- 2 -

Enlarge image

|

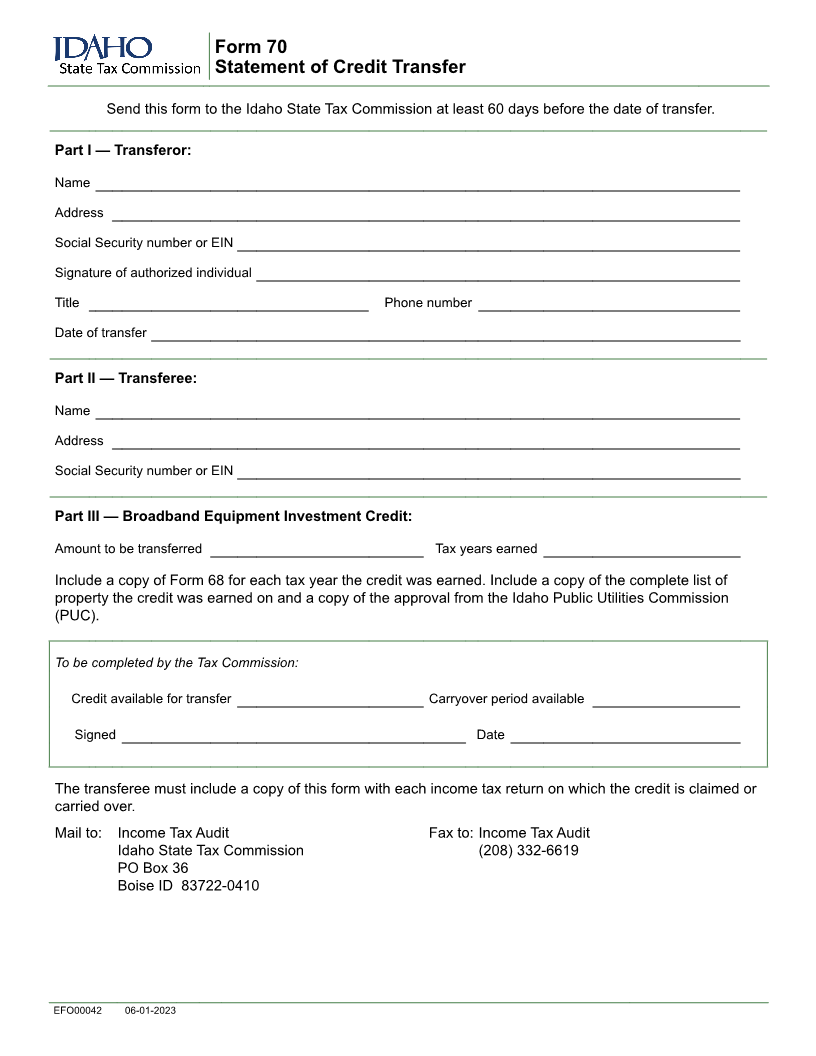

Form 70 — Instructions

Statement of Credit Transfer

General Instructions Any credit not claimed on the tax return filed during the

Use Form 70 to report the credit being transferred year of the transfer can be claimed on the transferee’s

and the number of years it can be carried forward. returns for the carryforward period approved on

Send this form to the Tax Commission at least 60 Form 70.

days before the transfer date.

Specific Instructions

Which Credits Can Be Transferred File a separate Form 70 to identify each transferee

Only the broadband equipment investment credit you’ll be transferring the credit to.

can be transferred. You can transfer all or a part of

the credit you earn. Part I — Transferor Information. If you’re transferring

the credit, enter your name as it appears on your tax

Who Can Transfer Credits return for the tax year when the transfer takes place.

You can transfer the broadband equipment Provide the additional identifying information. Enter the

investment credit if you originally earned the credit date the transfer will take place.

or you’re an intermediary. If you’re an intermediary,

you can either use all or part of the credit or resell If you’re an intermediary selling the credit to another

all or part of it to another taxpayer. The credit can’t taxpayer, complete Part I with your identifying

be transferred more than two times. information.

You can’t transfer the broadband equipment Part II — Transferee Information. Provide the

investment credit to another taxpayer if you name, address and Social Security number or

received the credit through unitary sharing. Employer Identification Number of the taxpayer you’re

transferring the credit to. This can be an intermediary.

Information You Must Provide

For each tax year the credit being transferred Part III — Credit Information. Enter the amount

was earned, you must provide copies of all of the to be transferred and the tax years the broadband

following: equipment investment credit was earned.

• Idaho Form 68 The Tax Commission will review the information

• Schedules that list the property the credit was provided and identify the credit available for transfer

earned on and the carryover period available to the transferee.

• The Idaho Public Utilities Commission The form will then be returned to the transferor.

approval authorizing the credit The Tax Commission may examine the transferor’s

books and records to verify that the credit claimed

When to Claim the Transferred Credit by the transferor was correct. If the Tax Commission

The transferee can claim transferred credits determines that the credit claimed was overstated or

on the original return filed in the calendar year that recapture of credit is necessary, any tax due from

of the transfer. For example, if the broadband an overstated or recaptured credit will be due from the

equipment investment credit was transferred on transferor.

June 1, 2021, the transferee can claim the credit on

their original return for calendar year 2020 filed on

October 15, 2021.

If you don’t claim the transferred credit on your

original return filed during the calendar year when

the transfer takes place, you can’t amend the return

for that tax year to claim the credit.

Contact us:

In the Boise area: (208) 334-7660 |Toll free: (800) 972-7660

Hearing impaired (TDD) (800) 377-3529

tax.idaho.gov/contact

EIN00086 06-01-2023

|