Enlarge image

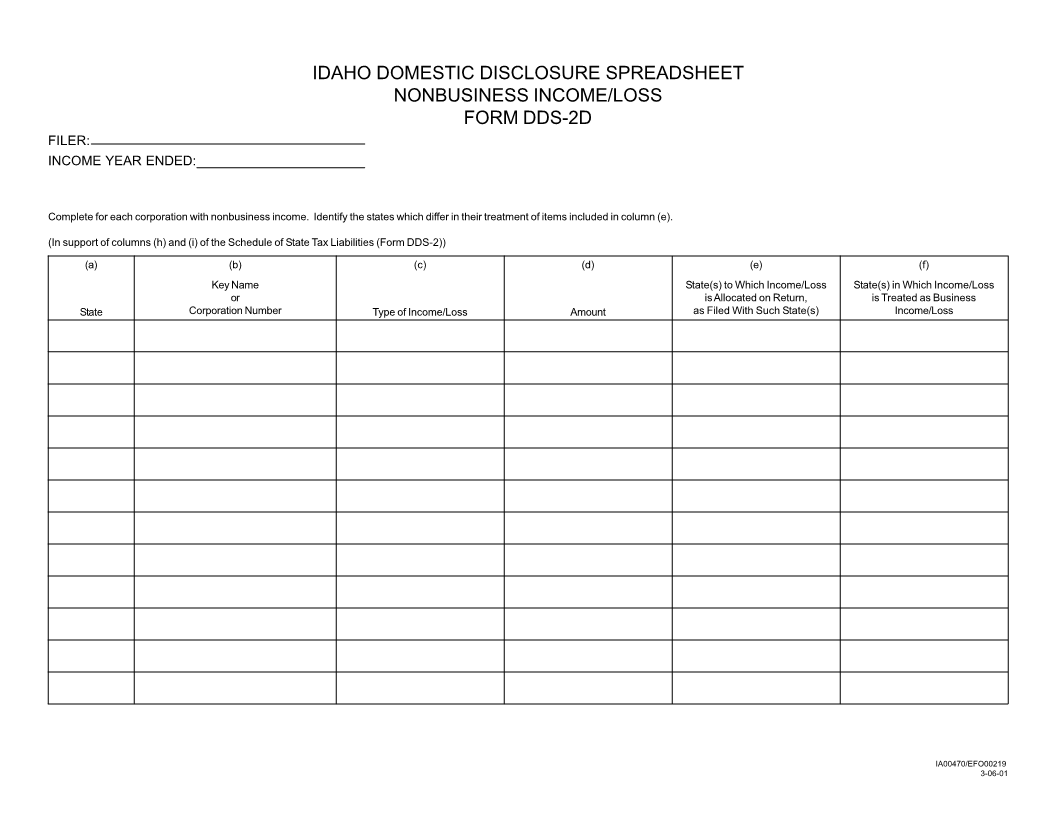

(In support of columns (h) and (i) of the Schedule of State Tax Liabilities (Form DDS-2)) Complete for each corporation with nonbusiness income. Identify the states which differ in their treatment of items included in column (e). INCOME YEAR ENDED: FILER:

State (a)

Corporation Number

Key Name

or (b)

IDAHO DOMESTIC DISCLOSURE SPREADSHEET

Type of Income/Loss

NONBUSINESS INCOME/LOSS

(c)

FORM DDS-2D

Amount

(d)

State(s) to Which Income/Loss

as Filed With Such State(s)

is Allocated on Return,

(e)

State(s) in Which Income/Loss

is Treated as Business

Income/Loss

(f)

IA00470

/EFO00219

3-06-01