Enlarge image

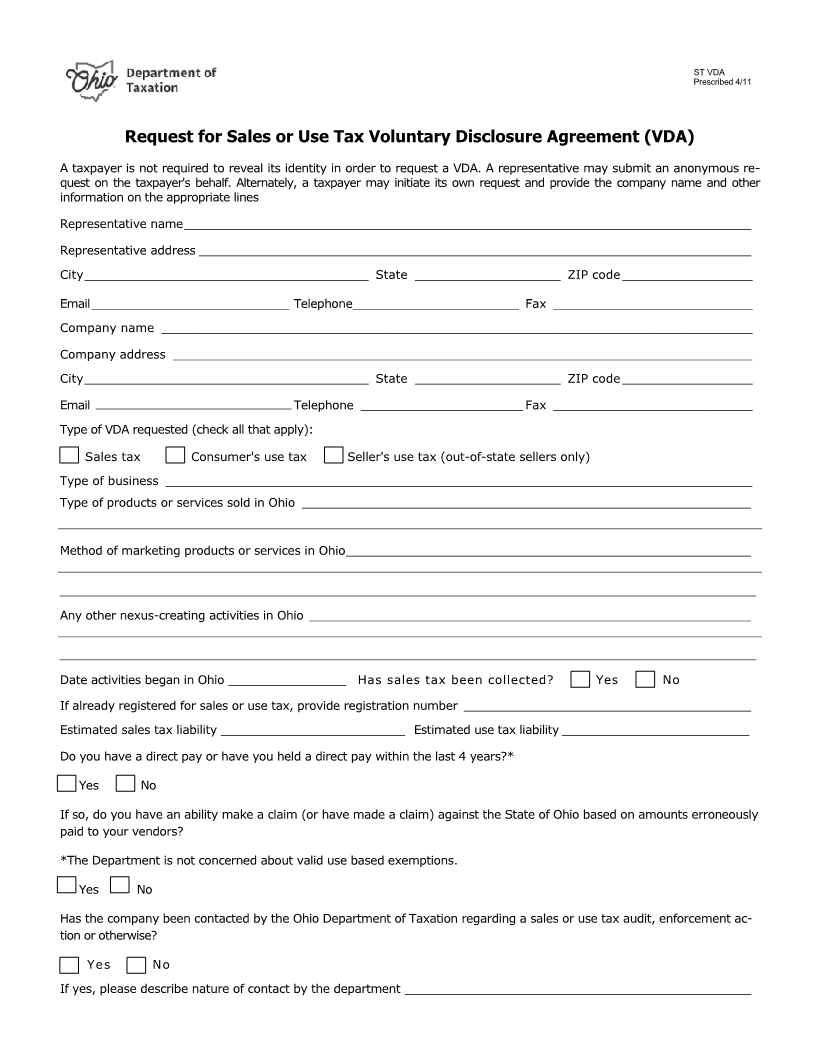

ST VDA

Prescribed 4/11

Request for Sales or Use Tax Voluntary Disclosure Agreement (VDA)

A taxpayer is not required to reveal its identity in order to request a VDA. A representative may submit an anonymous re-

quest on the taxpayer's behalf. Alternately, a taxpayer may initiate its own request and provide the company name and other

information on the appropriate lines

Representative name _____________________________________________________________________________

Representative address ___________________________________________________________________________

City _____________________________________ State ___________________ ZIP code _________________

Email ____________________________ Telephone _______________________ Fax __________________________

Company name _____________________________________________________________________________

Company address _____________________________________________________________________________

City _____________________________________ State ___________________ ZIP code _________________

Email Telephone ______________________ Fax __________________________

Type of VDA requested (check all that apply):

Sales tax Consumer's use tax Seller's use tax (out-of-state sellers only)

Type of business ______________________________________________________________________________

Type of products or services sold in Ohio _____________________________________________________________

Method of marketing products or services in Ohio _______________________________________________________

Any other nexus-creating activities in Ohio ____________________________________________________________

Date activities began in Ohio ________________ Has sales tax been collected? Yes No

If already registered for sales or use tax, provide registration number _______________________________________

Estimated sales tax liability _________________________ Estimated use tax liability __________________________

Do you have a direct pay or have you held a direct pay within the last 4 years?*

Yes No

If so, do you have an ability make a claim (or have made a claim) against the State of Ohio based on amounts erroneously

paid to your vendors?

*The Department is not concerned about valid use based exemptions.

Yes No

Has the company been contacted by the Ohio Department of Taxation regarding a sales or use tax audit, enforcement ac-

tion or otherwise?

Yes No

If yes, please describe nature of contact by the department _______________________________________________