Enlarge image

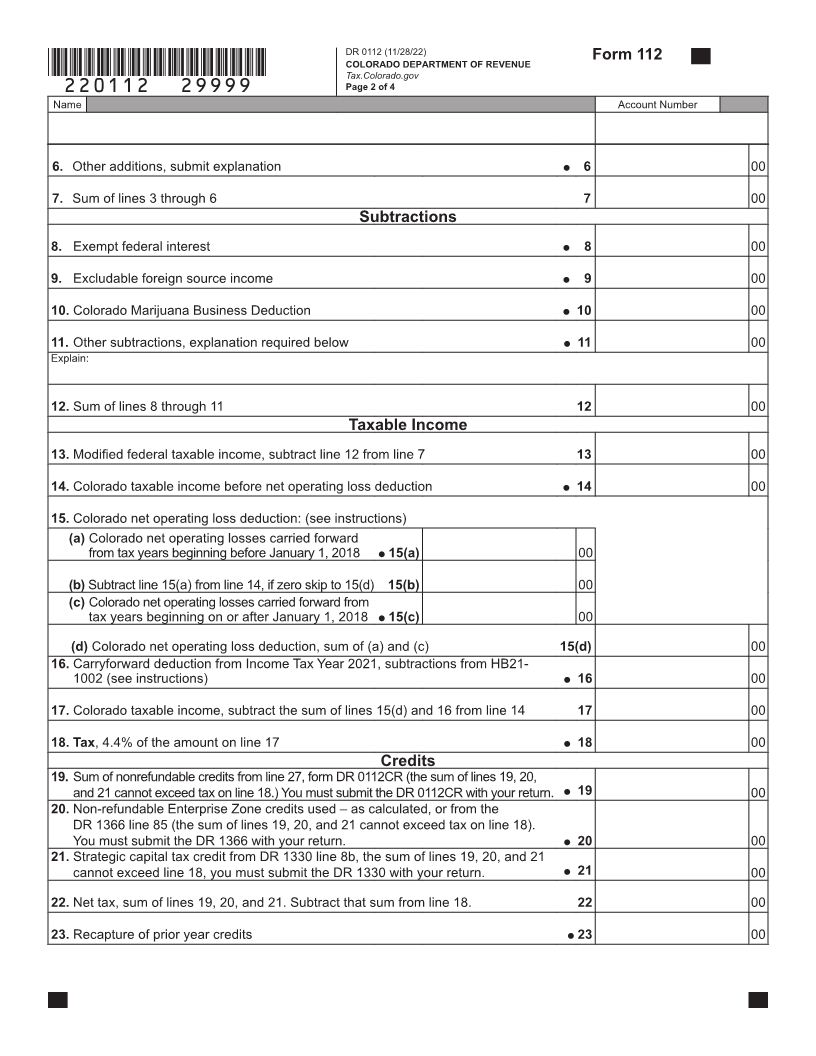

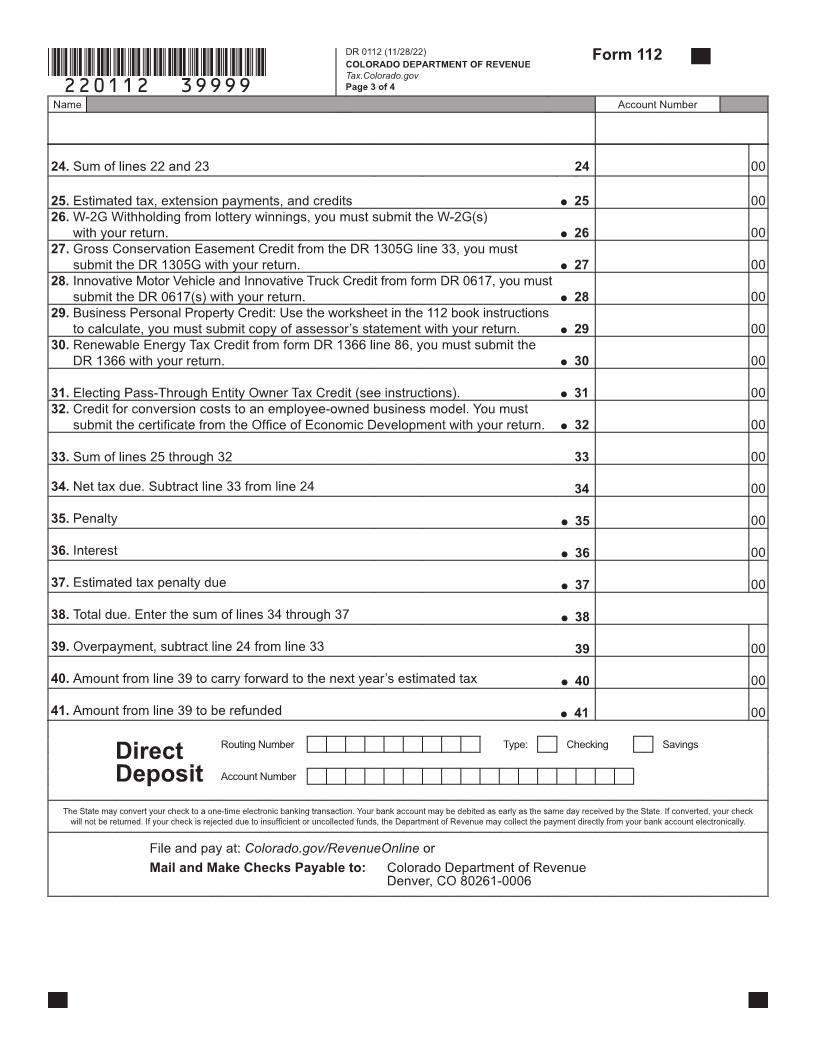

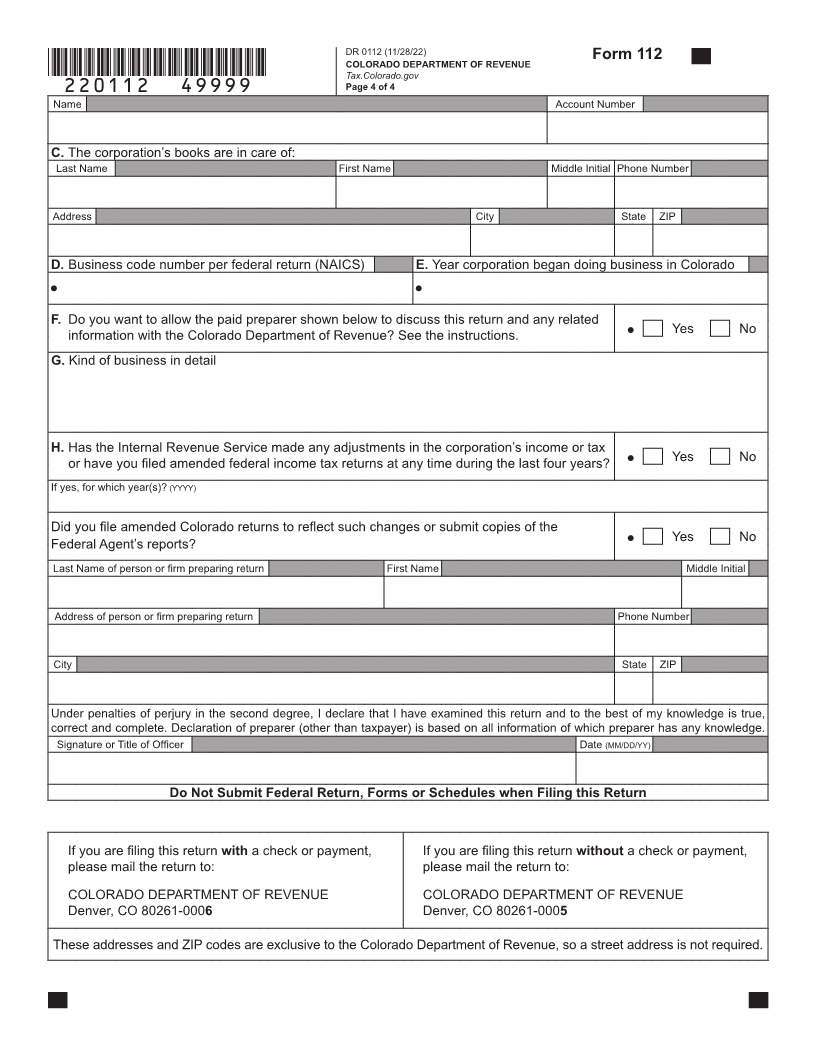

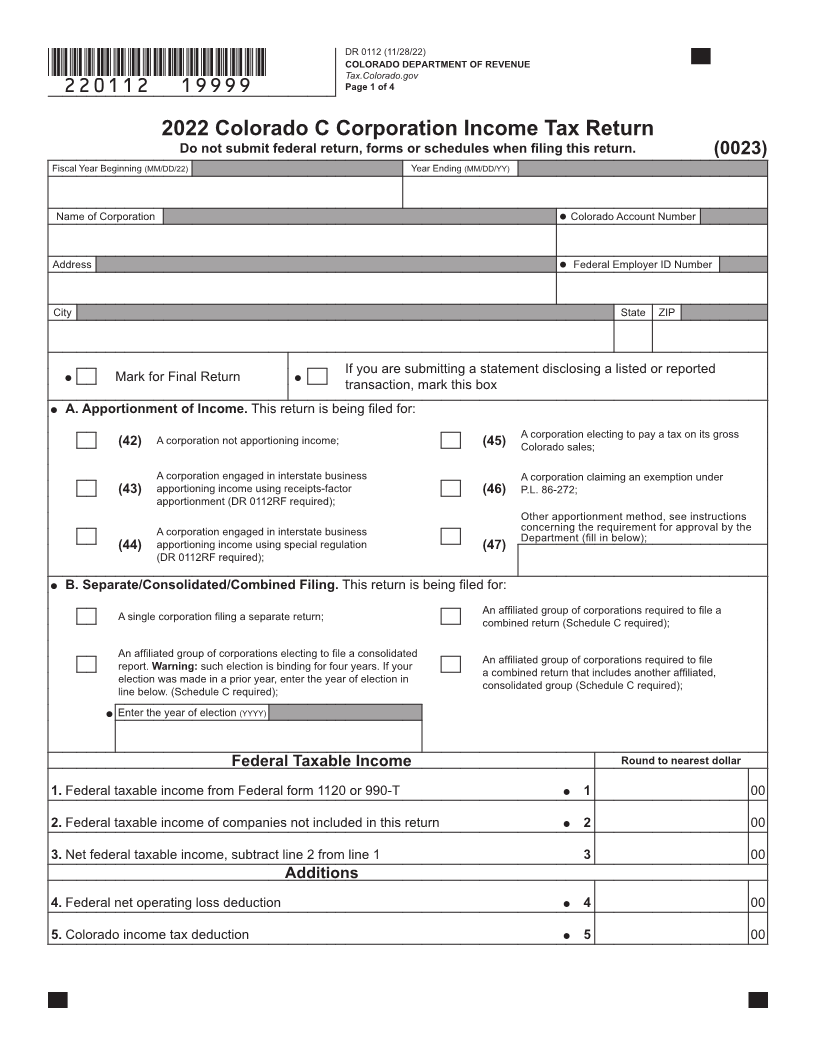

DR 0112 (11/28/22)

COLORADO DEPARTMENT OF REVENUE

*220112==19999* Tax.Colorado.gov

Page 1 of 4

2022 Colorado C Corporation Income Tax Return

Do not submit federal return, forms or schedules when filing this return. (0023)

Fiscal Year Beginning (MM/DD/22) Year Ending (MM/DD/YY)

Name of Corporation Colorado Account Number

Address Federal Employer ID Number

City State ZIP

If you are submitting a statement disclosing a listed or reported

Mark for Final Return

transaction, mark this box

A. Apportionment of Income. This return is being filed for:

A corporation electing to pay a tax on its gross

(42) A corporation not apportioning income; (45) Colorado sales;

A corporation engaged in interstate business A corporation claiming an exemption under

(43) apportioning income using receipts-factor (46) P.L. 86-272;

apportionment (DR 0112RF required);

Other apportionment method, see instructions

A corporation engaged in interstate business concerning the requirement for approval by the

Department (fill in below);

(44) apportioning income using special regulation (47)

(DR 0112RF required);

B. Separate/Consolidated/Combined Filing. This return is being filed for:

A single corporation filing a separate return; An affiliated group of corporations required to file a

combined return (Schedule C required);

An affiliated group of corporations electing to file a consolidated An affiliated group of corporations required to file

report. Warning: such election is binding for four years. If your a combined return that includes another affiliated,

election was made in a prior year, enter the year of election in consolidated group (Schedule C required);

line below. (Schedule C required);

Enter the year of election (YYYY)

Federal Taxable Income Round to nearest dollar

1. Federal taxable income from Federal form 1120 or 990-T 1 00

2. Federal taxable income of companies not included in this return 2 00

3. Net federal taxable income, subtract line 2 from line 1 3 00

Additions

4. Federal net operating loss deduction 4 00

5. Colorado income tax deduction 5 00