Enlarge image

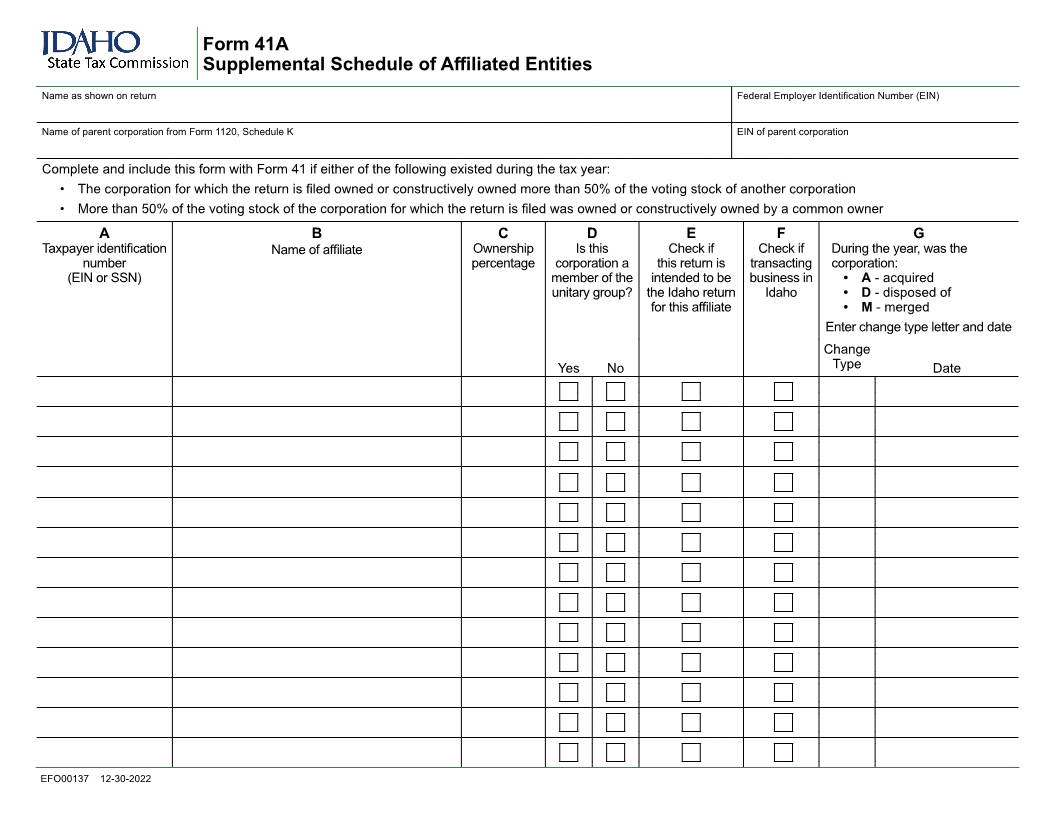

Form 41A

Supplemental Schedule of Affiliated Entities

Name as shown on return Federal Employer Identification Number (EIN)

Name of parent corporation from Form 1120, Schedule K EIN of parent corporation

Complete and include this form with Form 41 if either of the following existed during the tax year:

• The corporation for which the return is filed owned or constructively owned more than 50% of the voting stock of another corporation

• More than 50% of the voting stock of the corporation for which the return is filed was owned or constructively owned by a common owner

A B C D E F G

Taxpayer identification Name of affiliate Ownership Is this Check if Check if During the year, was the

number percentage corporation a this return is transacting corporation:

(EIN or SSN) member of the intended to be business in • A - acquired

unitary group? the Idaho return Idaho • D - disposed of

for this affiliate • M - merged

Enter change type letter and date

Change

Yes No Type Date

EFO00137 12-30-2022