Enlarge image

DR 0618 (12/30/22)

COLORADO DEPARTMENT OF REVENUE

Tax.Colorado.gov

*170618==19999*

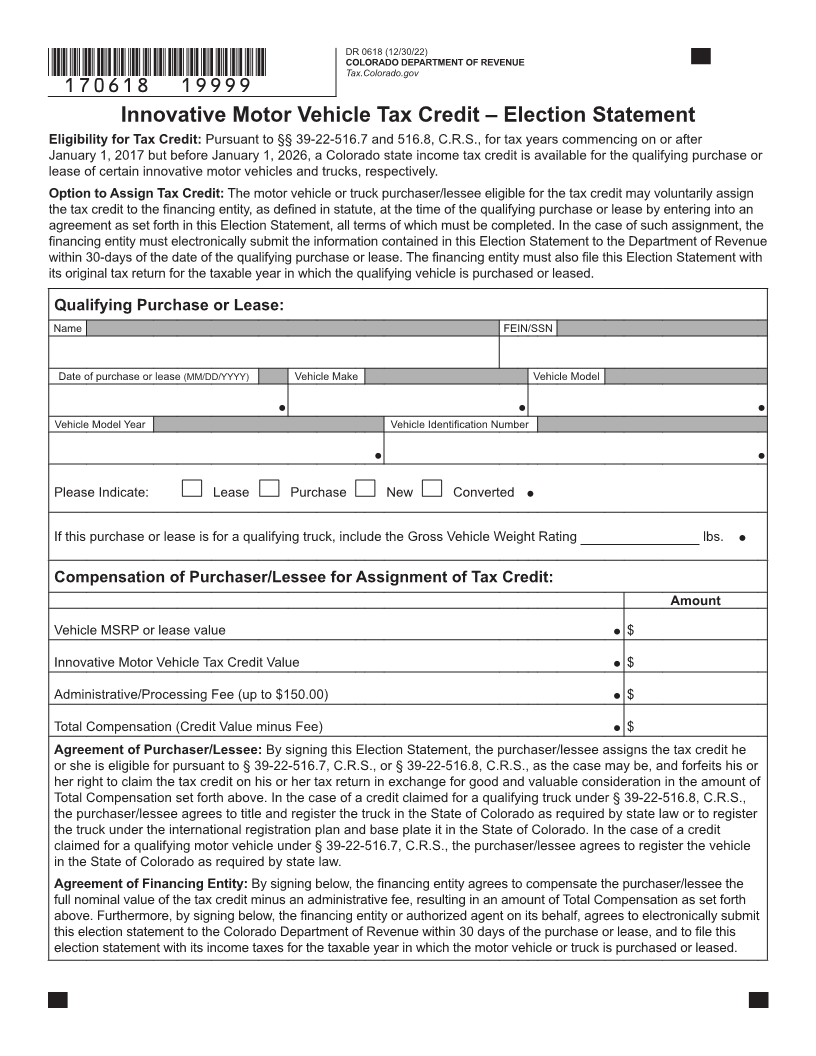

Innovative Motor Vehicle Tax Credit – Election Statement

Eligibility for Tax Credit: Pursuant to §§ 39-22-516.7 and 516.8, C.R.S., for tax years commencing on or after

January 1, 2017 but before January 1, 2026, a Colorado state income tax credit is available for the qualifying purchase or

lease of certain innovative motor vehicles and trucks, respectively.

Option to Assign Tax Credit: The motor vehicle or truck purchaser/lessee eligible for the tax credit may voluntarily assign

the tax credit to the financing entity, as defined in statute, at the time of the qualifying purchase or lease by entering into an

agreement as set forth in this Election Statement, all terms of which must be completed. In the case of such assignment, the

financing entity must electronically submit the information contained in this Election Statement to the Department of Revenue

within 30-days of the date of the qualifying purchase or lease. The financing entity must also file this Election Statement with

its original tax return for the taxable year in which the qualifying vehicle is purchased or leased.

Qualifying Purchase or Lease:

Name FEIN/SSN

Date of purchase or lease (MM/DD/YYYY) Vehicle Make Vehicle Model

Vehicle Model Year Vehicle Identification Number

Please Indicate: Lease Purchase New Converted

If this purchase or lease is for a qualifying truck, include the Gross Vehicle Weight Rating ________________ lbs.

