Enlarge image

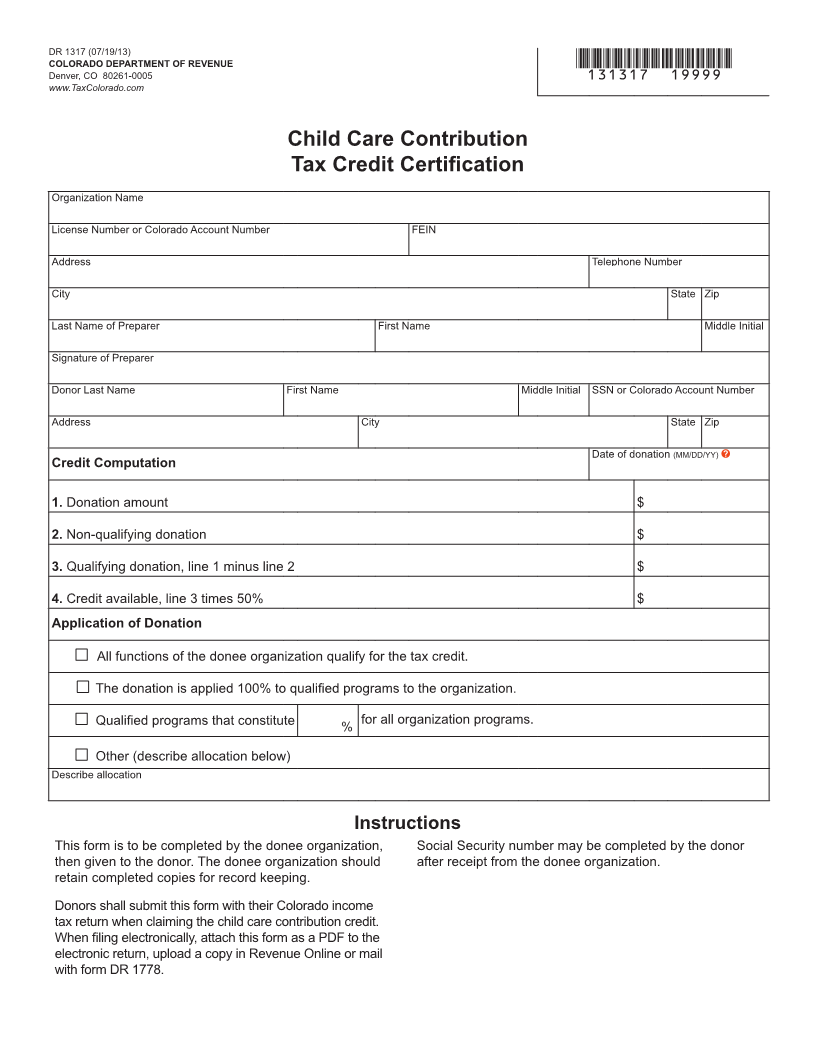

DR 1317 (07/19/13)

COLORADO DEPARTMENT OF REVENUE *131317==19999*

Denver, CO 80261-0005

www.TaxColorado.com

Child Care Contribution

Tax Credit Certification

Organization Name

License Number or Colorado Account Number FEIN

Address Telephone Number

( )

City State Zip

Last Name of Preparer First Name Middle Initial

Signature of Preparer

Donor Last Name First Name Middle Initial SSN or Colorado Account Number

Address City State Zip

Date of donation (MM/DD/YY)

Credit Computation

1. Donation amount $

2. Non-qualifying donation $

3. Qualifying donation, line 1 minus line 2 $

4. Credit available, line 3 times 50% $

Application of Donation

All functions of the donee organization qualify for the tax credit.

The donation is applied 100% to qualified programs to the organization.

for all organization programs.

Qualified programs that constitute %

Other (describe allocation below)

Describe allocation

Instructions

This form is to be completed by the donee organization, Social Security number may be completed by the donor

then given to the donor. The donee organization should after receipt from the donee organization.

retain completed copies for record keeping.

Donors shall submit this form with their Colorado income

tax return when claiming the child care contribution credit.

When filing electronically, attach this form as a PDF to the

electronic return, upload a copy in Revenue Online or mail

with form DR 1778.