Enlarge image

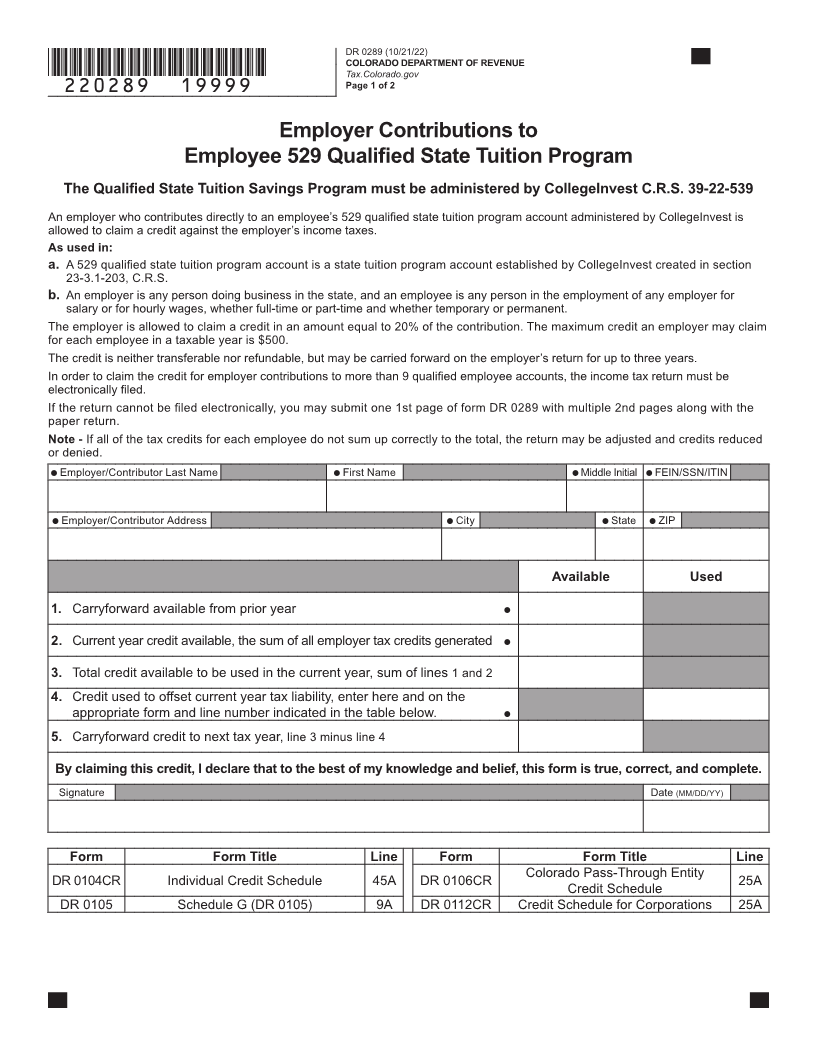

DR 0289 (10/21/22)

COLORADO DEPARTMENT OF REVENUE

Tax.Colorado.gov

*220289==19999* Page 1 of 2

Employer Contributions to

Employee 529 Qualified State Tuition Program

The Qualified State Tuition Savings Program must be administered by CollegeInvest C.R.S. 39-22-539

An employer who contributes directly to an employee’s 529 qualified state tuition program account administered by CollegeInvest is

allowed to claim a credit against the employer’s income taxes.

As used in:

a. A 529 qualified state tuition program account is a state tuition program account established by CollegeInvest created in section

23-3.1-203, C.R.S.

b. An employer is any person doing business in the state, and an employee is any person in the employment of any employer for

salary or for hourly wages, whether full-time or part-time and whether temporary or permanent.

The employer is allowed to claim a credit in an amount equal to 20% of the contribution. The maximum credit an employer may claim

for each employee in a taxable year is $500.

The credit is neither transferable nor refundable, but may be carried forward on the employer’s return for up to three years.

In order to claim the credit for employer contributions to more than 9 qualified employee accounts, the income tax return must be

electronically filed.

If the return cannot be filed electronically, you may submit one 1st page of form DR 0289 with multiple 2nd pages along with the

paper return.

Note - If all of the tax credits for each employee do not sum up correctly to the total, the return may be adjusted and credits reduced

or denied.

Employer/Contributor Last Name First Name Middle Initial FEIN/SSN/ITIN

Employer/Contributor Address City State ZIP

Available Used

1. Carryforward available from prior year

2. Current year credit available, the sum of all employer tax credits generated

3. Total credit available to be used in the current year, sum of lines 1 and 2

4. Credit used to offset current year tax liability, enter here and on the

appropriate form and line number indicated in the table below.

5. Carryforward credit to next tax year, line 3 minus line 4

By claiming this credit, I declare that to the best of my knowledge and belief, this form is true, correct, and complete.

Signature Date (MM/DD/YY)

Form Form Title Line Form Form Title Line

Colorado Pass-Through Entity

DR 0104CR Individual Credit Schedule 45A DR 0106CR 25A

Credit Schedule

DR 0105 Schedule G (DR 0105) 9A DR 0112CR Credit Schedule for Corporations 25A