Enlarge image

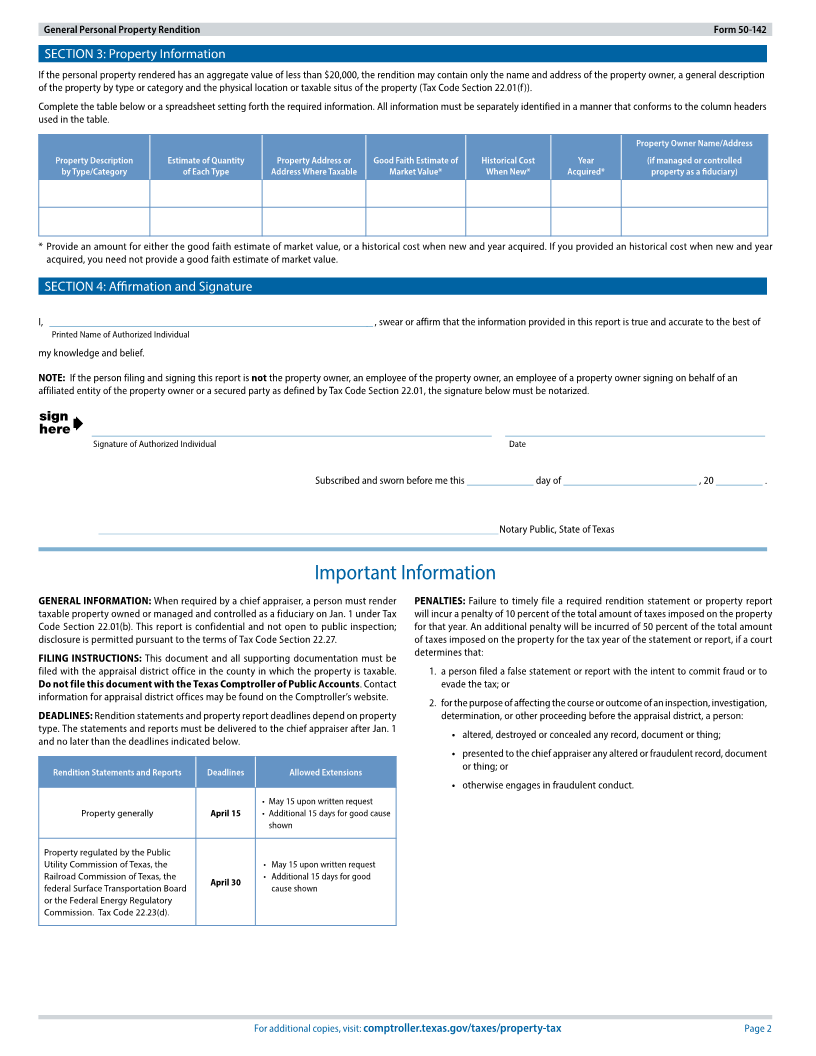

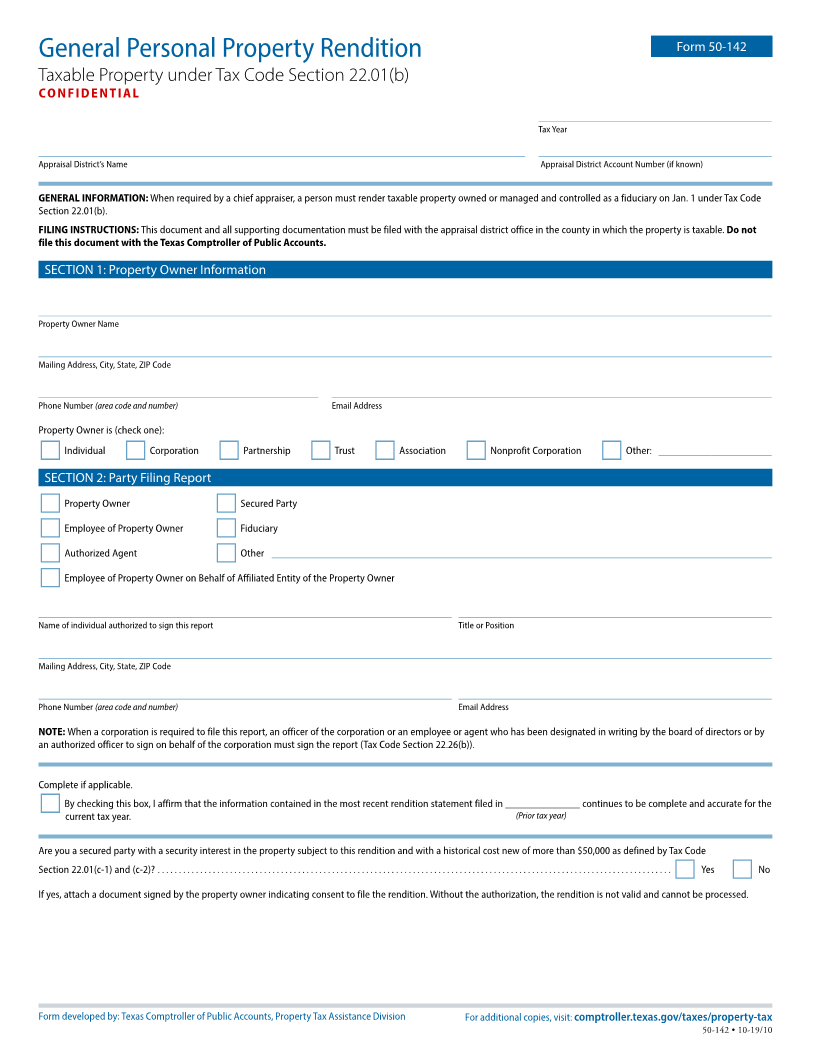

Form 50-142

General Personal Property Rendition

Taxable Property under Tax Code Section 22.01(b)

CONFIDENTIAL

___________________________________

Tax Year

_________________________________________________________________________ ___________________________________

Appraisal District’s Name Appraisal District Account Number (if known)

GENERAL INFORMATION: When required by a chief appraiser, a person must render taxable property owned or managed and controlled as a fiduciary on Jan. 1 under Tax Code

Section 22.01(b).

FILING INSTRUCTIONS: This document and all supporting documentation must be filed with the appraisal district office in the county in which the property is taxable. Do not

file this document with the Texas Comptroller of Public Accounts.

SECTION 1: Property Owner Information

______________________________________________________________________________________________________________

Property Owner Name

______________________________________________________________________________________________________________

Mailing Address, City, State, ZIP Code

__________________________________________ __________________________________________________________________

Phone Number (area code and number) Email Address

Property Owner is (check one):

Individual Corporation Partnership Trust Association Nonprofit Corporation Other: _________________

SECTION 2: Party Filing Report

Property Owner Secured Party

Employee of Property Owner Fiduciary

Authorized Agent Other ___________________________________________________________________________

Employee of Property Owner on Behalf of Affiliated Entity of the Property Owner

______________________________________________________________ _______________________________________________

Name of individual authorized to sign this report Title or Position

______________________________________________________________________________________________________________

Mailing Address, City, State, ZIP Code

______________________________________________________________ _______________________________________________

Phone Number (area code and number) Email Address

NOTE: When a corporation is required to file this report, an officer of the corporation or an employee or agent who has been designated in writing by the board of directors or by

an authorized officer to sign on behalf of the corporation must sign the report (Tax Code Section 22.26(b)).

Complete if applicable.

By checking this box, I affirm that the information contained in the most recent rendition statement filed in ______________ continues to be complete and accurate for the

current tax year. (Prior tax year)

Are you a secured party with a security interest in the property subject to this rendition and with a historical cost new of more than $50,000 as defined by Tax Code

Section 22.01(c-1) and (c-2)? ......................................................................................................................... Yes No

If yes, attach a document signed by the property owner indicating consent to file the rendition. Without the authorization, the rendition is not valid and cannot be processed.

Form developed by: Texas Comptroller of Public Accounts, Property Tax Assistance Division For additional copies, visit: comptroller.texas.gov/taxes/property-tax

50-142 • 10-19/10