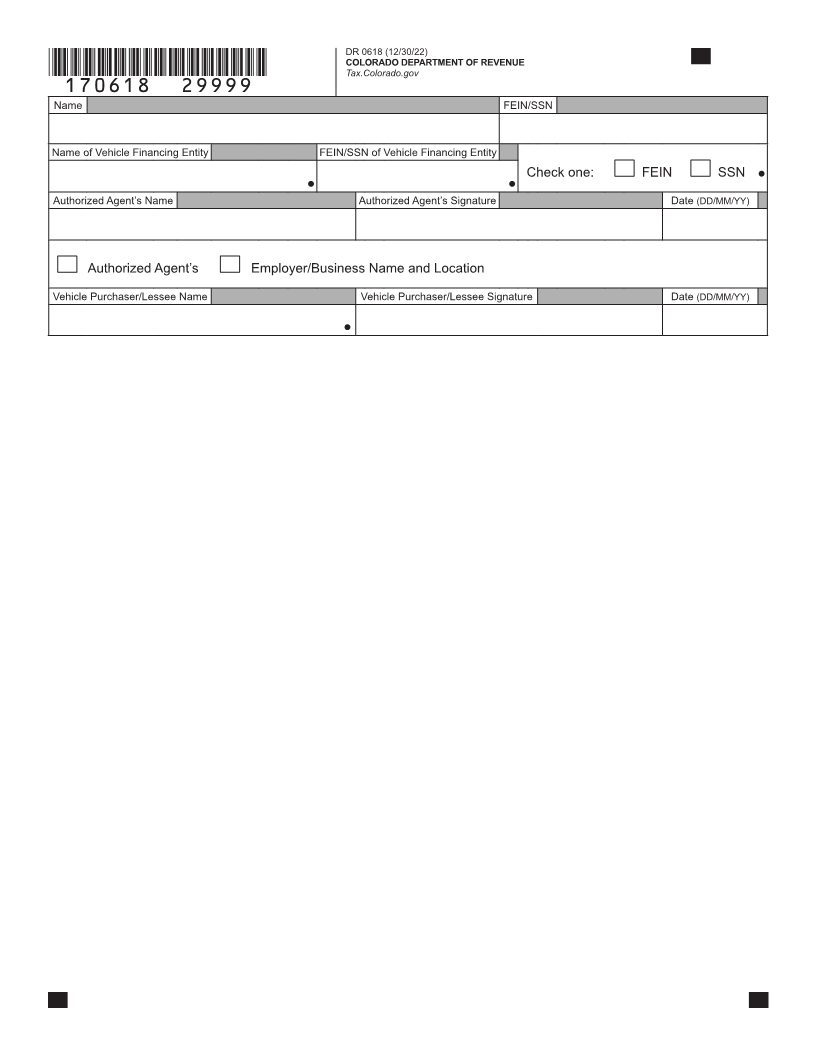

Compensation of Purchaser/Lessee for Assignment of Tax Credit:

Amount

Vehicle MSRP or lease value $

Innovative Motor Vehicle Tax Credit Value $

Administrative/Processing Fee (up to $150.00) $

Total Compensation (Credit Value minus Fee) $

Agreement of Purchaser/Lessee: By signing this Election Statement, the purchaser/lessee assigns the tax credit he

or she is eligible for pursuant to § 39-22-516.7, C.R.S., or § 39-22-516.8, C.R.S., as the case may be, and forfeits his or

her right to claim the tax credit on his or her tax return in exchange for good and valuable consideration in the amount of

Total Compensation set forth above. In the case of a credit claimed for a qualifying truck under § 39-22-516.8, C.R.S.,

the purchaser/lessee agrees to title and register the truck in the State of Colorado as required by state law or to register

the truck under the international registration plan and base plate it in the State of Colorado. In the case of a credit

claimed for a qualifying motor vehicle under § 39-22-516.7, C.R.S., the purchaser/lessee agrees to register the vehicle

in the State of Colorado as required by state law.

Agreement of Financing Entity: By signing below, the financing entity agrees to compensate the purchaser/lessee the

full nominal value of the tax credit minus an administrative fee, resulting in an amount of Total Compensation as set forth

above. Furthermore, by signing below, the financing entity or authorized agent on its behalf, agrees to electronically submit

this election statement to the Colorado Department of Revenue within 30 days of the purchase or lease, and to file this

election statement with its income taxes for the taxable year in which the motor vehicle or truck is purchased or leased.