Enlarge image

DR 8454 (01/26/23)

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261-0005

*DO=NOT=SEND* Tax.Colorado.gov

Instructions

Responsibility for this Form Line 3 Report the amount of tax reported on Colorado

If electronically filing more than one return for a taxpayer or Form 105, line 9.

entity/business, a separate DR 8454 is required for each Line 4 Report the amount indicated as Colorado

qualifying entity. By participating in the electronic filing option, payments from Colorado Form 105 line 17.

the PC online filer agrees to maintain this form (DR 8454) Please note: The name of the estate/trust should be

for four years from the due date of the return or the date the entered in the "Taxpayer Last Name or Business Name"

return was filed, whichever is later. The PC online filer also field and the fiduciary name should be entered in the

agrees to present this form upon request to the Department "First Name or Business DBA if different from Business

of Revenue at any time during the four-year period. Name" field.

DO NOT MAIL THIS FORM TO THE IRS OR THE

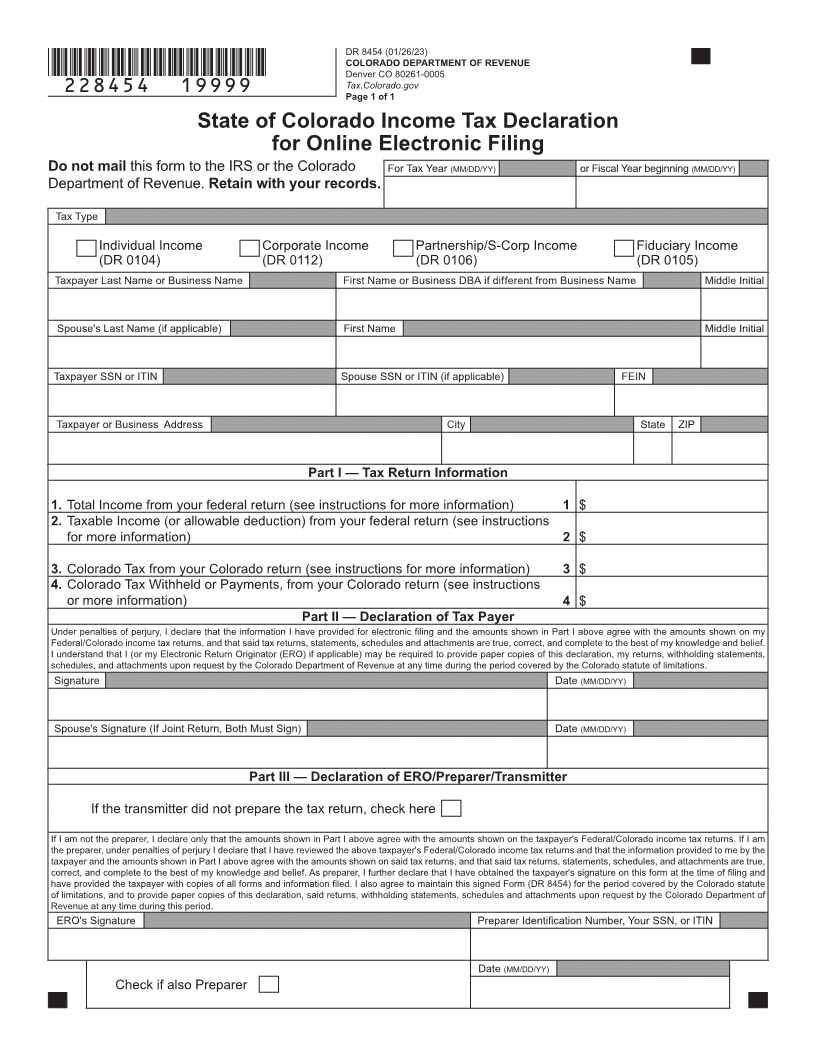

Part II - DECLARATION OF TAXPAYER (TAXPAYER

COLORADO DEPARTMENT OF REVENUE unless

USING ERO OR TAXPAYER WHO IS A PC FILER)

you receive a request from the Colorado Department of

Revenue for this document. All Taxpayers

All Taxpayers are required to sign and date the DR 8454

Line Instructions at the time of filing. An electronically transmitted income

tax return will not be considered complete and/or filed until

Name, Address, and Social Security Number

Print or type this information in the space provided exactly the DR 8454 has been signed/dated by all appropriate

as it is shown on the electronically filed Colorado tax taxpayers. Retain a copy of this form in your records for

return form. four years. When feasible, attach this form in PDF format to

the e-filed return, but do not mail this form to the Colorado

Part I - TAX RETURN INFORMATION Department of Revenue or the IRS unless requested.

Individual Income Taxpayers Using an Electronic Return Originator (ERO)

Line 1 Report the total income from federal Form 1040, or Preparer

line 9. Taxpayers who use an ERO or tax preparer should

Line 2 Report the amount of taxable income reported on maintain copies of all information given to them by the

federal Form 1040, line 15. ERO or tax preparer for the period covered by the statute

of limitations, but are not required to mail anything to the

Line 3 Report the amount of tax reported on Colorado

Colorado Department of Revenue at the time of filing.

Form 104, line 19.

Line 4 Report the amount indicated as Colorado Part III - DECLARATION OF ELECTRONIC RETURN

withholding tax from Colorado Form 104 line 20. ORIGINATOR (ERO), PREPARER OR TRANSMITTER

Corporate Income The ERO or the preparer of the return is required to sign

Line 1 Report the total income from Federal Form 1120. and date the DR 8454 at the time of filing. If the ERO is

Line 2 Report the amount of taxable income reported on also the preparer, the check box labeled "Check if also

Federal Form 1120. preparer" must be checked. The ERO or preparer is also

required to report their Social Security Number or preparer

Line 3 Report the amount of tax reported on Colorado

identification number (PTIN) in the space provided. If the

Form 112, line 18.

taxpayer is the preparer, PART III does not need to be

Line 4 Report the amount indicated as Colorado signed/dated.

payments from Colorado Form 112 line 25.

Partnership/S-Corp Income OTHER INFORMATION

Line 1 Report the total income from federal Schedule K. Colorado Statute of Limitations

Line 2 Allowable deduction from federal Schedule K. The general rule for the Colorado statute of limitations

Line 3 Report the amount of tax reported on Colorado is the federal statute of limitations plus one year, or four

Form 106, line 15 in Part II or line 20 in Part III, if years from the federal due date of the return or the date the

applicable. return was filed, whichever is later.

Line 4 Report the amount indicated as Colorado DR 8454 on Demand by Colorado Department of

payments from Colorado Form 106 line 22 in Revenue

Part IV. The paid preparer is also responsible for establishing

Fiduciary Income and maintaining a system that allows retrieval of any

Line 1 Report the total income from Federal Form 1041. particular DR 8454 and attachments by taxpayer social

Line 2 Report the amount of taxable income reported on security number on demand by the Colorado Department

Federal Form 1041. of Revenue.