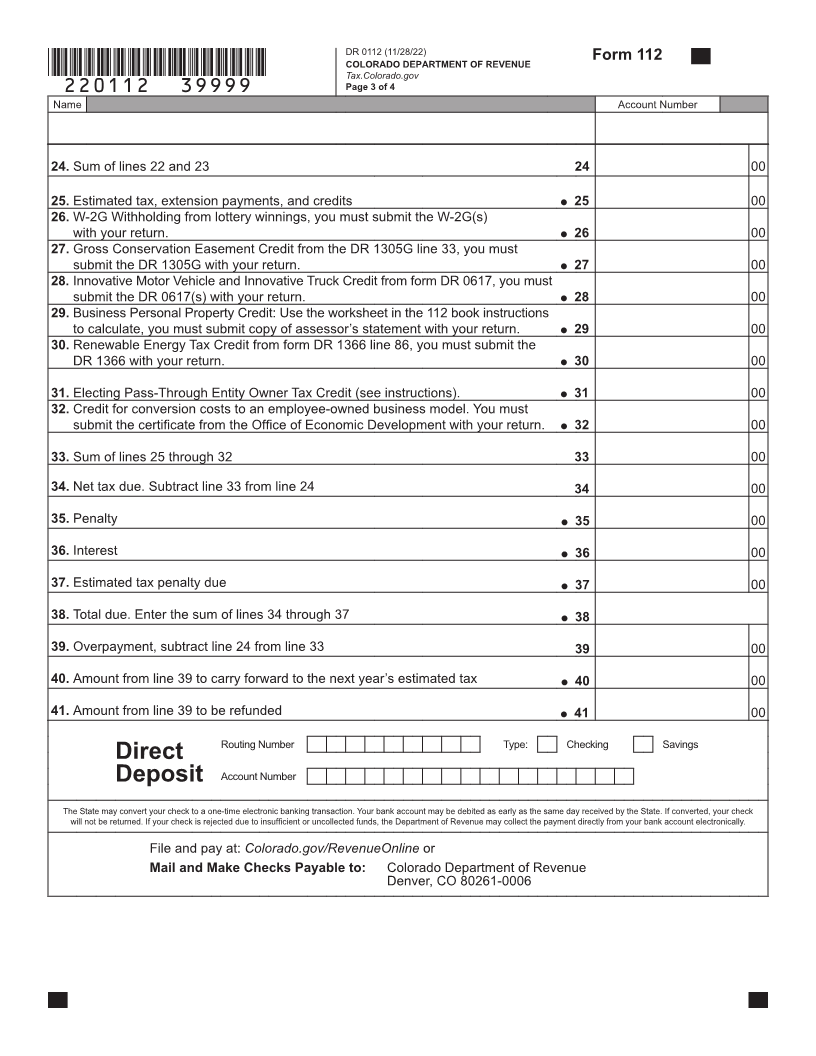

- 10 -

Enlarge image

|

Page 10

maximum penalty is 12%. If you prefer not to calculate this Section F

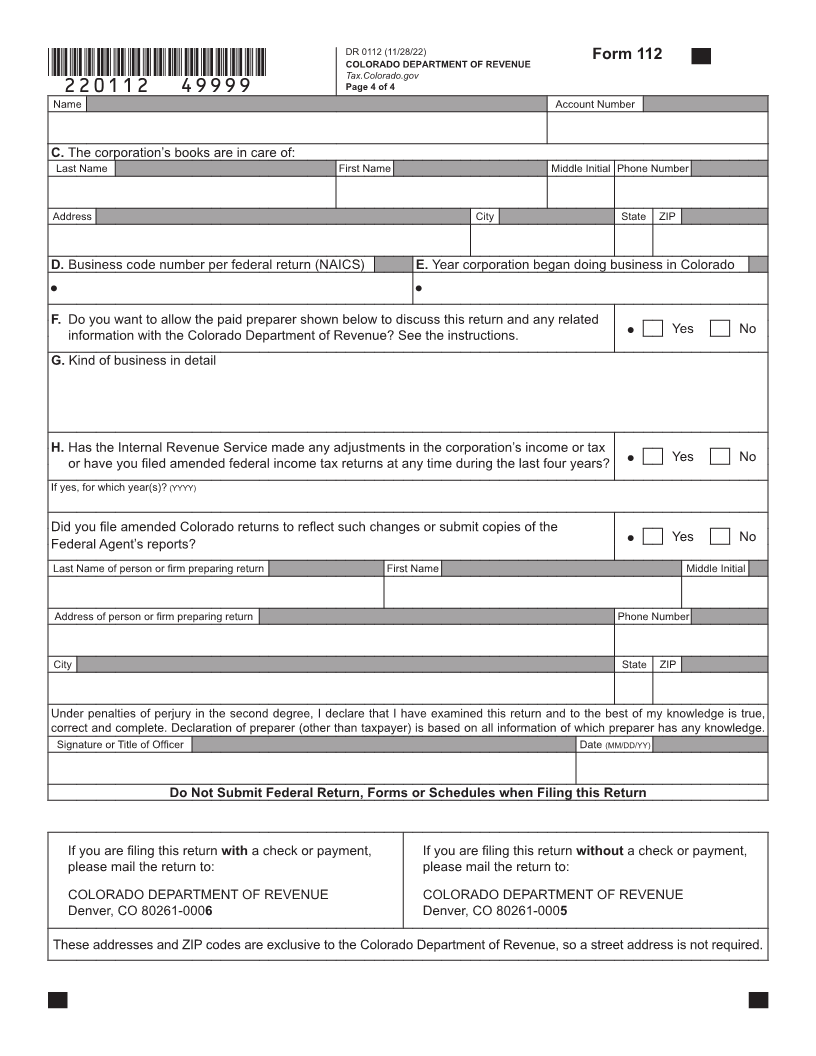

penalty, the Department will bill you. Mark the “Yes” box to appoint the paid preparer entered

Line 36 on the return as the designee to receive and inspect

Calculate any interest owed for delinquent filing or confidential tax information related to this tax return.

payment. The interest rate is 3% of the net tax due. If you If a firm or organization is listed, this tax information

prefer not to calculate this interest, the Department will bill authorization will apply to any of its employees. The

you. Interest on any bill issued that remains unpaid after 30 designee may:

days of issuance will increase to 6%. • call for information about the return, including

processing time and refund status;

Line 37

• request copies of notices, bills or transcripts

To calculate this penalty, complete the DR 0205. Enter any

estimated tax penalty owed on this line. You must submit the related to the return, and

DR 0205 with your return. If you over compute your estimated • respond to inquiries regarding calculations and

tax penalty from what the Department calculates, any amount supporting documentation for the return.

of overpayment of penalty will be refunded to you. However, a designee cannot sign any form or protest,

