Enlarge image

Form PTE-01 — Instructions

Income Tax Withheld for a Nonresident Individual Owner

of a Pass-through Entity

General Information

A pass-through entity (entity), as defined in Idaho Code section 63-3006C, includes a partnership, limited liability company taxed as a

partnership, an S corporation, a trust, or an estate.

An entity transacting business in Idaho must withhold income tax for nonresident individual owners who:

• Have distributable income of $1,000 or more for the tax year

• Aren’t included in a composite return

• Haven’t filed an Idaho Nonresident Owner Agreement or

• Aren’t a corporation, partnership, trust, or an estate

Send payment with completed Forms PTE-01 for the above individuals. Don’t send payment with the entity return.

PTE-01 Tax Payment Instructions (Withholding)

Calculate the amount of income tax you must pay to the Idaho State Tax Commission. Multiply the owner’s share of Idaho-source

distributable income by 6%. This includes guaranteed payments reportable to Idaho as Idaho taxable income.

Complete Form PTE-01 with the owner’s name as it will be shown on the owner’s individual income tax return.

In the Amount Paid box, enter the amount of income tax withheld on the owner’s Idaho-source income. Enter the owner’s name,

address, and Social Security number in the spaces provided.

Grantor trusts and disregarded entities will complete the bottom row and provide the name and Social Security number of the

individual reporting the withholding tax.

How to Pay

To pay online, visit tax.idaho.gov/epay. You can pay using EFT, ACH Debit, ACH Credit, credit/debit cards, or e-checks. If you’re

making a payment of $100,000 or more, you must use ACH Debit or ACH Credit.

You can send a single payment for a maximum of 250 PTE-01 vouchers. For example, if you’re making withholding payments for

300 individual owners, you would send two checks: one with 250 PTE-01 vouchers and a second check with the remaining 50 PTE-

01 vouchers.

You must pay the total amount of income tax required to be withheld. If your payment isn’t postmarked or electronically submitted by

April 18, 2023, we’ll charge penalty and interest on the amount due.

Check Payments. Make your check or money order payable to the Idaho State Tax Commission. Don’t staple your check to your

voucher or send a check stub.

Mail voucher and payment to: Idaho State Tax Commission, PO Box 83784, Boise ID 83707-3784.

Contact us:

In the Boise area: (208) 334-7660 | Toll free: (800) 972-7660

Hearing impaired (TDD) (800) 377-3529

tax.idaho.gov/contact

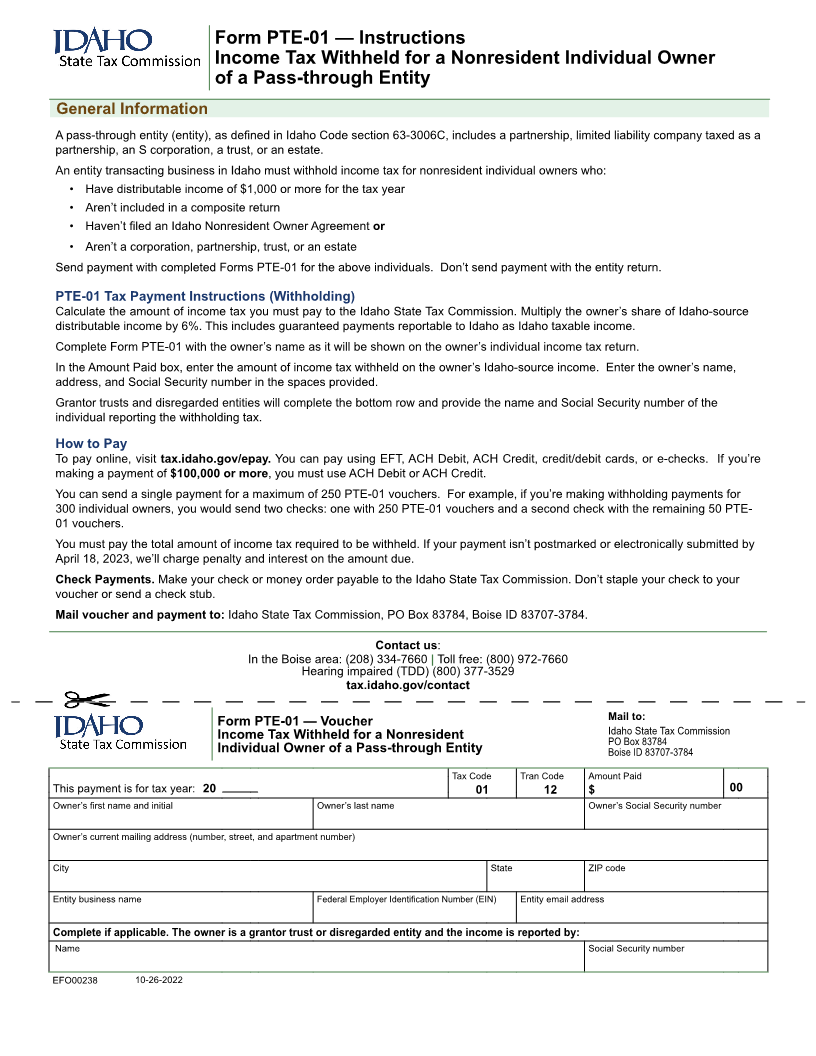

Form PTE-01 — Voucher Mail to:

Income Tax Withheld for a Nonresident Idaho State Tax Commission

PO Box 83784

Individual Owner of a Pass-through Entity Boise ID 83707-3784

Tax Code Tran Code Amount Paid

This payment is for tax year: 20 01 12 $ 00

Owner’s first name and initial Owner’s last name Owner’s Social Security number

Owner’s current mailing address (number, street, and apartment number)

City State ZIP code

Entity business name Federal Employer Identification Number (EIN) Entity email address

Complete if applicable. The owner is a grantor trust or disregarded entity and the income is reported by:

Name Social Security number

EFO00238 10-26-2022