Enlarge image

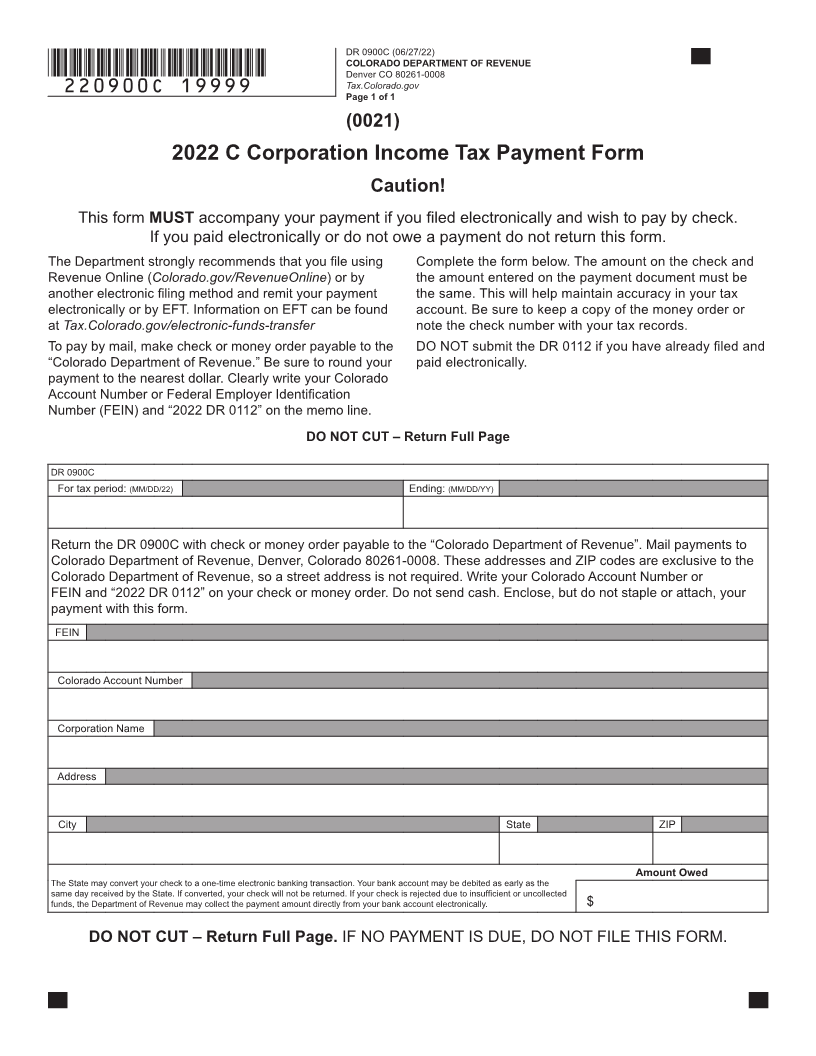

DR 0900C (06/27/22)

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261-0008

*220900C=19999* Tax.Colorado.gov

Page 1 of 1

(0021)

2022 C Corporation Income Tax Payment Form

Caution!

This form MUST accompany your payment if you filed electronically and wish to pay by check.

If you paid electronically or do not owe a payment do not return this form.

The Department strongly recommends that you file using Complete the form below. The amount on the check and

Revenue Online (Colorado.gov/RevenueOnline ) or by the amount entered on the payment document must be

another electronic filing method and remit your payment the same. This will help maintain accuracy in your tax

electronically or by EFT. Information on EFT can be found account. Be sure to keep a copy of the money order or

at Tax.Colorado.gov/electronic-funds-transfer note the check number with your tax records.

To pay by mail, make check or money order payable to the DO NOT submit the DR 0112 if you have already filed and

“Colorado Department of Revenue.” Be sure to round your paid electronically.

payment to the nearest dollar. Clearly write your Colorado

Account Number or Federal Employer Identification

Number (FEIN) and “2022 DR 0112” on the memo line.

DO NOT CUT – Return Full Page

DR 0900C

For tax period: (MM/DD/22) Ending: (MM/DD/YY)

Return the DR 0900C with check or money order payable to the “Colorado Department of Revenue”. Mail payments to

Colorado Department of Revenue, Denver, Colorado 80261-0008. These addresses and ZIP codes are exclusive to the

Colorado Department of Revenue, so a street address is not required. Write your Colorado Account Number or

FEIN and “2022 DR 0112” on your check or money order. Do not send cash. Enclose, but do not staple or attach, your

payment with this form.

FEIN

Colorado Account Number

Corporation Name

Address

City State ZIP

Amount Owed

The State may convert your check to a one-time electronic banking transaction. Your bank account may be debited as early as the

same day received by the State. If converted, your check will not be returned. If your check is rejected due to insufficient or uncollected

funds, the Department of Revenue may collect the payment amount directly from your bank account electronically. $

DO NOT CUT – Return Full Page. IF NO PAYMENT IS DUE, DO NOT FILE THIS FORM.