Enlarge image

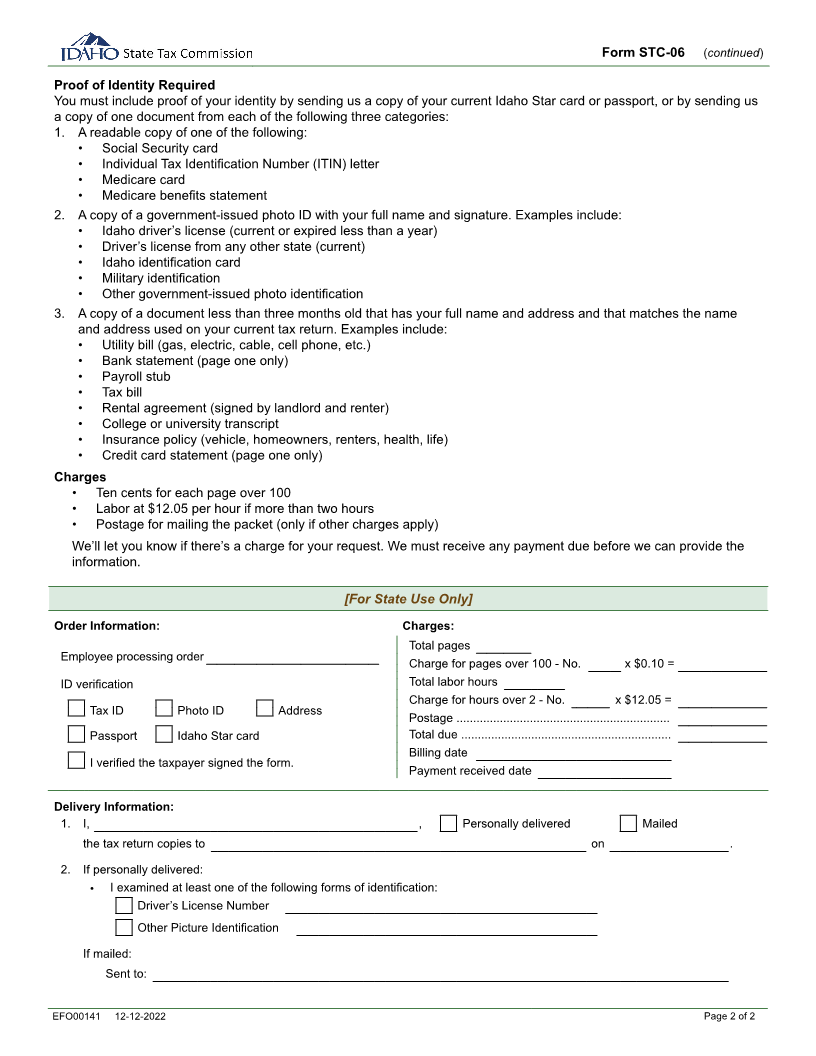

Form STC-06

Request for Copies of Idaho Tax Returns

Individual

Taxpayer’s name SSN or ITIN

Spouse’s name Spouse’s SSN or ITIN

Current address

Mailing address change

City State ZIP Code Current phone number

Business

Legal name FEIN

DBA name Permit number

Location address Authorized person name

City State ZIP Code Authorized person title

Requested Documents

Income Tax Permit Tax

Years Tax Type

Periods

List what you’re requesting

Select Delivery Method

Taxpayer

Pick up from this local office: Boise Coeur d’Alene Idaho Falls Lewiston Pocatello Twin Falls

For local office locations and hours go to: tax.idaho.gov/visit

Call me at this number when documents are ready:

Mail to my current address:

Representative

My representative will pick up from this local office:

Boise Coeur d’Alene Idaho Falls Lewiston Pocatello Twin Falls

For local office locations and hours go to: tax.idaho.gov/visit

Representative name and phone number:

Mail to my representative at:

I understand that by selecting a representative to receive this information, I’m allowing the Idaho State Tax Commission to release

my personal or business tax information to the representative. I understand it’s my responsibility to make sure the representative’s

information is correct.

Sign here to authorize a representative for this request:

Authorized Signature

Taxpayer’s signature Date

Individual

Spouse’s signature Date

Authorized signature Date

Business

Authorized signature Date

Power of Attorney

Mail form to: Idaho State Tax Commission, PO Box 36, Boise ID 83722-0410

EFO00141 12-12-2022 Page 1 of 2