Enlarge image

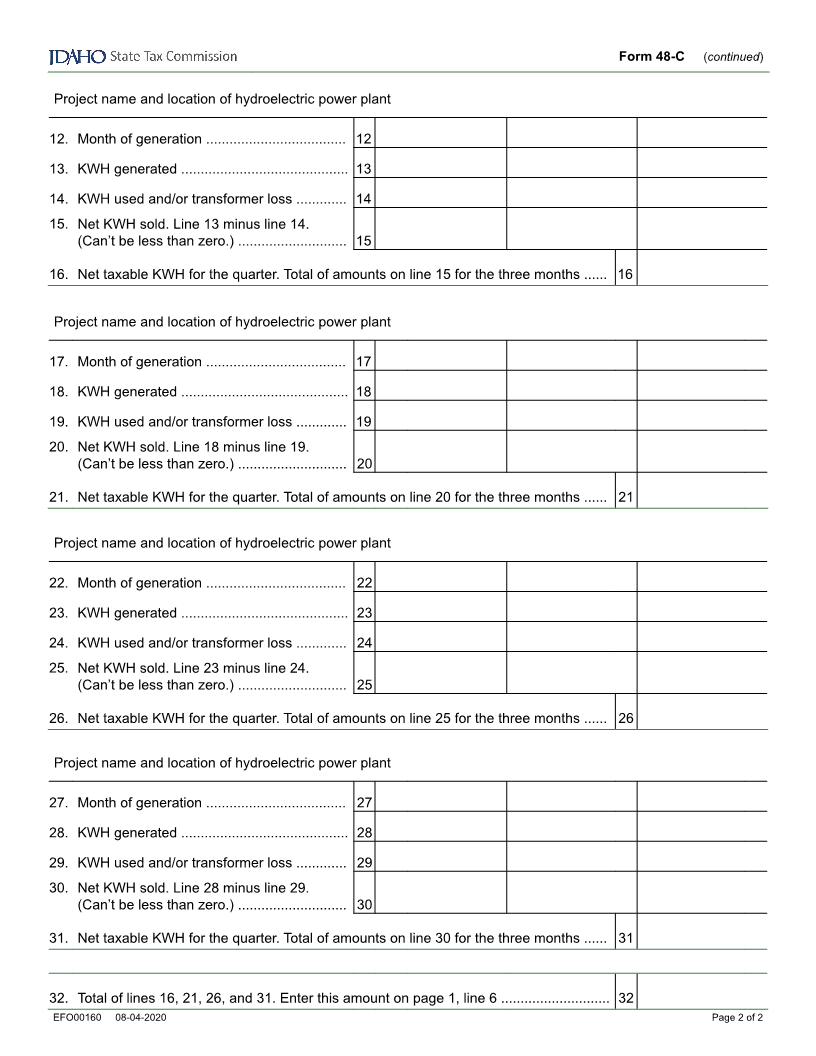

Form 48-C

Kilowatt Hour (KWH) License

Tax Statement for Cogenerator (Quarterly)

Tax on hydroelectric energy eneratedg in Idaho for arter, b ale s or , xchangee

For the quarter ending

(Month) (Year)

Name of producer Social Security number or EIN

Producer’s current mailing address

City State ZIP Code

Energy sold to

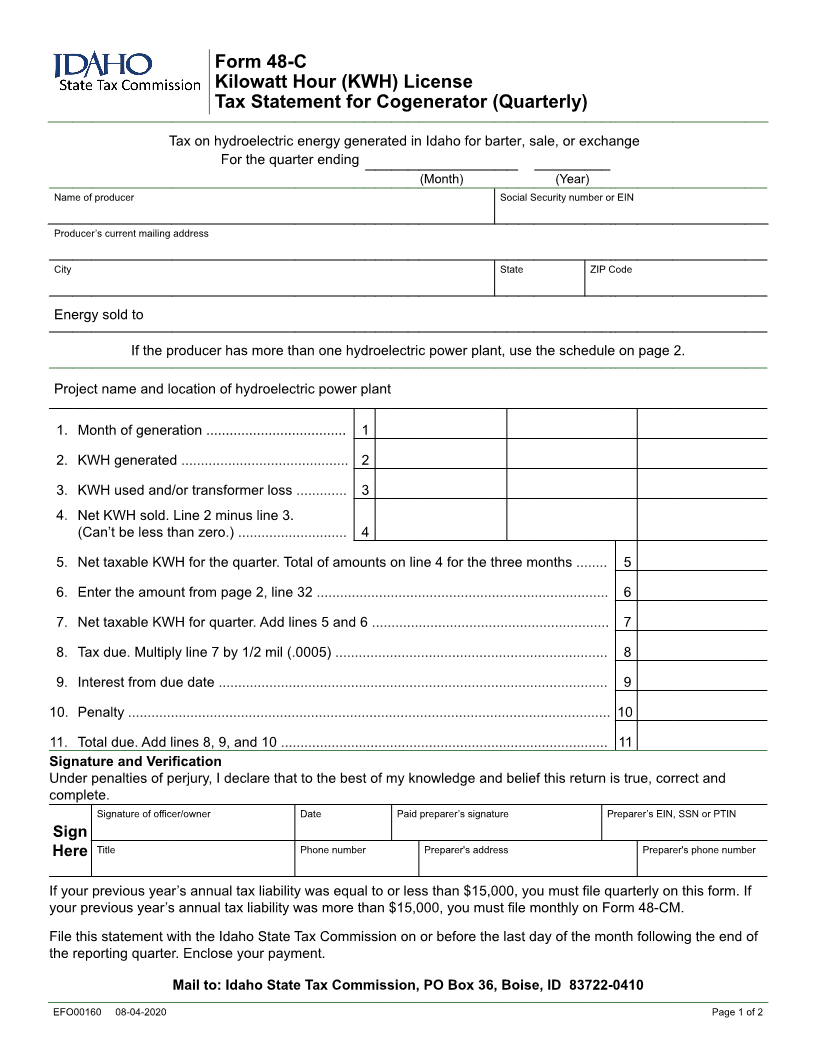

If the producer has more than one hydroelectric power plant, use the schedule on page 2.

Project name and location of hydroelectric power plant

1. Month of generation .................................... 1

2. KWH generated ........................................... 2

3. KWH used and/or transformer loss ............. 3

4. Net KWH sold. Line 2 minus line 3.

(Can’t be less than zero.) ............................ 4

5. Net taxable KWH for the quarter. Total of amounts on line 4 for the three months ........ 5

6. Enter the amount from page 2, line 32 ........................................................................... 6

7. Net taxable KWH for quarter. Add lines 5 and 6 ............................................................. 7

8. Tax due. Multiply line 7 by 1/2 mil (.0005) ...................................................................... 8

9. Interest from due date .................................................................................................... 9

10. Penalty ............................................................................................................................ 10

11. Total due. Add lines 8, 9 , and 10 .................................................................................... 11

Signature and Verification

Under penalties of perjury, I declare that to the best of my knowledge and belief this return is true, correct and

complete.

Signature of officer/owner Date Paid preparer’s signature Preparer’s EIN, SSN or PTIN

Sign

Here Title Phone number Preparer's address Preparer's phone number

If your previous year’s annual tax liability was equal to or less than $15,000, you must file quarterly on this form. If

your previous year’s annual tax liability was more than $15,000, you must file monthly on Form 48-CM.

File this statement with the Idaho State Tax Commission on or before the last day of the month following the end of

the reporting quarter. Enclose your payment.

Mail to: Idaho State Tax Commission, PO Box 36, Boise, ID 83722-0410

EFO00160 08-04-2020 Page 1 of 2