Enlarge image

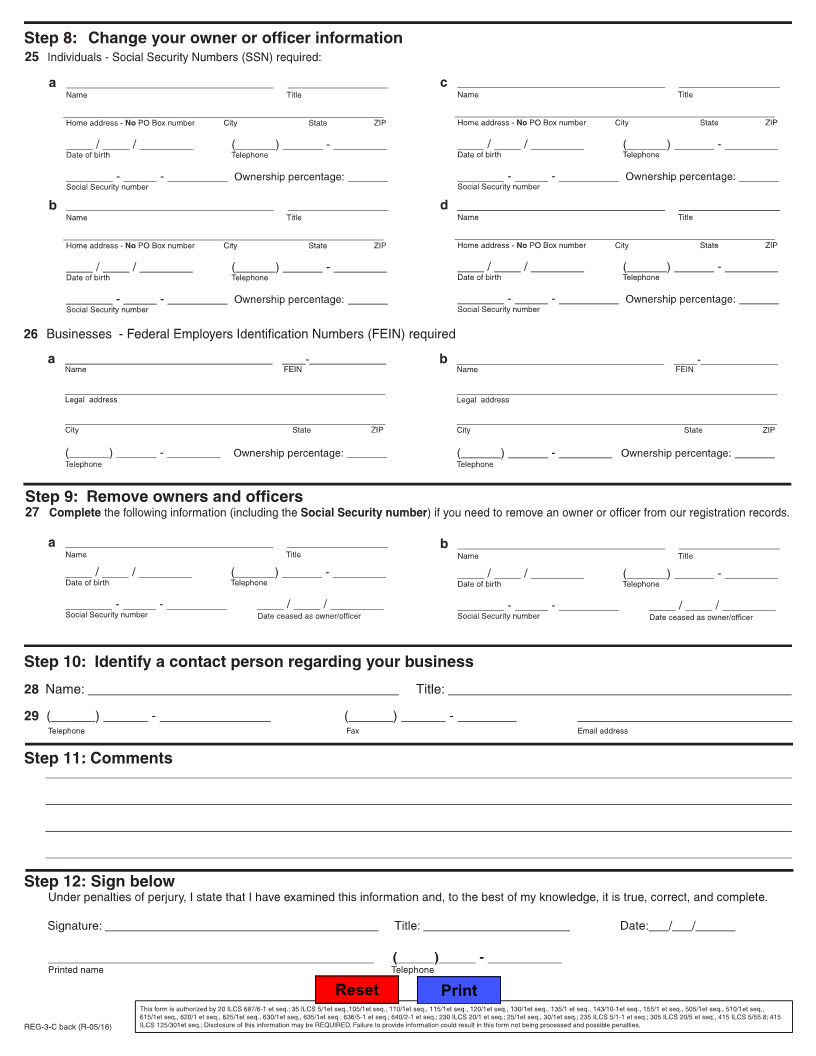

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

REG-3-C Business Information Update

Step 1: Read this information first

Complete the following information to update your registration information. To change or update your responsible party, complete

Schedule REG-1-R, Responsible Party Information. Mail your completed information to Illinois Department of Revenue, P.O. Box 19030,

Springfield, Illinois, 62794-9030. You can fax your information to217 785-6013 or217 557-4398 .

Step 2: Identify your current business

1 __________________________________________________________ 4 FEIN or SSN: _____________________

Business name

2 __________________________________________________________ 5 (_____)_____ - __________

Number and street City State ZIP Telephone

3 _________________________________________________________

Email address

Step 3: Discontinuation or sale of entire business - If you sold your business, Form CBS-1, Notice of Sale, Purchase, or

Transfer of Business Assets, may be required. Visit our website at tax.illinois.gov for more information.

6 Date this became effective: ____/____/________

Step 4: Change business name - If your FEIN has changed due to a name change, you must complete a new Form REG-1, Illinois

Business Registration Application. For a copy or to register on-line, visit our website attax.illinois.gov.

7 Previous legal business name: _________________________ New legal business name: ___________________________

8 Previous DBA name: _______________________________ New DBA name: ___________________________________

Step 5: Change current address

a Legal address - Date this became effective: ____/____/________

9 __________________________________________________________ 12 (_____)_____ - __________

Number and street City State ZIP Telephone

10 __________________________________________________________ 13 _________________________________

County Township

11 Identify the taxes affected by this change (e.g., sales, hotel, etc.). ____________________________

b Mailing address - Date this became effective: ____/____/________

14 __________________________________________________________ 17 (_____)_____ - __________

Number and street City State ZIP Telephone

15 __________________________________________________________

In care of name

16 Identify the taxes affected by this change (e.g., sales, hotel, etc.). ____________________________

Step 6: Add a location - Date this became effective: ____/____/________ Complete Schedule REG-1-L, Illinois Business Site

Location Information, to add more than one location. For a copy or to add a location on-line, visit our website at tax.illinois.gov.

18 __________________________________________________________ 21 (_____)_____ - __________

Number and street City State ZIP Telephone

19 Check the best physical description of this location: permanent one that will change (e.g., fairs, flea market)

20 Is the address outside the city limits? yes no

Step 7: Close a location - Date this location closed: ____/____/________

If closing more than one location, attach a separate sheet following the same format as below including the date closed.

22 __________________________________________________________

Number and street City State ZIP

23 __________________________________________________________ 24 _________________________________

County Township

REG-3-C front (R-05/16)