Enlarge image

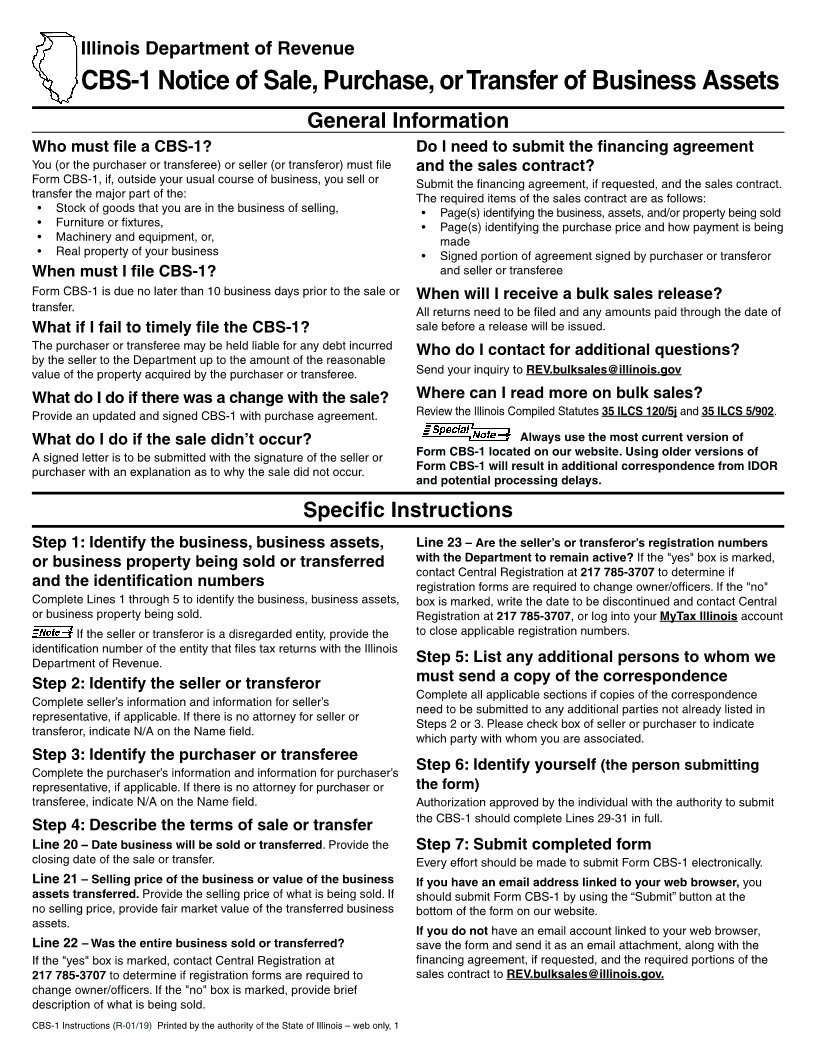

Illinois Department of Revenue

CBS-1 Notice of Sale, Purchase, or Transfer of Business Assets

General Information

Who must file a CBS-1? Do I need to submit the financing agreement

You (or the purchaser or transferee) or seller (or transferor) must file and the sales contract?

Form CBS-1, if, outside your usual course of business, you sell or Submit the financing agreement, if requested, and the sales contract.

transfer the major part of the: The required items of the sales contract are as follows:

• Stock of goods that you are in the business of selling, • Page(s) identifying the business, assets, and/or property being sold

• Furniture or fixtures, • Page(s) identifying the purchase price and how payment is being

• Machinery and equipment, or, made

• Real property of your business • Signed portion of agreement signed by purchaser or transferor

When must I file CBS-1? and seller or transferee

Form CBS-1 is due no later than 10 business days prior to the sale or When will I receive a bulk sales release?

transfer. All returns need to be filed and any amounts paid through the date of

What if I fail to timely file the CBS-1? sale before a release will be issued.

The purchaser or transferee may be held liable for any debt incurred Who do I contact for additional questions?

by the seller to the Department up to the amount of the reasonable

value of the property acquired by the purchaser or transferee. Send your inquiry to REV.bulksales@illinois.gov

What do I do if there was a change with the sale? Where can I read more on bulk sales?

Provide an updated and signed CBS-1 with purchase agreement. Review the Illinois Compiled Statutes 35 ILCS 120/5j and 35 ILCS 5/902.

What do I do if the sale didn’t occur? Always use the most current version of

A signed letter is to be submitted with the signature of the seller or Form CBS-1 located on our website. Using older versions of

purchaser with an explanation as to why the sale did not occur. Form CBS-1 will result in additional correspondence from IDOR

and potential processing delays.

Specific Instructions

Step 1: Identify the business, business assets, Line 23 – Are the seller’s or transferor’s registration numbers

or business property being sold or transferred with the Department to remain active? If the "yes" box is marked,

contact Central Registration at 217 785-3707 to determine if

and the identification numbers registration forms are required to change owner/officers. If the "no"

Complete Lines 1 through 5 to identify the business, business assets, box is marked, write the date to be discontinued and contact Central

or business property being sold. Registration at 217 785-3707, or log into your MyTax Illinois account

If the seller or transferor is a disregarded entity, provide the to close applicable registration numbers.

identification number of the entity that files tax returns with the Illinois

Department of Revenue. Step 5: List any additional persons to whom we

must send a copy of the correspondence

Step 2: Identify the seller or transferor

Complete all applicable sections if copies of the correspondence

Complete seller’s information and information for seller’s

need to be submitted to any additional parties not already listed in

representative, if applicable. If there is no attorney for seller or

Steps 2 or 3. Please check box of seller or purchaser to indicate

transferor, indicate N/A on the Name field.

which party with whom you are associated.

Step 3: Identify the purchaser or transferee

Complete the purchaser’s information and information for purchaser’s Step 6: Identify yourself (the person submitting

representative, if applicable. If there is no attorney for purchaser or the form)

transferee, indicate N/A on the Name field. Authorization approved by the individual with the authority to submit

the CBS-1 should complete Lines 29-31 in full.

Step 4: Describe the terms of sale or transfer

Line 20 – Date business will be sold or transferred. Provide the Step 7: Submit completed form

closing date of the sale or transfer. Every effort should be made to submit Form CBS-1 electronically.

Line 21 – Selling price of the business or value of the business If you have an email address linked to your web browser, you

assets transferred. Provide the selling price of what is being sold. If should submit Form CBS-1 by using the “Submit” button at the

no selling price, provide fair market value of the transferred business bottom of the form on our website.

assets.

If you do not have an email account linked to your web browser,

Line 22 – Was the entire business sold or transferred? save the form and send it as an email attachment, along with the

If the "yes" box is marked, contact Central Registration at financing agreement, if requested, and the required portions of the

217 785-3707 to determine if registration forms are required to sales contract to REV.bulksales@illinois.gov.

change owner/officers. If the "no" box is marked, provide brief

description of what is being sold.

CBS-1 Instructions (R-01/19) Printed by the authority of the State of Illinois – web only, 1