Line 38 request any other change to the account, receive any

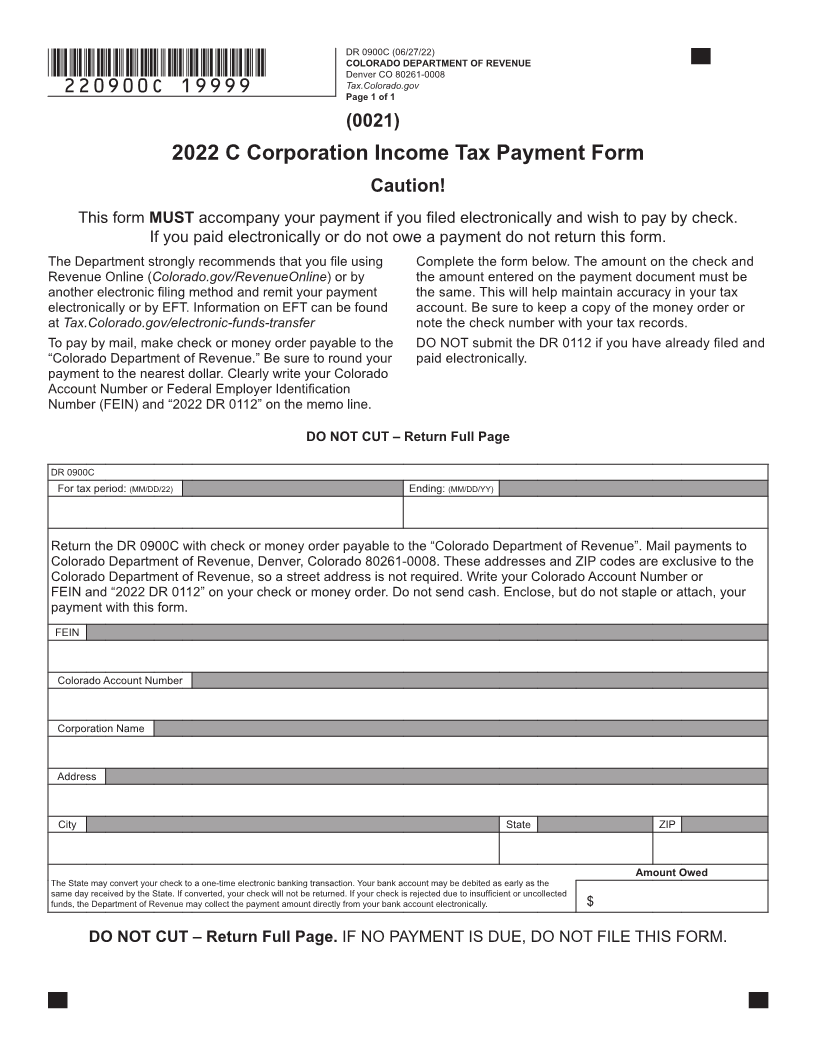

Enterthe sum of lines 34 through37. Payment can be made refund, or otherwise represent or act on behalf of the

electronically at: taxpayer with the Colorado Department of Revenue.

• Colorado.gov/RevenueOnline ; or This authorization expires four years after the date the

• Tax.Colorado.gov/electronic-funds-transfer ; or return is signed. A taxpayer may change or revoke it, or

an appointee may withdraw from it. For more information,

• If you are filing this return WITH a check or see the instructions for form DR 0145, Tax Information

payment, please mail the return to: Authorization or Power of Attorney for Department-

Colorado Department of Revenue Administered Tax Matters and submit via Revenue Online.

Denver, CO 80261-0006

Section G – H

Line 39 Complete the data as requested.

Subtract line 24 from line 33.

Signature

Line 40 The law requires the return to be signed under penalty

Enter the amount you would like to be available for 2023 of perjury. Persons authorized to sign this return must

estimated tax. either be the president, vice president, treasurer, assistant

Line 41 treasurer, chief accounting officer, or other officer that is

duly authorized to act on behalf of the corporation. In cases

Subtract line 40 from line 39 to calculate the amount of

where receivers, trustees in bankruptcy, or assignees

your refund.

are operating the property or business of corporations,

Direct Deposit such receivers, trustees, or assignees shall make returns

You have the option of authorizing the Department to for such corporations in the same manner and form as

directly deposit these funds into your bank account. corporations are required to make returns.

Otherwise, a refund check will be mailed to the address you

have designated on this return. Amendments

If an amended return is filed with the IRS, or if the IRS

Enter the routing and account numbers and account type. The changes the content of the return, an amendment must be

routing number is 9 digits. Account numbers can be up to 17 filed with Colorado. Use Revenue Online or the DR 0112X to

characters (numbers and/or letters). Include hyphens, but do amend the Colorado return. A taxpayer must file a Colorado

NOT enter spaces or special symbols. We recommend that amended return whenever a change has been made to their

you contact your financial institution to ensure you are using federal taxable income and attach a copy of the RAR to their

the correct information and that they will honor a direct deposit. amended return, if applicable. Be sure to list the Colorado

Intercepted Refunds Account Number on the revenue agent report (RAR) before

The Department will intercept your refund if you owe mailing a copy to one of the addresses below:

back taxes or if you owe a balance to another Colorado

If you are filing this return WITH a check or payment,

government agency or the IRS.

please mail the return to:

Section C Colorado Department of Revenue

Enter the name, phone, and address of the party responsible Denver, CO 80261-0006

for maintaining the books belonging to this corporation. If you are filing this return WITHOUT a check or payment,

Section D please mail the return to:

Enter the 6-digit North American Industry Classification Colorado Department of Revenue

System (NAICS) number that best describes the purpose of Denver, CO 80261-0005

this business. Use the same code used on the federal return.

Caution: Federal adjustments must be reported to the

Section E

Colorado Department of Revenue. See §39-22-601(6),

Enter the year the corporation began doing business

C.R.S. for information about the statute of limitations.

in Colorado.

|