Enlarge image

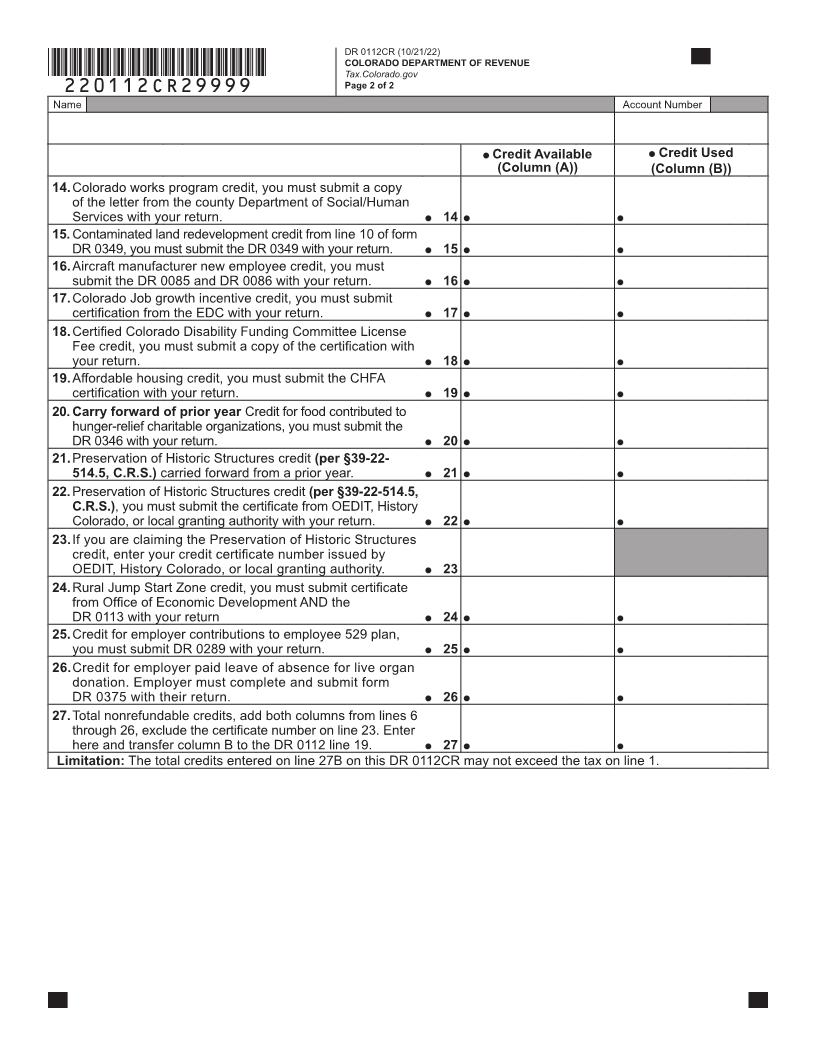

DR 0112CR (10/21/22)

COLORADO DEPARTMENT OF REVENUE

Tax.Colorado.gov

*220112CR19999* Page 1 of 2

2022 Credit Schedule for Corporations

Submit the DR 0112CR with your tax return do not attach the documents electronically, fill out and

• Use this schedule to determine which tax credits you submit the DR 1778 with your return and include all

are eligible to claim. required supporting documentation. Revenue Online

can also be used to file your return and attachments

• Be sure to submit the required supporting

electronically. Otherwise, include ALL required

documentation for each credit claimed, including

documents to your paper return.

supporting schedules.

• Dollar amounts shall be rounded to the nearest whole

• Most e-file software products and tax preparers have

dollar. Calculate percentages to the fourth decimal

the ability to submit attachments electronically. If you

place. Round to four significant digits, e.g. xxx.xxxx

Name of Corporation Colorado Account Number

Pass-through Entity Name Ownership % Entity Account Number

Enter in Section (A) the total credit generated in 2022 and any carryforward credit that is available from a prior year. Enter

in Section (B) the portion of the credit in Section (A) that is being used to offset tax in 2022. If Section (A) is larger than

Section (B), the credit can generally be carried forward to future years.

1. Tax liability from the DR 0112 line 18 1

A. The New Investment Tax Credit Section (A) Section (B)

2. $1,000 minus amount on line 7 2

3. Current year qualified investment 3

4. 1% of the amount on line 3 4

5. New investment tax credit carried over from prior year 5

6. Enter in Section (A) the total of lines 4 and 5. The amount

entered in Section (B) cannot exceed either the amount in

Section (A) or the amount on line 2. 6

B. Other Credits Credit Available Credit Used

(Column (A)) (Column (B))

7. Old investment tax credit 7

8. Crop and livestock contribution credit 8

9. Carry forward of prior year Historic property preservation

credit (per §39-22-514, C.R.S.). 9

10. Child Care Contribution credit, you must submit the DR 1317

with your return. 10

11. Child care center/family care home investment credit, you

must submit a copy of your facility license and a list of

depreciable tangible personal property with your return. 11

12. Employer child care facility investment credit, you

must submit a copy of your facility license and a list of

depreciable tangible personal property with your return. 12

13. School-to-Career investment credit, you must submit your

certification letter with your return. 13