Enlarge image

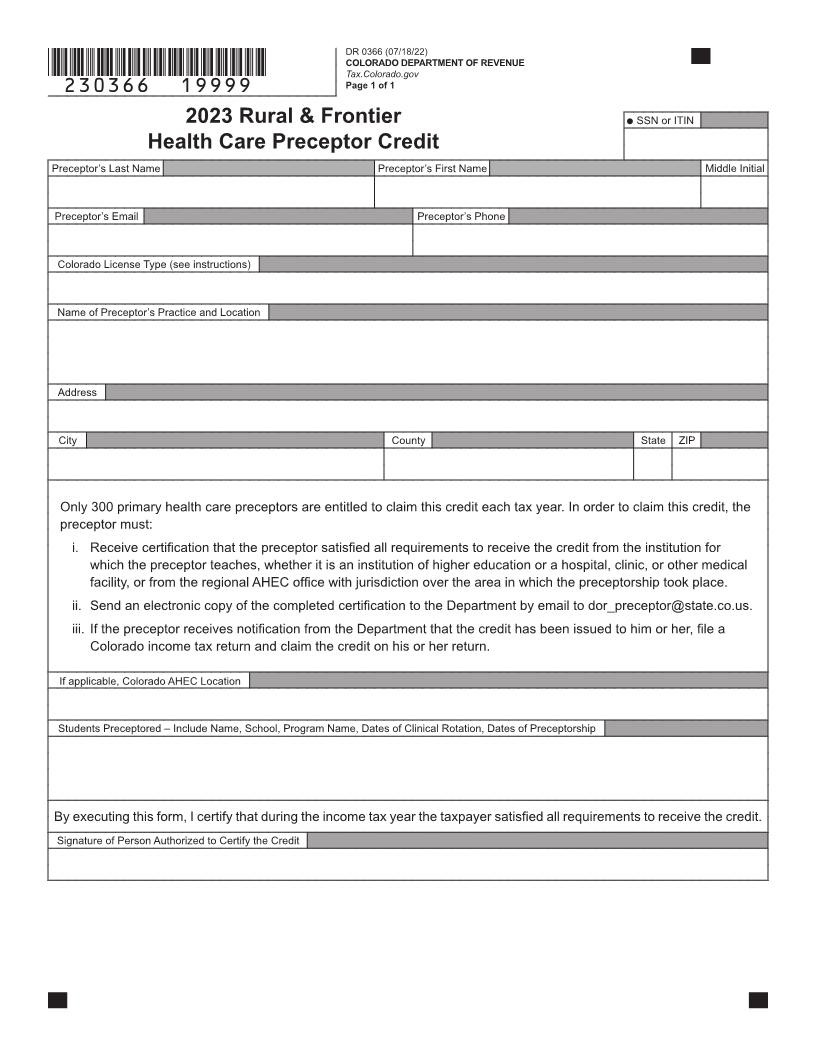

DR 0366 (07/18/22)

COLORADO DEPARTMENT OF REVENUE

Tax.Colorado.gov

*DO=NOT=SEND*

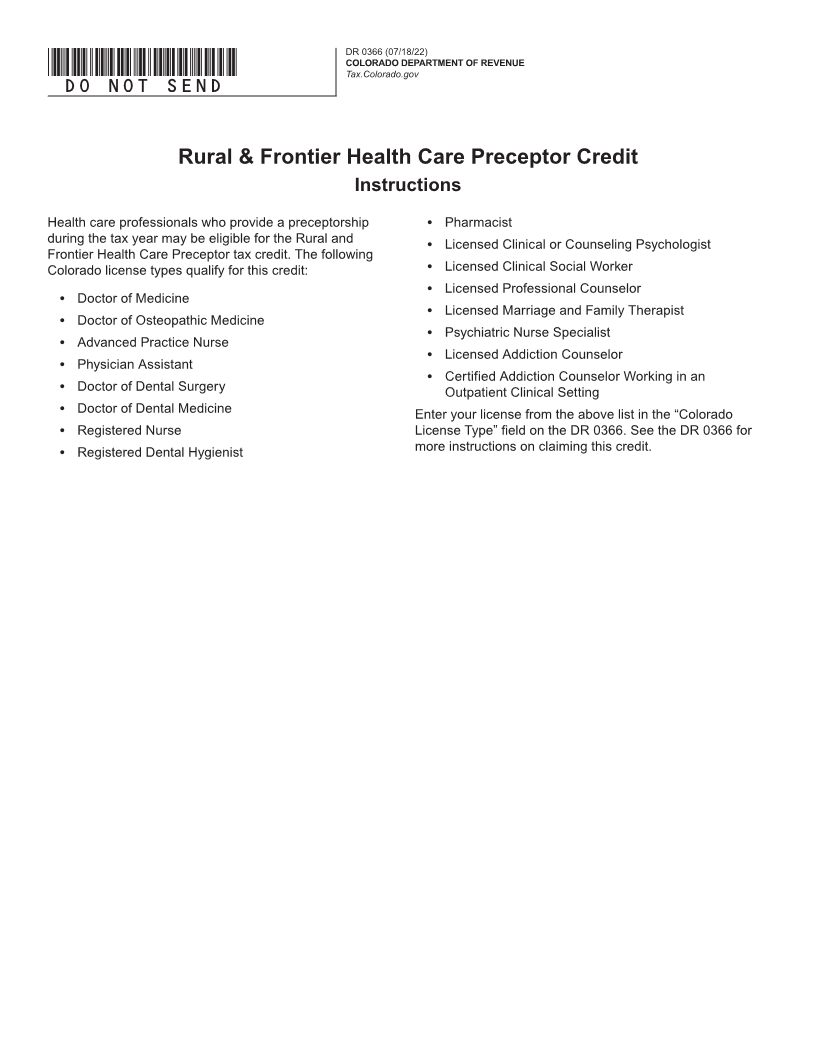

Rural & Frontier Health Care Preceptor Credit

Instructions

Health care professionals who provide a preceptorship ● Pharmacist

during the tax year may be eligible for the Rural and ● Licensed Clinical or Counseling Psychologist

Frontier Health Care Preceptor tax credit. The following

●

Colorado license types qualify for this credit: Licensed Clinical Social Worker

● Licensed Professional Counselor

● Doctor of Medicine

● Licensed Marriage and Family Therapist

● Doctor of Osteopathic Medicine

● Psychiatric Nurse Specialist

● Advanced Practice Nurse

● Licensed Addiction Counselor

● Physician Assistant

● Certified Addiction Counselor Working in an

● Doctor of Dental Surgery Outpatient Clinical Setting

● Doctor of Dental Medicine Enter your license from the above list in the “Colorado

● Registered Nurse License Type” field on the DR 0366. See the DR 0366 for

● Registered Dental Hygienist more instructions on claiming this credit.