Enlarge image

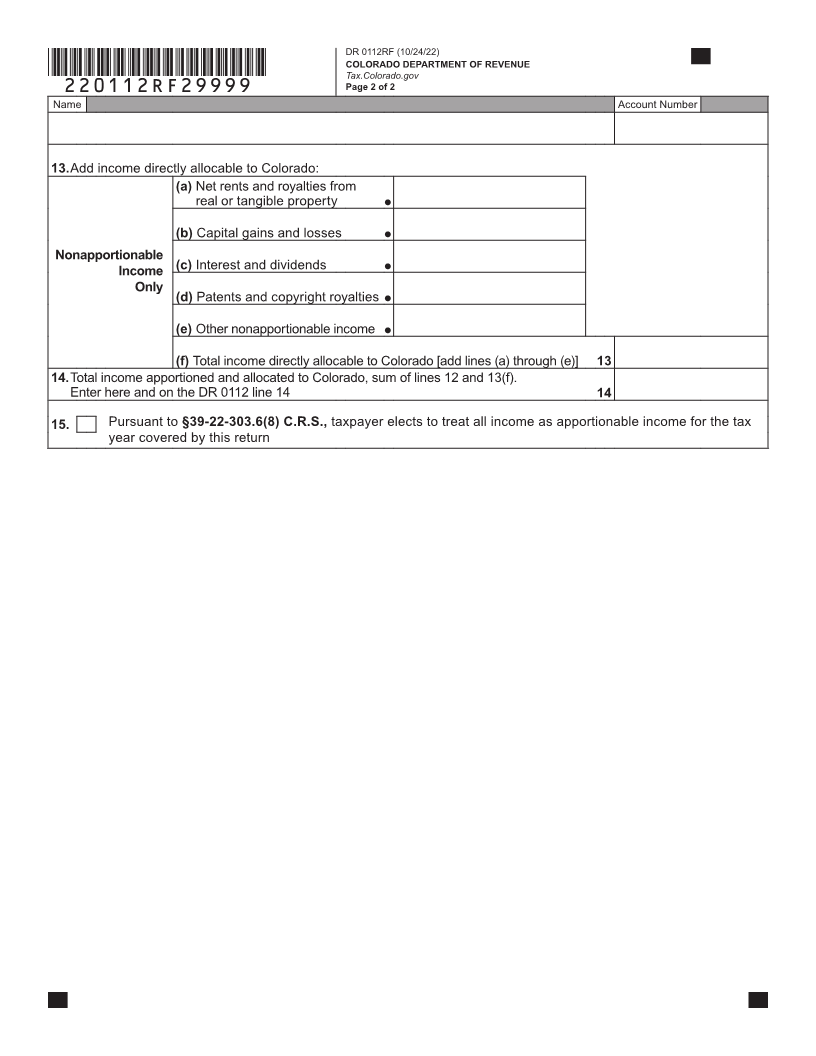

DR 0112RF (10/24/22)

COLORADO DEPARTMENT OF REVENUE

*220112RF19999* Tax.Colorado.gov

Page 1 of 2

2022 Schedule RF —

Apportionment Schedule

Complete this form in accordance with section 39-22-303.6 C.R.S., and the regulations thereunder.

Name Account Number

1. Total modified federal taxable income from the DR 0112 line 13 1

Apportionable Income Apportioned to Colorado By Use of the Receipts Factor

Do not include foreign source income modified out on the DR 0112 line 9.

Colorado Everywhere

2. Gross receipts from the sale of

tangible personal property 2

3. Gross receipts from the sale

of services 3

4. Gross receipts from the sale, rental,

lease, or license of real property 4

5. Gross receipts from the rental,

lease, or license of tangible

personal property 5

6. Gross receipts from the sale, rental,

lease, or license of intangible property 6

7. Distributive share of partnership

factors 7

8. Total receipts (total of lines 2

through 7 in each column) 8

9. Line 8 (Colorado) divided by line 8 (Everywhere) 9

Complete Lines 10 and 13 only if nonapportionable income is being directly allocated. If all income is being

treated as apportionable income, enter 0 (Zero) on Lines 10 and 13.

10. Less income directly allocable to any state, including Colorado

(a) Net rents and royalties from

real or tangible property

(b) Capital gains and losses

Nonapportionable

Income (c) Interest and dividends

Only

(d) Patents and copyright royalties

(e) Other nonapportionable income

(f) Total income directly allocable [add lines (a) through (e)] 10

11. Modified federal taxable income subject to apportionment, line 1 less line 10 11

12. Income apportioned to Colorado, line 9 multiplied by line 11 12

Do not submit federal return, forms or schedules when filing this return.