Enlarge image

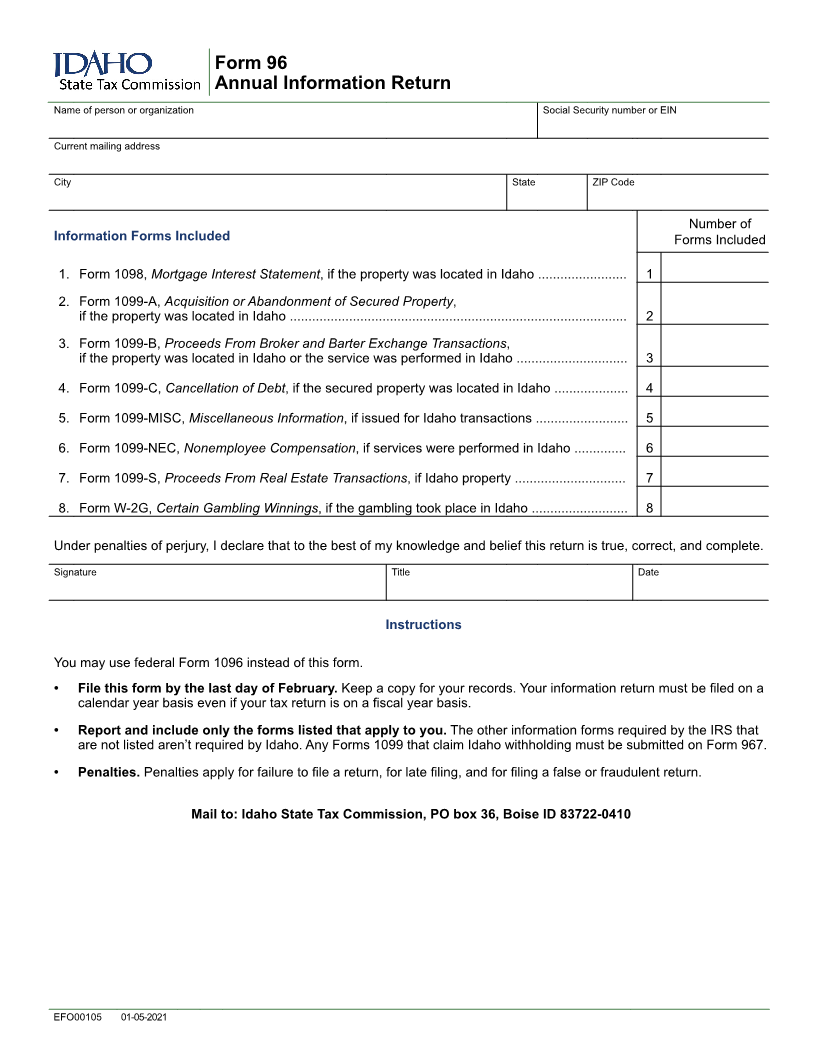

Form 96

Annual Information Return

Name of person or organization Social Security number or EIN

Current mailing address

City State ZIP Code

Number of

Information Forms Included Forms Included

1. Form 1098, Mortgage Interest Statement, if the property was located in Idaho ........................ 1

2. Form 1099-A, Acquisition or Abandonment of Secured Property,

if the property was located in Idaho ........................................................................................... 2

3. Form 1099-B, Proceeds From Broker and Barter Exchange Transactions,

if the property was located in Idaho or the service was performed in Idaho .............................. 3

4. Form 1099-C, Cancellation of Debt, if the secured property was located in Idaho .................... 4

5. Form 1099-MISC, Miscellaneous Information, if issued for Idaho transactions ......................... 5

6. Form 1099-NEC, Nonemployee Compensation, if services were performed in Idaho .............. 6

7. Form 1099-S, Proceeds From Real Estate Transactions, if Idaho property .............................. 7

8. Form W-2G, Certain Gambling Winnings, if the gambling took place in Idaho .......................... 8

Under penalties of perjury, I declare that to the best of my knowledge and belief this return is true, correct, and complete.

Signature Title Date

Instructions

You may use federal Form 1096 instead of this form.

• File this form by the last day of February. Keep a copy for your records. Your information return must be filed on a

calendar year basis even if your tax return is on a fiscal year basis.

• Report and include only the forms listed that apply to you. The other information forms required by the IRS that

are not listed aren’t required by Idaho. Any Forms 1099 that claim Idaho withholding must be submitted on Form 967.

• Penalties. Penalties apply for failure to file a return, for late filing, and for filing a false or fraudulent return.

Mail to: Idaho State Tax Commission, PO box 36, Boise ID 83722-0410

EFO00105 01-05-2021