Enlarge image

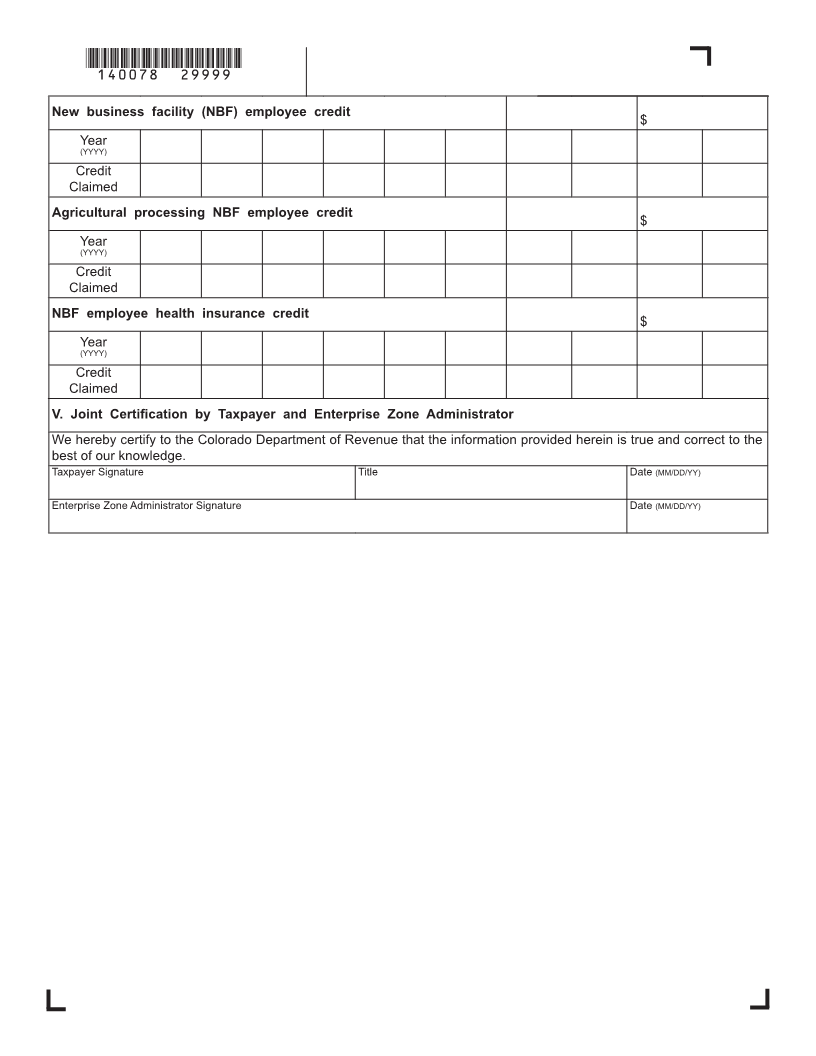

DR 0078 (07/25/14)

*140078==19999* COLORADO DEPARTMENT OF REVENUE

Denver, CO 80261-0005

Application for Extended Enterprise Zone Tax Credits

in Terminated Enterprise Zone Area

Joint Certification by Taxpayer and Enterprise Zone Administrator

I. Enterprise Zone Date termination of this area officially announced: (MM/DD/YY) Effective date of termination of this zone area: (MM/DD/YY)

II. Corporation or Last Name First Name Middle Initial

Colorado Account Number SSN or FEIN

Mailing Address City State Zip

Contact Person's Last Name First Name Middle Initial

Location of Enterprise Zone Facility City State Zip

Date Established/Acquired/Planned to be Established by Taxpayer (MM/DD/YY) Phone Number

( )

III. Describe business planning documentation in place prior to the announcement of the zone termination

(do not attach; retain with your tax records and send only if specifically requested by the Department):

Real estate Plant or equipment Permit applications (zoning, building,

acquisition plans purchasing specifications environmental, etc.)

Utility service applications Financing plans Other

If other, please describe

IV. Planned Activity Eligible for Enterprise Zone Tax Credits

through ten years following termination of zone.

Amount of

Tax Credit Cumulative

For each applicable credit, first list only the planned and cumulative total amounts Planned

when requesting the certification. Then, complete the areas to designate the year and Investment, Total Anticipated

amount of each credit claimed. Jobs, etc. Tax Credits

Contribution to enterprise zone administrator credit

$ $

Year

(YYYY)

Credit

Claimed

Investment tax credit

$ $

Year

(YYYY)

Credit

Claimed

Job training tax credit

$ $

Year

(YYYY)

Credit

Claimed