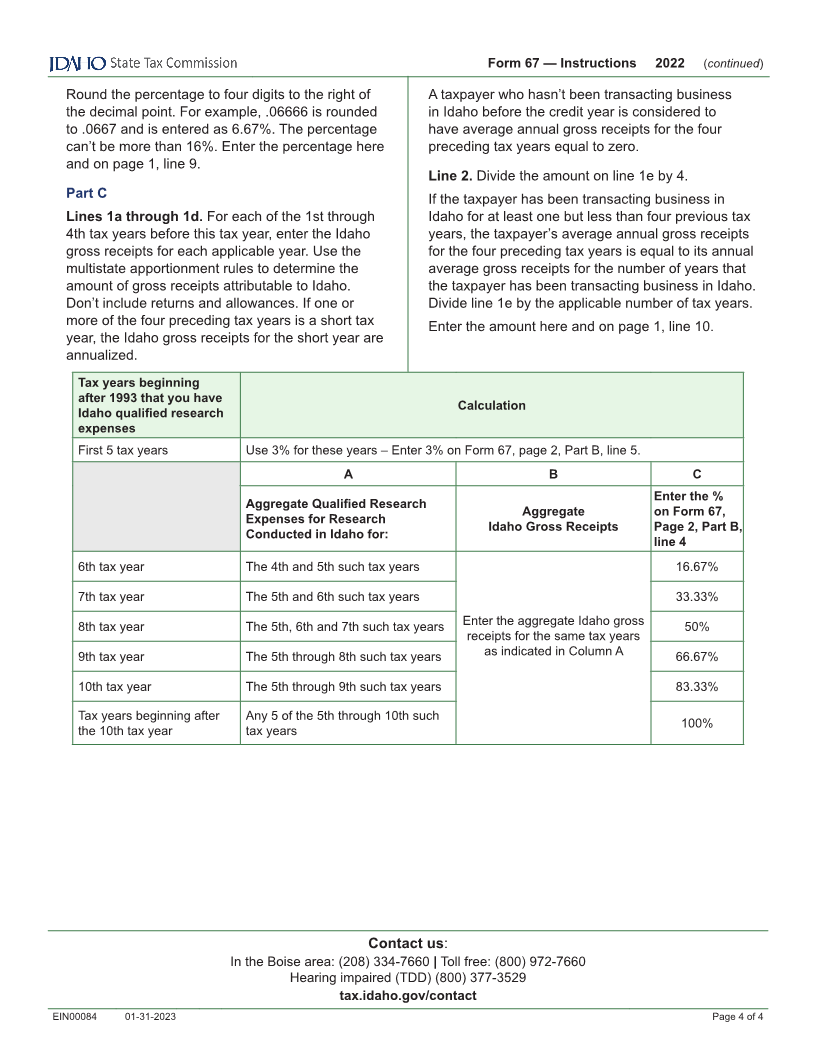

9. Enter fixed-base percentage, but not more than 16%, from page 2, Part A or B ........................ 9 %

10. Enter average annual Idaho gross receipts from page 2, Part C ................................................ 10

11. Base amount. Multiply line 10 by the percentage on line 9 ........................................................ 11

12. Subtract line 11 from line 8. If zero or less, enter zero ................................................................ 12

13. Multiply line 8 by 50% ................................................................................................................. 13

14. Enter the smaller amount from line 12 or line 13 ........................................................................ 14

15. Add lines 3 and 14 ...................................................................................................................... 15

16. Credit earned. Multiply line 15 by 5% ......................................................................................... 16

17. Pass-through share of credit from an S corporation, partnership, trust, or estate ...................... 17

18. Credit received through unitary sharing. Include a schedule ...................................................... 18

19. Carryover of credit for Idaho research activities from prior years ............................................... 19

20. Credit distributed to shareholders, partners, or beneficiaries ..................................................... 20

21. Credit shared with unitary affiliates ............................................................................................. 21

22. Total credit available subject to limitations. Add lines 16 through 19,

then subtract lines 20 and 21 ..................................................................................................... 22

23. Enter the Idaho income tax from your tax return ........................................................................ 23

24. a. Credit for income tax paid to other states .............................................. 24a

b. Credit for contributions to Idaho educational entities ............................. 24b

c. Investment tax credit .............................................................................. 24c

d. Credit for contributions to Idaho youth and rehabilitation facilities ......... 24d

e. Credit for production equipment using post-consumer waste ................ 24e

f. Promoter-sponsored event credit ........................................................... 24f

g. Add lines 24a through 24f .................................................................................................... 24g

25. Net income tax after allowance of other credits. Subtract line 24g from line 23 ......................... 25

26. Total credit available subject to limitations. Enter the amount from line 22 ................................ 26

27. Credit for Idaho research activities allowed.

Enter the smaller amount from line 25 or line 26 here and on Form 44, Part I, line 4 ................ 27

Credit Carryover

28. Total credit available subject to limitations. Enter the amount from line 22 ................................ 28

29. Credit allowed. Enter the amount from line 27...................................................... ............................. 29

30. Credit carryover to future years. Subtract line 29 from line 28. Enter the amount here

and on Form 44, Part I, line 4 ...................................................................................................... 30

EFO00037 01-31-2023 Page 1 of 2