Enlarge image

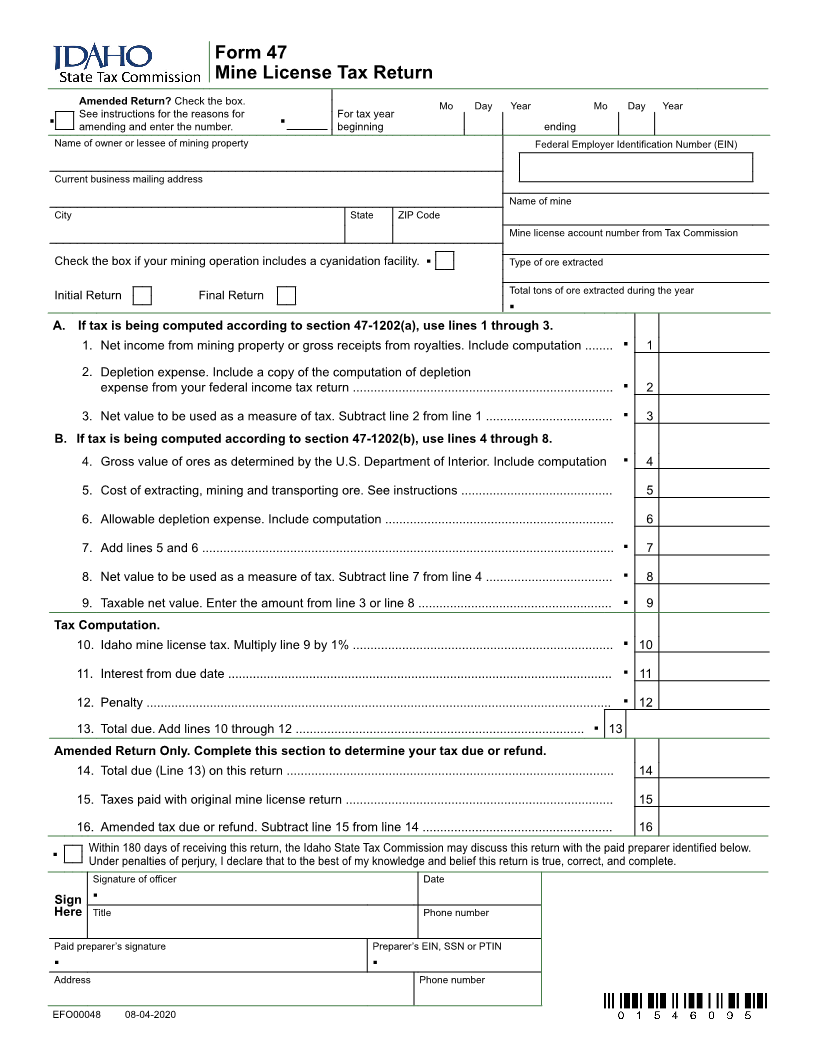

Form 47

Mine License Tax Return

Amended Return? Check the box. Mo Day Year Mo Day Year

See instructions for the reasons for For tax year

▪ amending and enter the number. ▪ beginning ending

Name of owner or lessee of mining property Federal Employer Identification Number (EIN)

Current business mailing address

Name of mine

City State ZIP Code

Mine license account number from Tax Commission

Check the box if your mining operation includes a cyanidation facility. ▪ Type of ore extracted

Initial Return Final Return Total tons of ore extracted during the year

▪

A. If tax is being computed according to section 47-1202(a), use lines 1 through 3.

1. Net income from mining property or gross receipts from royalties. Include computation ........ ▪ 1

2. Depletion expense. Include a copy of the computation of depletion

expense from your federal income tax return .......................................................................... ▪ 2

3. Net value to be used as a measure of tax. Subtract line 2 from line 1 .................................... ▪ 3

B. If tax is being computed according to section 47-1202(b), use lines 4 through 8.

4. Gross value of ores as determined by the U.S. Department of Interior. Include computation ▪ 4

5. Cost of extracting, mining and transporting ore. See instructions ........................................... 5

6. Allowable depletion expense. Include computation ................................................................. 6

7. Add lines 5 and 6 ..................................................................................................................... ▪ 7

8. Net value to be used as a measure of tax. Subtract line 7 from line 4 .................................... ▪ 8

9. Taxable net value. Enter the amount from line 3 or line 8 ....................................................... ▪ 9

Tax Computation.

10. Idaho mine license tax. Multiply line 9 by 1% .......................................................................... ▪ 10

11. Interest from due date ............................................................................................................. ▪ 11

12. Penalty ....................................................................................................................................▪ 12

13. Total due. Add lines 10 through 12 ..................................................................................▪ 13

Amended Return Only. Complete this section to determine your tax due or refund.

14. Total due (Line 13) on this return ............................................................................................. 14

15. Taxes paid with original mine license return ............................................................................ 15

16. Amended tax due or refund. Subtract line 15 from line 14 ...................................................... 16

Within 180 days of receiving this return, the Idaho State Tax Commission may discuss this return with the paid preparer identified below.

▪ Under penalties of perjury, I declare that to the best of my knowledge and belief this return is true, correct, and complete.

Signature of officer Date

Sign ▪

Here Title Phone number

Paid preparer’s signature Preparer’s EIN, SSN or PTIN

▪ ▪

Address Phone number

EFO00048 08-04-2020